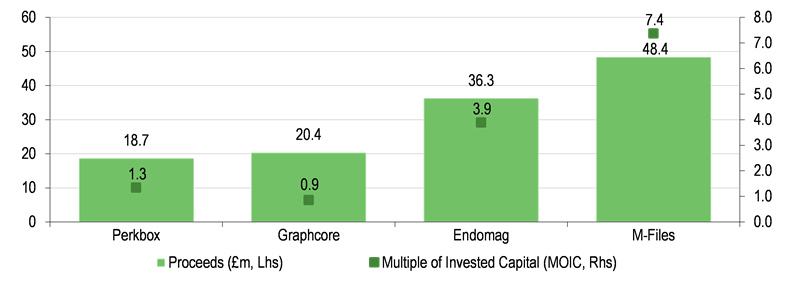

Molten’s (LON:GROW) portfolio valuations remain stable in H125, illustrated by the limited fair value movements of its core holdings that recently completed new funding rounds, as well as Molten’s recent exits (representing aggregate proceeds of c £124m), all of which were completed at or slightly above previous carrying values.

While the valuations of listed cloud businesses compressed somewhat between end-March 2024 and end-September 2024, they rebounded visibly after the US election. Moreover, Molten expects its core holdings to deliver weighted average revenue growth of 71% in 2024 and 48% in 2025. Its H125 NAV TR decline of 2.4% came largely from FX headwinds, while the 1.4% constant currency increase in gross portfolio value was driven by the revaluation of Revolut, partly offset by a markdown of Thought Machine.

Molten has completed £124m in exits so far in FY25

Source: Molten Ventures

VC investors remaining selective so far this year

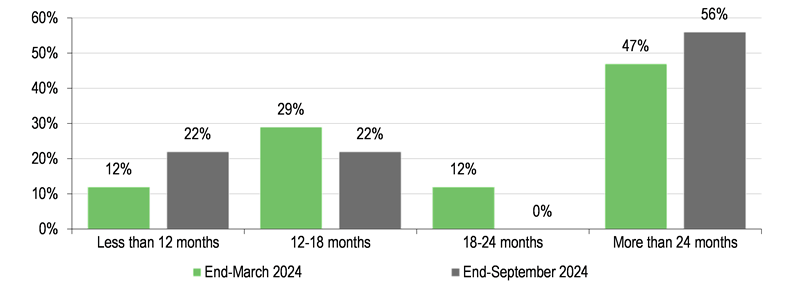

Molten’s CEO highlighted that top-tier, VC-backed companies command premium valuations and have good access to capital, while funding is less readily available to most other companies. In this context, it is encouraging that several of Molten’s portfolio companies closed new funding rounds during the period, and 78% of its core holdings have a cash runway of more than 12 months as at end-September 2024.

The remaining core holdings are currently carrying out new funding rounds and Molten’s management expressed confidence in the companies’ ability to price these rounds in line with Molten’s current portfolio fair values. Despite recent market weakness, we consider European VC as a compelling route to gain exposure to the European tech sector, especially given the limited options in European public markets, the fact that companies are staying private for longer and superior long-term historical VC returns versus public markets in Europe.

Preparing for the next VC cycle

As a well-established listed VC player in Europe, Molten provides exposure to a diverse portfolio of private high-growth technology companies across enterprise software, hardware and deeptech, and digital health and wellness, which are otherwise hard to access. Molten seized exit opportunities arising from the gradually stabilising European VC market. Coupled with its new credit facility, this provides it with a good balance sheet position for new and follow-on investments.

