- In Q1, Intel suffered the biggest loss in its history after its revenues plunged 36%.

- The chipmaker presents results on July 27 and is expected to post losses similar to Q1.

- Can Intel's ambitious manufacturing plans help the company bounce back in the next quarter?

- In 2022, the dividend increased to $1.46, representing a growth of +4.89% compared to the previous year.

- In 2021, the dividend reached $1.392, experiencing a rise of +5.45% from the preceding year.

- In 2020, the dividend stood at $1.320, showing an increase of +4.47% compared to the year before.

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

On July 18, 1968, two brilliant engineers at Fairchild Semiconductor, Robert Noyce and Gordon Moore, came together to establish N.M. Electronics, which later became known as Intel Corporation (NASDAQ:INTC). Their first-year revenue was $2,672 – not bad for a start!

Fast forward to today, Intel holds the crown as the world's largest microchip manufacturer, responsible for crafting the processors found in most personal computers. With its headquarters nestled in Santa Clara, California, Intel has firmly secured its spot at the forefront of the industry.

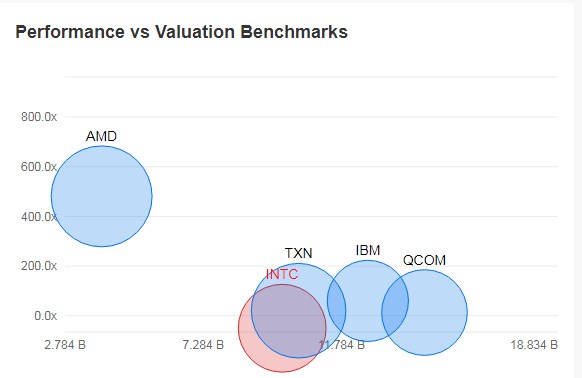

Speaking of microprocessor manufacturers, Intel was the trailblazer, launching its groundbreaking Intel 4004 in 1971. Although it faced fierce competition from the likes of Qualcomm Incorporated (NASDAQ:QCOM), Taiwan Semiconductor Manufacturing (NYSE:TSM), Advanced Micro Devices (NASDAQ:AMD), and International Business Machines (NYSE:IBM), Intel has managed to maintain its leading position in the market and even expand.

Source: InvestingPro

Intel and AMD have long dominated the market as the leading manufacturers of processors for PCs and laptops. The X86 architecture, powered by Intel, has been the go-to choice for the industry for decades, while cell phones rely on ARM architecture.

To support their new chip designs, Intel has announced ambitious plans for massive manufacturing plants called fabs. With two fabs scheduled for construction near Phoenix, two more in Ohio, and another in Germany, the company is aiming to bolster its chip production capacity.

Recently, Intel made a significant announcement about transforming its manufacturing unit into an independent business. This move is a crucial step in their turnaround and diversification plans.

Now, let's try and take a closer look at Intel and IBM's recent earnings using InvestingPro.

Intel Vs. IBM Earnings

In the first quarter, both Intel and IBM reported contrasting results. IBM recorded a net profit of $927 million, a 26.5% year-over-year increase, surpassing earnings forecasts. This growth was attributed in part to expense management and productivity measures implemented earlier in the year. Looking ahead to 2023, IBM anticipates revenue growth of 3% to 5%, with modest sales growth expected in the second half of the year.

On the other hand, Intel faced challenges in the first quarter, with revenues dropping by -36% to $11.7 billion. This marked the largest loss in its history, largely due to decreased computer sales impacting its microprocessor revenue. The gross margin also declined substantially, falling to -37.5% compared to 50.4% in the previous year's first quarter. Moreover, the company's costs surged, and four out of its five divisions experienced significant revenue declines. The only exception was Mobileye, which managed to increase its revenues by +16%.

One of the main issues is the decline in microprocessor sales after the initial boost during the pandemic when increased computer sales resulted from confinement and remote work. However, with the return to normalcy, both consumers and businesses reduced their investments in computers, leading to decreased demand for Intel microprocessors. Notebook microprocessor sales plunged by -43%, and desktop sales also suffered, falling by -30%.

Furthermore, Intel faced challenges in competing with NVIDIA Corporation (NASDAQ:NVDA) in the high-powered microprocessor segment used for artificial intelligence applications.

Looking ahead, Intel's upcoming results on July 27 are expected to show second-quarter losses similar to those experienced in the first quarter, with sales forecasted to be just below the range of $11.5 billion to $12.5 billion.

Source: InvestingPro

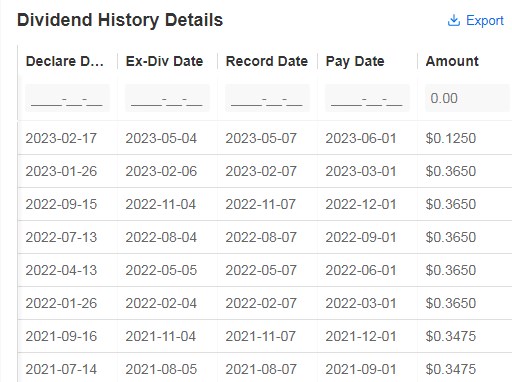

Dividend

Intel pays out dividends to its shareholders four times a year, with a payout ratio of 30%, meaning they distribute 30% of their earnings as dividends. Over time, it has maintained a steady and gradually increasing dividend payout history, delivering an average yield of +1.7%.

The company has been consistently paying dividends to its shareholders since 1992, marking an unbroken streak of 31 years of dividend payments every fiscal year.

Source: InvestingPro

Let's take a look at the dividend performance over the past three years:

For the current year, Intel has already distributed two dividends. In February, shareholders received $0.365 per share, and in May, they were paid $0.125 per share.

Source: InvestingPro

Price

Over the last 12 months, the stock is down 10.75%.

Source: InvestingPro

Intel: Technical View

From a technical perspective, Intel's stock formed a floor towards the end of February, coinciding with a strong support level established back in October 2022. Since then, the stock has been on an upward climb, achieving new highs and higher lows.

At the close on Wednesday, both the 50-day moving average and the 200-day moving average align at the same point, creating a small yet significant support level. This convergence of three elements in the area around $31.85 could present an interesting opportunity for a potential upside bounce if the stock price reaches that level.

***

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by subscribing and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the summer sale won't last forever!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky and, therefore, any investment decision and the associated risk remains with the investor. The author owns the stocks mentioned in the analysis.