The next leg of the gold stock bull market is in play amid confusion, misunderstanding and noise

Please see edit at the bottom of the article. The next leg of the bull is in “play”, but it is not technically activated. The sector will be subject to a potential broad market bear or liquidation in 2024. What is “activated” now is a rally; a potentially strong one. We’ll evaluate future risk/rewards at the appropriate time.

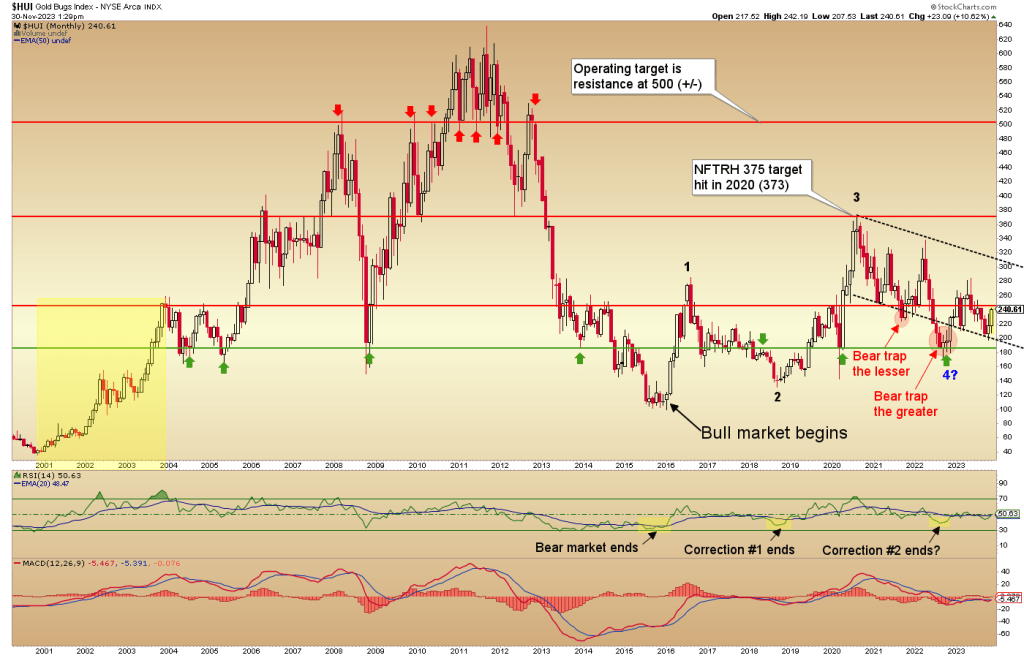

First off, despite the pain and agony endured by long-term holders of gold stocks, it is a bull market and it has been a bull market since the January 2016 low (with a bull market defined as a series of higher highs/lows).

The issue with gold stocks, always volatile and heretofore operating against poor macro fundamentals, is that it is not a bull market you can simply hold and maintain a healthy blood pressure. You do not perma-hold gold stocks, especially when the macro is a headwind, as opposed to the tailwind that is setting up currently. There is also the fact that mining is a dirty and risky business. So discrete stock selection is paramount. Technically for the sector, however, it has been a series of higher highs and lows since 2016. That is the definition of a bull market.

What’s more, if point 4 on this monthly chart of HUI proves to be the low of the correction that began in mid-2020 the bull market is now generating its next leg higher. However, the chart shows an index bumping up against clear resistance. So some volatility can be expected. This monthly chart is included for big big-picture perspective. But for the sake of this article’s main topic, cast your gaze upon the 2001-2003 ‘launch’ phase of the previous bull market

That phase was attended not by inflation, which the Alan Greenspan Fed worked so hard to produce during that time. It was attended by a deflation scare, which was the Maestro’s rationale for creating an inflationary macro. At that time (2004), a righteous gold stock bull market ended, and a gold stock bubble began.

