Investing.com -- Bitcoin on Tuesday surged to $108,000 for the first time in its history, marking a significant milestone as it reached a new all-time high.

Piper Sandler initiated research coverage on Bitcoin miners and crypto infrastructure firms on Monday, including MARA Holdings (NASDAQ:MARA), Riot Platforms (NASDAQ:RIOT), Hut 8 Corp (NASDAQ:HUT), and Galaxy Digital (TSX:GLXY). Each firm was assigned an Overweight rating.

US-listed shares of Riot Platforms and MARA rose around 2.6% and 1.9% in premarket trading, respectively, while Hut stock climbed 3.2%.

The investment bank notes that mainstream crypto sentiment “is improving -- a trend we expect to continue with greater regulatory clarity and a more crypto-friendly SEC under the incoming Trump administration.”

“Should the US establish a strategic bitcoin reserve (which Trump plans to implement) we expect the price of Bitcoin to rise, leading to expanded profitability and larger bitcoin treasuries for bitcoin miners,” analysts Patrick Moley and Will Copps said in a note.

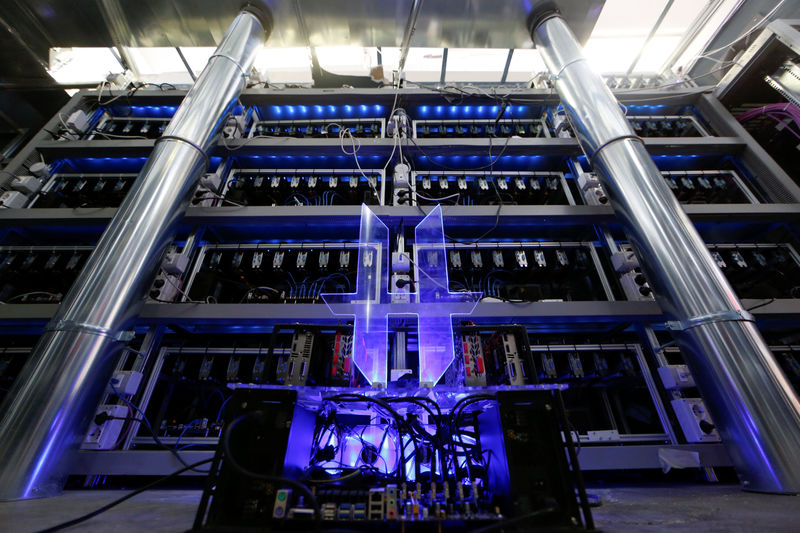

BTC miners, while fundamentally tied to the future of the cryptocurrency, are also well-positioned to benefit from their extensive energy infrastructure. Analysts highlight growing demand from AI hyperscalers, which could offer a significant new growth opportunity beyond the crypto market.

Piper Sandler started MARA Holdings with a price target of $34. Analysts expect MARA's mining capacity to reach approximately 50 EH/s by the end of the fourth quarter in 2024, with a Bitcoin treasury exceeding 40,000 BTC, valued at roughly $4 billion.

“We believe MARA has a “fastest to scale” advantage in bitcoin mining and should benefit from compounding returns on a larger initial bitcoin treasury and mining fleet relative to peers,” analysts said.

Riot Platforms, has been initiated with a $23 price target. Although RIOT trails MARA in both mining capacity and Bitcoin holdings, Piper Sandler's team is optimistic about the company’s potential to scale its operations.

RIOT aims to triple its mining capacity from approximately 28 EH/s to around 100 EH/s by year-end 2027, with the expansion of its Corsicana facility in Texas playing a key role.

Meanwhile, Piper Sandler set a price target of $33 for Hut 8 Corp. The firm highlights its extensive energy assets and the potential for profitable scaling.

Hut 8's experience as a Bitcoin miner and its approved capacity for future AI/High-Performance Computing (HPC) co-location deals are seen as significant factors in the company's strategy moving forward.

Lastly, Galaxy Digital Holdings, with a $29 price target, is recognized for its Global Markets segment and the potential for revenue growth from institutional crypto adoption.

“The company has announced plans to reduce its mining footprint in pursuit of AI/HPC colocation deals and has already executed a non-binding term sheet with a US hyper scaler to utilize its Helios facility,” analysts noted.

With 800 MW of approved power at the site, analysts believe the deal could drive an approximately 40% increase in total firm revenues by 2027.