NOT INTENDED FOR PERSONS IN THE EEA

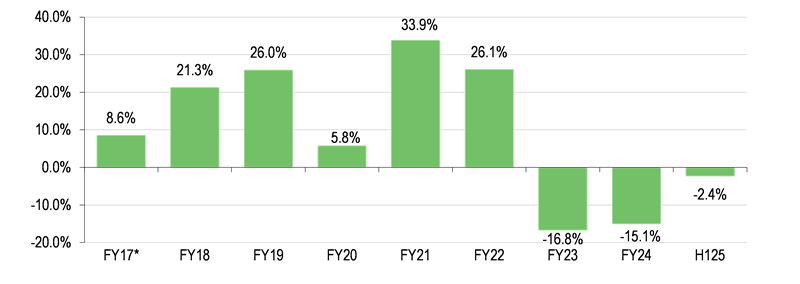

Stable valuations in H125

Molten’s slight 2.4% decline in NAV per share in H125 (to end-September 2024) reflects a continued stabilisation in aggregate portfolio valuations, coupled with adverse currency movements from a strengthening sterling (while operating costs remain limited at below 1% of NAV net of fee income). The 1.4% increase in Molten’s gross portfolio value excluding FX is broadly equal to the net effect of its major positive (Revolut) and negative (Thought Machine) contributors. Revolut’s fair value in Molten’s books increased by £62.1m (nearly doubling vs end-March 2024) on the back of the recent secondary share sale (see our previous note for details).

Despite the recent uplift, it is held at a 20% discount to the secondary sale price, in line with Molten’s cautious approach of not pricing in all future expected growth and the strategic premium a potential trade buyer may be willing to pay. Revolut’s revaluation was partly offset by a c 36% markdown of Thought Machine (which provides cloud-native core banking infrastructure and was Molten’s largest holding at end-March 2024) in light of the slower than expected materialisation of major contracts with top-tier banks (not uncommon for large banking groups). Nevertheless, Molten’s management remains confident in the prospects for this business.

A £22.8m net negative valuation impact in H125 (on a constant currency basis) came from Molten’s emerging portfolio. Management highlighted that there are several emerging holdings which are scaling well and Molten is willing to further support them with funding if needed (while it has refrained from follow-on funding of some less promising names).

Exhibit 1: Molten’s historical NAV per share TR in sterling terms

Source: Molten Ventures, Edison Investment Research. Note: *Since IPO in June 2016.

Listed cloud valuations rebounded post-US election

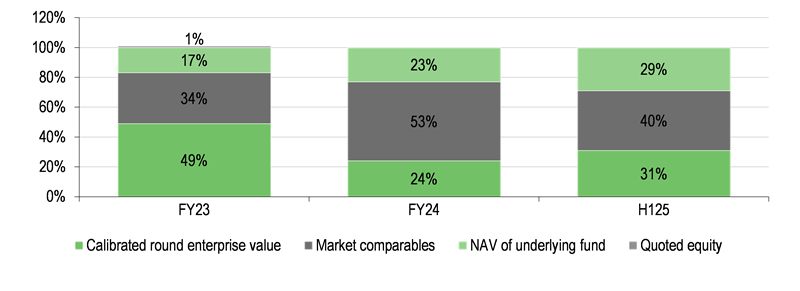

The meaningful proportion of the more mature holdings that are generating substantial revenues is illustrated by the c 40% share of Molten’s portfolio at end-September 2024, valued based on market multiples (see Exhibit 2). Molten’s management expects its core portfolio (which makes up 61% of end-September 2024 portfolio value) to deliver value-weighted average revenue growth of 71% in 2024 and 48% in 2025. This should be accompanied by a 68% and 70% gross margin in FY24 and FY25, respectively (vs 66% in FY23).