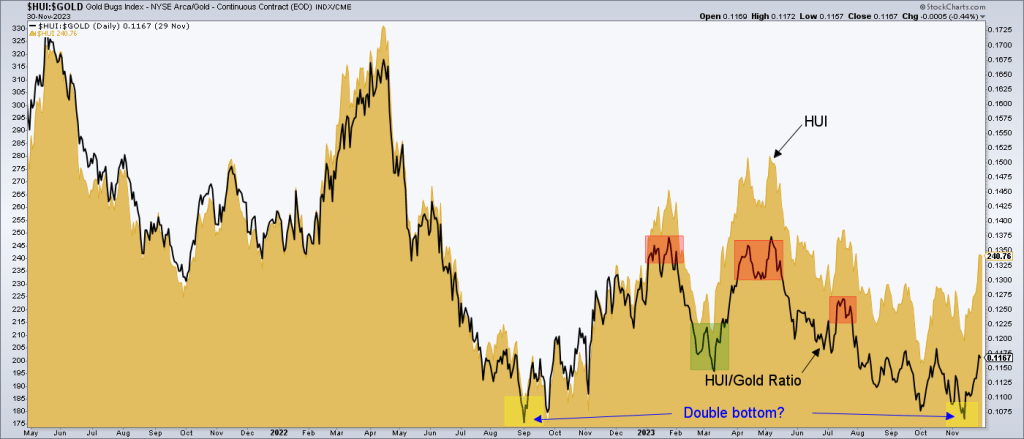

Today, as inflation-centric gold bugs continue to fear an “attack”, “smack down” and “bankster”-instigated demolition of the monetary metal and its miners… as analysts either give up on gold mining due to the sector’s chronic under-performance to its product (negative leverage) or highlight its epic undervaluation vs. its product, the simple fact is that with a disinflationary (Goldilocks) macro due to transition into deflationary pressure, the time is right to anticipate that all too rare phenomenon, positive leverage (to gold) by gold mining operations.

Again, reference the 2001-2003 period. Another monthly chart shows that amid the deflationary backdrop and before the Maestro really got the inflation machinery cranking, gold stocks rose, leading broad commodities and US and global stock markets. The HUI/Gold ratio then RIGHTLY topped out and it’s been inflationary ignominy ever since (with brief interruptions) for the gold mining industry.

This chart shows that gold stocks kept rising vs. broad stocks (not to mention nominally per the chart above) even as inflationary pressure forced the HUI/Gold ratio downward (and rightly so). But what we are looking for today, as the macro slips further into disinflation and future deflation (just today, Thursday, Europe is out with weakening economic numbers, and yup, inflation data as well) is a replay of the green-shaded period, which was mainly attended by deflationary pressure.

While it appears these words are routinely drowned out by legions of gold bugs claiming that China and India gold buying, rising oil prices (and inflationary cost effects) and other incorrect analyses are catalysts for gold stocks, the simple fact is that the gold mining industry will leverage gold’s standing within a disinflationary/deflationary macro. Those claiming that gold stocks have been unfairly “undervalued” vs. gold are wrong. Gold miners have more often than not negatively leveraged the inflationary macro we’ve had since 2003, when Alan Greenspan’s age of Inflation onDemand really took root and went global.

This was as it should have been. Gold is an anti-bubble and Greenspan blew a bubble with an inflationary policy that eventually launched commodities (including important mining cost commodities like oil and materials) and stocks the world over into one big and highly promoted bubble. Said age of “Inflation onDemand” as I used to call it. A commodity super cycle was touted, the China Trade was touted (complete with Jim Rogers “teaching my baby girl Mandarin”), Peak Oil (ha ha ha) was touted by other promoters.

On and on it went while gold stocks rose too and eventually got the bear market they deserved in 2012. The problem was that gold was flat-lining or worse in comparison to cyclical commodities and some other asset markets while gold stock valuations bloated as it it were a fundamentally sound backdrop. Well, it wasn’t.

But I digress. What we care about today is today. What we have today is an HUI/Gold ratio quite possibly bottoming, as this NFTRH chart shows.

The Gold/RINF) ratio is an admittedly rough comparison of gold to that fuzzy thing we call “inflation expectations”, which is made even fuzzier by an ETF trying to define what those expectations are. It does work well, however, as a general guide showing that today the gold stock sector is in line with improving fundamentals, unlike during a majority of those post-2003 years. We began using this chart in NFTRH a few weeks ago with the intent to watch HUI’s progress in line with one measure of its proper fundamentals. And what do you know, the breakout in Gold/RINF preceded a breakout in the gold mining sector.

