- Lululemon reported earnings slightly ahead of expectations

- Currently trading about 25% below the 52-week high

- Wall Street analyst consensus is bullish

- Market-implied outlook is moderately bearish up to early 2023

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

-

Any company’s financials for the last 10 years

-

Financial health scores for profitability, growth, and more

-

A fair value calculated from dozens of financial models

-

Quick comparison to the company’s peers

-

Fundamental and performance charts

Lululemon Athletica (NASDAQ:LULU) has built an athletic clothing brand that has substantially defined the high end of athletic leisure wear. Yoga pants, once worn primarily for exercise classes, have become a staple in casual fashion. The shares have enjoyed a huge rally in recent years, with 3- and 5-year annualized returns of 26.2% per year and 46.8% per year, respectively.

The Vancouver, Canada-based leisure wear giant is currently trading about 25% below its 12-month high closing price of $477.91 recorded Nov.16, 2021. While Nike (NYSE:NKE) has been in a steady decline over the past six months, with a return of -25% YTD, LULU has rallied from its 12-month low in mid-March and is only down 9.4% so far in 2022.

Source: Investing.com

One of Lululemon’s strengths is that the company manages growth expectations very well and has consistently beaten quarterly consensus earnings estimates. Most recently, the company reported FY 2022 Q4 results on Mar. 29, with EPS of $3.37 versus an expected value of $3.28. This track record adds to the company’s credibility when it lays out plans for future growth.

Source: E-Trade

To maintain its growth rate, the company is forecasting for the next five years, LULU needs to double the size of its men’s wear business and e-commerce, as well as grow international sales by a factor of 4. Given that some of the growth in the past couple of years is attributed to people dressing more comfortably when working from home during the pandemic, the question is how sales may change as more people return to the office.

While management is executing well, the stock has a forward P/E of 38 and a TTM P/E of 47.3. This level of valuation depends on continued strong growth and, consequently, makes the stock’s performance quite sensitive to rising interest rates. When a company is relying on high future earnings as the foundation for the valuation, the stock is more responsive to changes in the discount rate, which rises and falls with interest rates.

On Sept. 8, 2021, I assigned a bullish/buy rating and in the almost eight months since, LULU has returned a total of -7.3% vs. -8.6% for the S&P 500 (NYSE:SPY), including dividends. At that time, LULU had a forward P/E of 57.1, well above the forward P/E ratios of 38.5 for Nike and 36.2 for Under Armour (NYSE:UA). The valuation was high, even given the strong growth outlook.

The Wall Street consensus rating was bullish, with a consensus 12-month price target that was 13.6% above the share price at that time, according to E-Trade, but only 3.9% above the share price using the Wall Street consensus calculated by Investing.com. This range of expected return was not terribly high given the risks (the expected volatility was about 36%).

In addition to the fundamentals and the Wall Street consensus outlook, I rely on the market-implied outlook, which represents the consensus view from the options market, when analyzing a stock. The market-implied outlook in early September of 2021, looking out to March of 2022, was bullish.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of put and call options, all with the same expiration date, it is possible to calculate a probable price forecast for the stock that reconciles the options prices. This is the market-implied outlook. For a deeper discussion than is provided here and in the previous link, check out this excellent monograph published by the CFA Institute.

I have calculated the market-implied outlook for LULU to early 2023 and I have compared this with the current Wall Street consensus outlook in revisiting my rating on the stock.

Wall Street Consensus Outlook For LULU

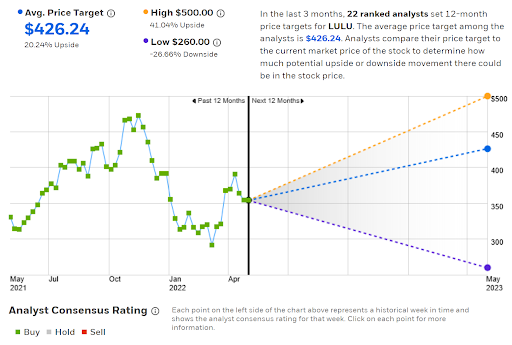

E-Trade calculates the Wall Street consensus outlook for LULU by aggregating the views of 22 ranked analysts who have published ratings and price targets over the past three months. The consensus rating is bullish, as it has been for all of the past year, and the consensus 12-month price target is 20.2% above the current share price.

One note of caution here is that there is a large spread between the highest and lowest analyst price targets. High dispersion in price targets makes the consensus less meaningful as a predictor of the future share price. The lowest analyst price target is, however, something of an outlier, with the next three lowest price targets all at about $340.