Exhibit 2: Molten’s portfolio by valuation method at end-September 2024

Source: Molten Ventures

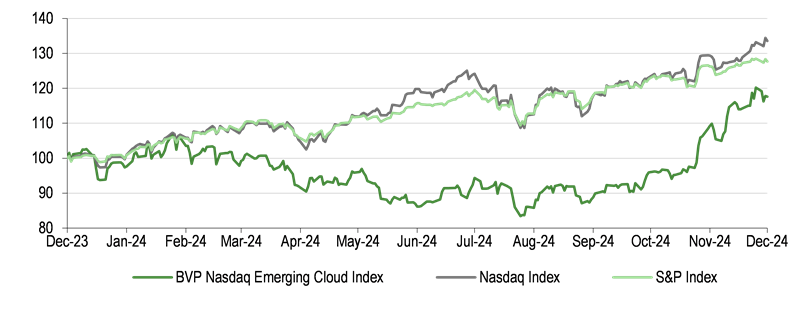

The weighted average revenue multiple applied by Molten declined to 6.0x from 6.6x at end-March 2024, reflecting a broader trend across listed tech companies, Software-as-a-Service (SaaS) businesses in particular (54% of Molten’s end-September 2024 portfolio by value was made up of enterprise technology businesses). This is illustrated by the movement in the Bessemer BVP Nasdaq Emerging Cloud Index (tracking 65 US-listed providers of cloud-based software and services), which subsequently posted strong c 27% growth between the end of September and 13 December, closing most of the performance gap to the S&P 500 and Nasdaq indices over the last 12 months, likely on the back of the ‘Trump trade’. We calculate that the current-year EV/sales multiple for a set of US-listed SaaS companies tracked by our technology team (based on LSEG Data & Analytics consensus) declined from 6.3x at end-March 2024 to 6.1x at end-September 2024, but then rebounded to 7.3x as at 13 December, indicating some valuation tailwinds post the balance sheet date. However, Molten’s management highlighted that multiples of listed tech peers remain below the 10-year historical average (which may suggest further upside potential).

Exhibit 3: BVP Emerging Cloud Index compared to Nasdaq and S&P 500, rebased

Source: LSEG Data & Analytics

Solid cash runways assisted by recent funding rounds

We note that the share of holdings valued based on the calibrated price of recent funding rounds (31%) was up versus 24% at end-March 2024, which may have been a function of several successfully closed funding rounds in Molten’s Core holdings over the last 12 months, including ICEYE, FintechOS, Isar Aerospace, RavenPack, Riverlane and Form3. The fair value Molten assigned to these holdings was broadly stable in H125, except for the quantum computing company Riverlane, whose value increased by c 26% versus end-March 2024 on the back of its US$75m Series C up-round in August 2024. Around 78% of Molten’s core portfolio holdings had a cash runway of more than 12 months at end-September 2024 (see Exhibit 4), with the rest currently in the process of raising new funding. Molten’s CEO expects funding requirements across Molten’s portfolio for FY25 to be at a limited level of c £20m, with its EIS/VCT schemes providing additional funding flexibility.

Exhibit 4: Molten’s core portfolio by cash runway

Source: Molten Ventures

The higher share of portfolio, which was valued based on the NAV of the underlying fund (29%), comes partly from Molten’s £11m deployment into fund of funds and Earlybird funds and the £18.6m secondary acquisition of a 97% stake in Connect Ventures Fund I, which holds minority positions in eight European software companies, most notably Typeform and Soldo (making up 85% of the fund’s fair value).

Looking for new return drivers for the next VC cycle

Molten’s exit activity benefited from the gradually stabilising European VC environment, as it collected £76m in cash proceeds in H125 (out of the total £124m expected from recent realisations) and completed a £10m share buyback in line with its updated capital allocation policy (see our previous notes for details). The remaining proceeds of c £48m, coupled with holding-level cash and equivalents (£82.2m at end-September 2024) and the £60m undrawn revolving credit facility (available subject to certain covenants) more than cover Molten’s unfunded commitments to its fund of funds programme and Earlybird funds of £63.6m (which will be deployed over several years). They also provide the company with good balance sheet headroom to take advantage of available attractively priced opportunities (especially in the secondary market) and in turn to position Molten’s portfolio for the next VC market cycle over the next two to three years.

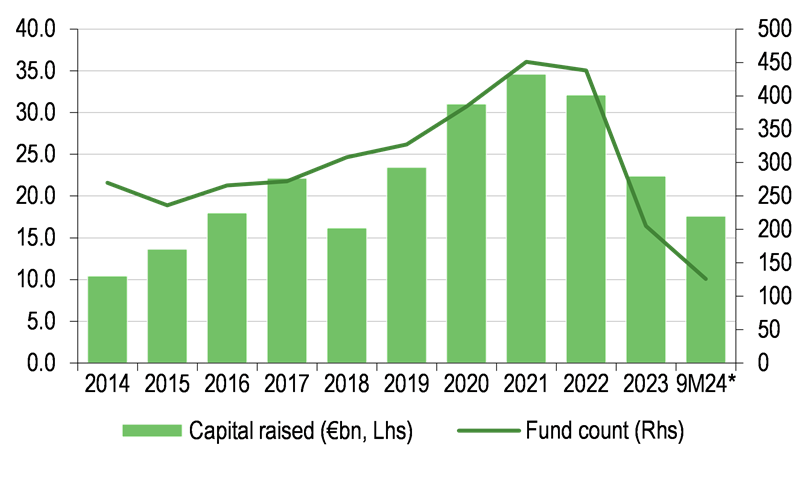

We note that the pricing of VC secondaries in H124 remained close to 2022 levels at a c 30% average discount to NAV (vs 12% in 2021 and c 17–25% in 2018–20), according to the latest Jefferies Global Secondary Market Review. Jefferies highlighted that, while there was demand for revenue-generating, later-stage assets with a clear path to exit, valuations were viewed as inflated amid limited improvements in fund-raising. However, Molten expects capital across the VC market to be deployed more uniformly on the back of new VC funds being raised. The latter reached €17.6bn in the first nine months of FY24 (9M24) in the European VC market according to PitchBook, which expects the full-year 2024 figure to at least match the 2023 level of €22.4bn (compared to more than €30bn per year in 2020, 2021 and 2022). PitchBook underlined the strong median deal values across all stages in Europe in Q324, suggesting increasing capital flowing into rounds and funding start-ups across a more confident ecosystem.

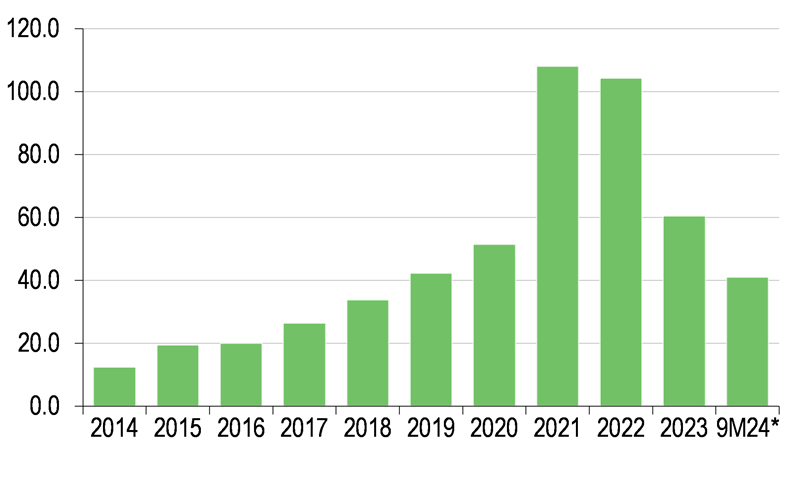

PitchBook also noted some initial recovery in exits and, while the €26.2bn in 9M24 includes €12.7bn attributable to Puig’s IPO, the 9M24 run rate excluding Puig implies a slight 6.6% y-o-y increase in exit value from €16.9bn in 2023 (vs €32.2bn in 2022 and €155.1bn in 2021). European VC deal value reached €41.0bn in 9M24 (compared to €60.6bn in 2023 and €104.3bn in 2022), with SaaS remaining the top vertical.

Exhibit 5: European VC fund-raising

Source: PitchBook. Note: *Data as at end-September 2024.

Exhibit 6: European VC deal value (€m)

Source: PitchBook. Note: *Data as at end-September 2024.

Molten sees strong arbitrage opportunities from limited partners (looking for liquidity that can be recycled into newer vintages) which it can access thanks to its strong origination network via, among others, its fund-of-funds programme. Its H125 investments of £51m include £13m deployed across three new primary investments and one additional investment in transit (ie where Molten was called for capital from the investment vehicle, but the latter had not yet completed the investment as at the period end). H125 investments also include £8m into 12 follow-on investments (a run rate broadly in line with its target of 15–30 new and follow-on investments per year), capital deployed in its fund-of-funds programme (£7m) and Earlybird funds (£4m), as well as the above-mentioned secondary investment.

Molten’s new primary investments in H125 included SalesApe.ai (offering AI sales agents), Sightline Climate (which provides a climate-first market intelligence platform) and One Data (providing an AI-powered data product builder). After the reporting date, Molten co-led a £3m round of the nanomaterial technology firm Concretene (which is developing a graphene-enhanced admixture to reduce the carbon footprint of concrete) and participated in the seed round of PocDoc, a Cambridge-based digital diagnostics company.