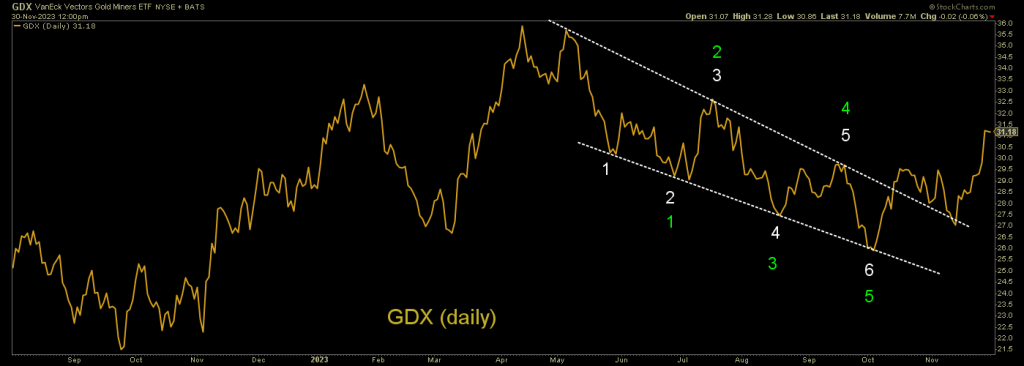

First, we had a breakout from from a falling wedge (long bull flag with 6 solid touch points that represented the post-May correction), a retest and a launch higher.

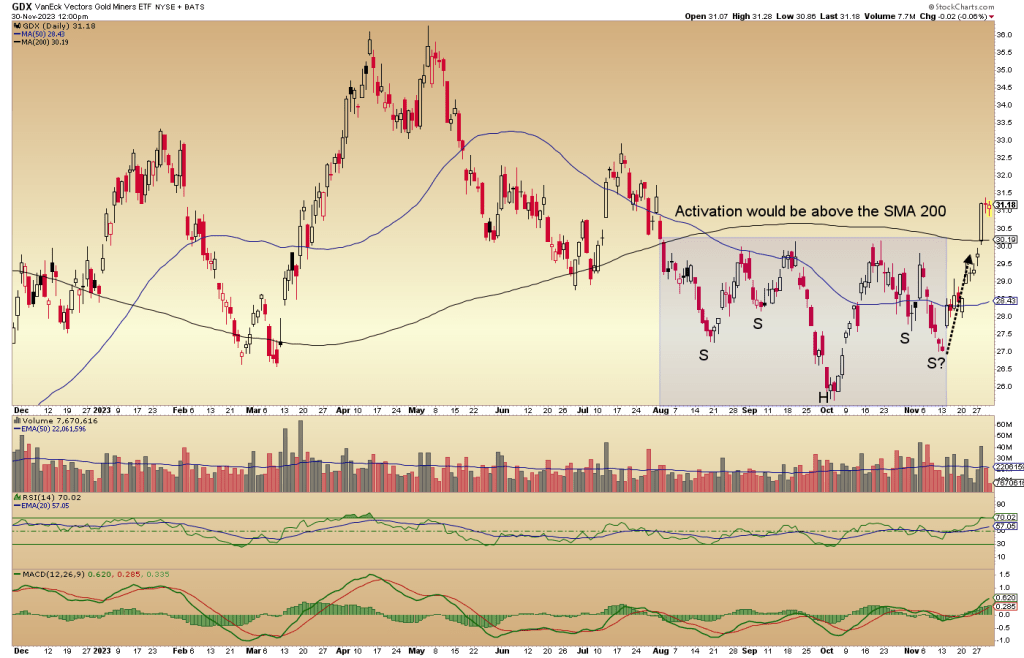

That launch broke a pattern that I speculated upon publicly on the day GDX (NYSE:GDX) hit its most recent low back on November 13. The original post shows the state of daily GDX then along with my imagining of what could transpire (black dashed arrow).

For months upon months now we’ve been managing the correction, and the imagined pattern on this chart would need to take out its neckline to activate. I have not drawn it in because the daily SMA 200 is dutifully easing into that zone at 30, which has been our get out of jail parameter all along. The correction is ongoing until it no longer is.

Well, consider the neckline activated. Now the fun begins, and it’s not just because of a technical breakout. It’s because of a technical breakout and a macro backdrop finally and slowly shifting in favor of the gold mining industry, much like 2001-2003, when the sector seemed to be alone in its improbable bull market. It is improbable today to the vast majority as well. One day, it won’t be and the sector should be orders of magnitude higher, price-wise, by then.

[edit] Here is a screenshot from the comments section adding some color to the above. It is included here so that other websites that may publish this article can include these details.