Source: E-Trade

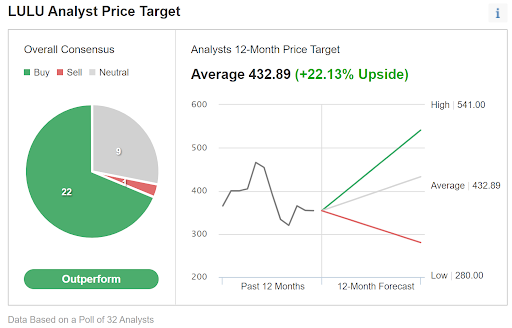

Investing.com calculates the Wall Street consensus using ratings and price targets from 32 analysts. The consensus rating is bullish and the consensus 12-month price target is 22.1% above the current share price. The spread between the highest and lowest price targets is high, consistent with the results from E-Trade.

Source: Investing.com

The Wall Street analyst consensus outlook for LULU predicts a 12-month return of around 20%, somewhat below the annualized rate of return over the past three years. While there is fairly high dispersion among the price targets, this is exacerbated by outlier effects.

Market-Implied Outlook For LULU

I have calculated the market-implied outlook for LULU for the 8.6-month period from now until Jan. 20, 2023, using the price of call and put options that expire on this date. I chose to analyze the January options to provide a view through the end of the year.

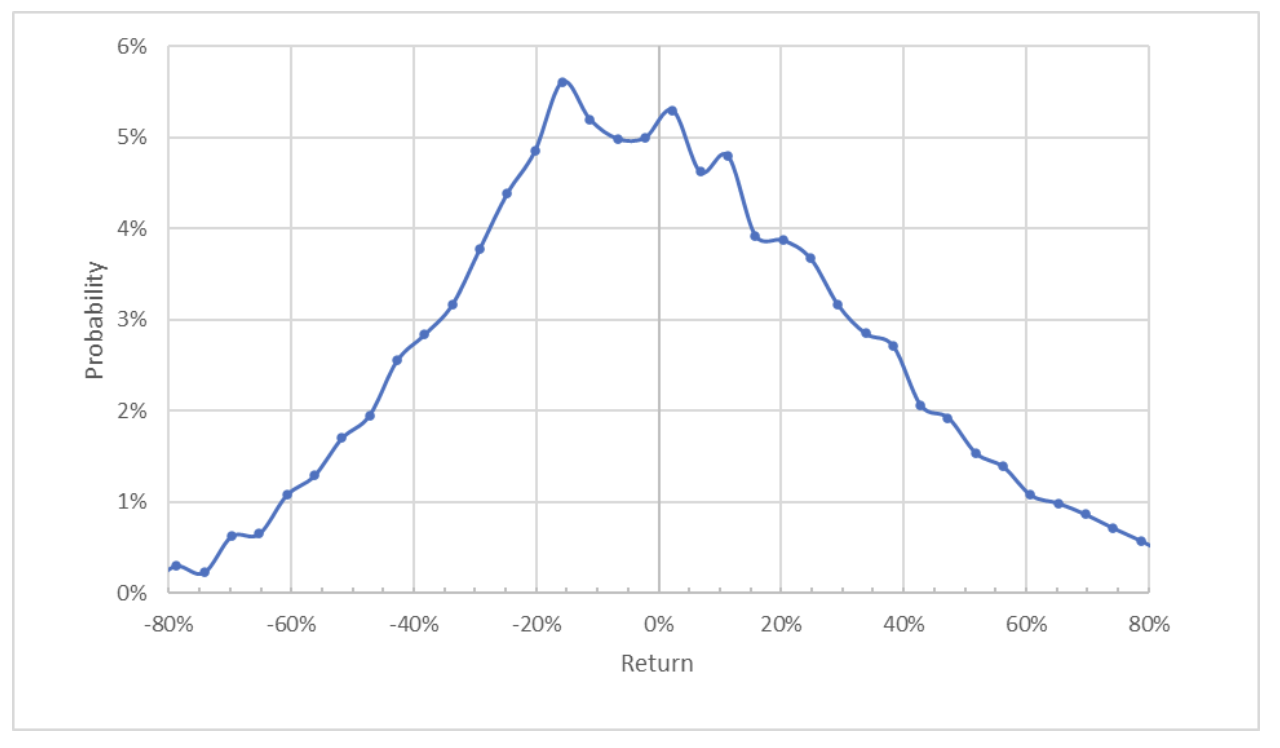

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook to Jan. 20, 2023, is tilted to favor negative returns (bearish). The maximum probability corresponds to a price return of -15.8% for this period. The expected volatility calculated from this outlook is 44%, substantially higher than the expected volatility calculated in September, although market volatility (VIX) has also increased substantially over this period.

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

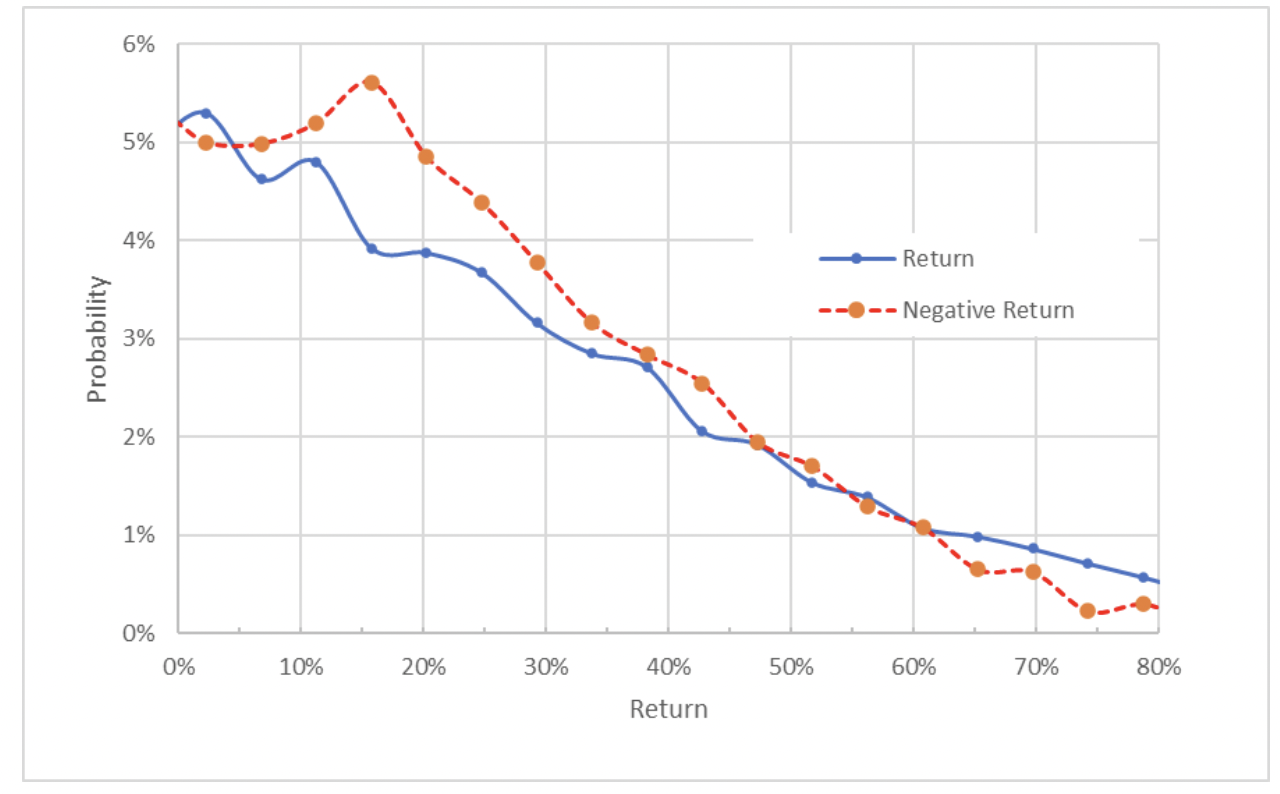

Source: Author’s calculations using options quotes from E-Trade

This view highlights the consistency with which the probabilities of negative returns are higher than the probabilities of positive returns of the same magnitude across a range of the most probable outcomes (the dashed red line is above the solid blue line over most of the left two-thirds of the chart above). This is a bearish outlook.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, tend to be risk-averse and, as a result, overpay for downside protection (e.g. put options). There is no way to measure whether this bias is present, however. Even considering that the market-implied outlook probably overstates the probabilities of loss, I interpret this outlook as moderately bearish. In addition, this market-implied outlook is markedly more negative than the results from September.

Summary

Lululemon has built a premium athletic leisure brand, which has benefited from a pandemic-driven work-from-home boost. The question is whether the valuation reflects reasonable growth expectations. While management has demonstrated the ability to deliver on its vision, the current goals are very ambitious and the valuation leaves limited room for missteps.

The Wall Street consensus outlook continues to be bullish, and the consensus 12-month price target implies a fairly high return, largely because of the share price declines from late 2021. As a rule of thumb for assigning a buy rating, I want to see an expected 12-month return that is at least half the expected volatility (44%) and the average of the two consensus price targets, 21.2%, is right at the threshold. Taking the analyst consensus price target at face value, the expected return is not especially high relative to the expected risk level.

The market-implied outlook to early 2023 is moderately bearish, in marked contrast to the market-implied outlook from September. The options market’s consensus view has become more negative. Considering all of these factors, I am changing my rating on LULU to neutral.

Looking to get up to speed on your next idea? With InvestingPro+ you can find

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »