- The Federal Reserve holds its highly anticipated March FOMC policy meeting next week against an increasingly uncertain economic backdrop.

- The U.S. central bank is widely expected to raise interest rates by 0.25% and signal that further moves are on hold for the time being.

- As such, I believe Powell and company are on track to commit a major policy error as they relent on their hawkish stance.

- No Change (21.8%): If the Fed were to fold under the pressure and keeps rates unchanged next week due to strains in the financial sector it would put into serious question its resolve to bring persistently high inflation back under control. Additionally, the damage to the central bank’s credibility would be unprecedented, especially after Powell stated numerous times that rates would have to stay higher for longer to battle inflation.

- 25BPS Hike (78.2%): While a quarter-point move would make the most sense at this point in time, the fact that the Fed may relent on its previous hawkish stance would put policymakers in a tough spot, especially with inflation still running well above the central bank’s 2%-target. This too could leave the Fed at risk of easing policy just as inflationary pressures begin to reaccelerate.

- 50BPS Hike (0%): A 50bps rate hike won't do the Fed much good either, with such an aggressive move likely to add to ‘hard-landing’ fears for the economy consisting of a deep and prolonged recession. As such, the U.S. central bank would likely face criticism for making such a large move, considering signs of mounting stress in the banking sector.

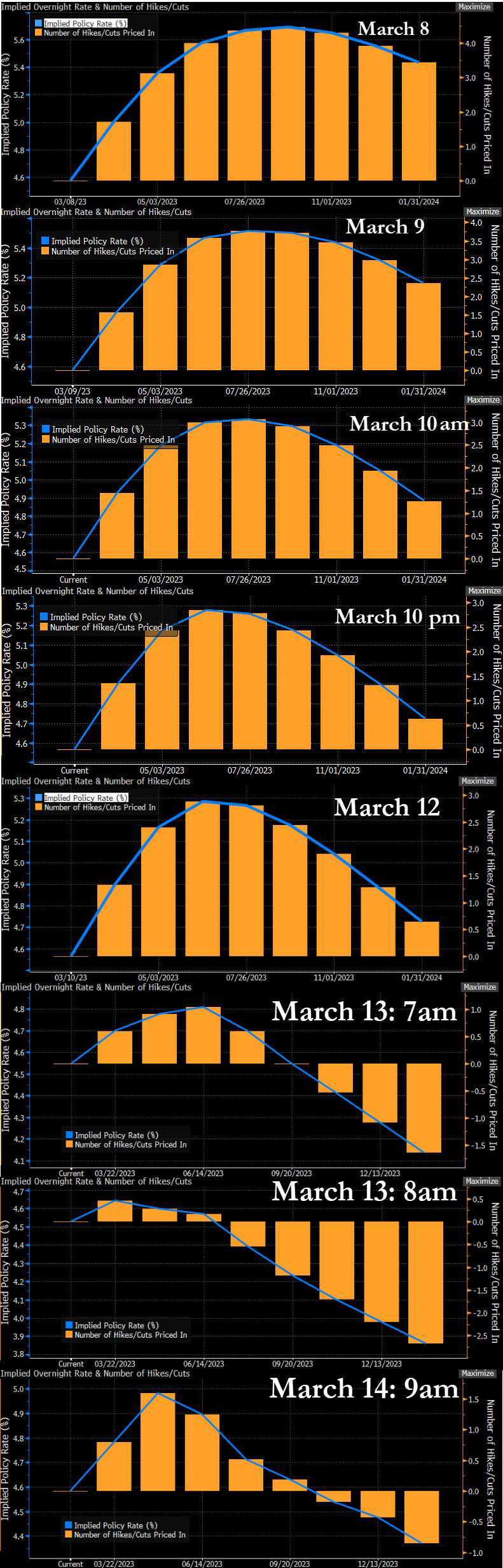

Markets have once again changed their mind about what they think the Federal Reserve will do next week regarding interest rates as cracks begin to appear in the financial system.

The U.S. central bank’s original plan to potentially raise rates by another 50 basis points at the conclusion of its March 21-22 meeting has been thrown into question in the past week due to growing signs of turmoil in the global banking sector.

After odds for a half-point rate hike spiked to almost 80% following Fed chief Jerome Powell's hawkish congressional testimony on Wednesday, March 8, those bets evaporated in just a few days, with chances of a 50bps move plunging to under 2% by the morning of Monday, March 13.

Source: Bloomberg

Essentially, what we saw was a historic repricing of rate hike bets as more banking turmoil emerged, with traders shifting pricing to indicate that the U.S. central bank may potentially hold the line this month. The probability for no Fed action next week briefly shot up to as high as 65% by Wednesday morning, then fell back to about 22% as of Thursday’s market close.

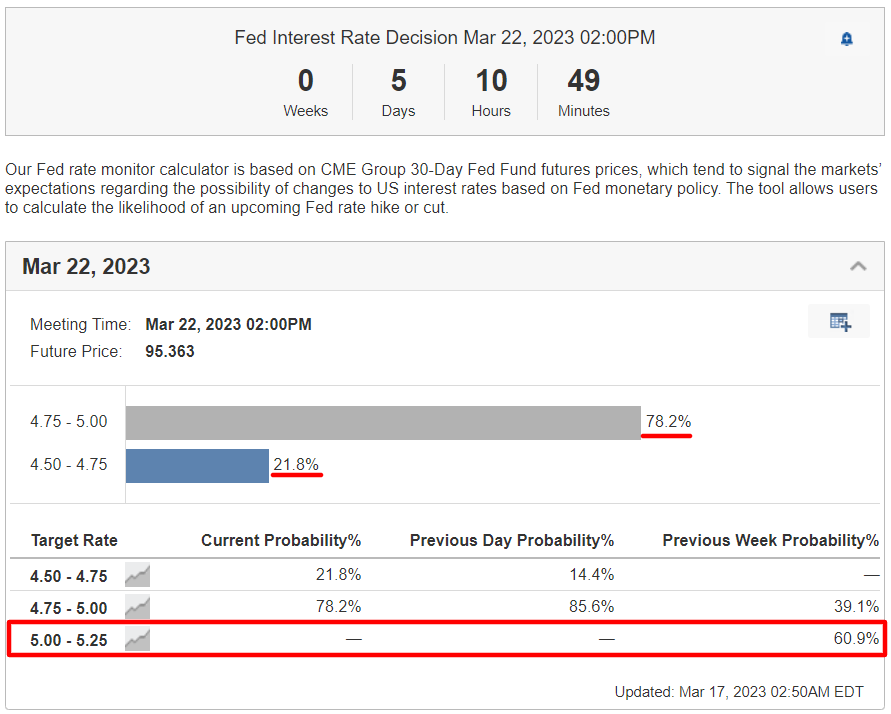

The latest moves suggested a 78% likelihood of a 0.25 percentage point move, according to the Investing.com Fed Rate Monitor Tool. That would put the Fed funds target in a range between 4.75% and 5.00%.

Source: Investing.com

Either way, market sentiment has shifted.

Fed chair Powell had been widely signaling a 50bps hike in the lead-up to the March FOMC meeting, but worsening fears about the health of the financial sector in the past week paved the way for a more restrained view for monetary policy.

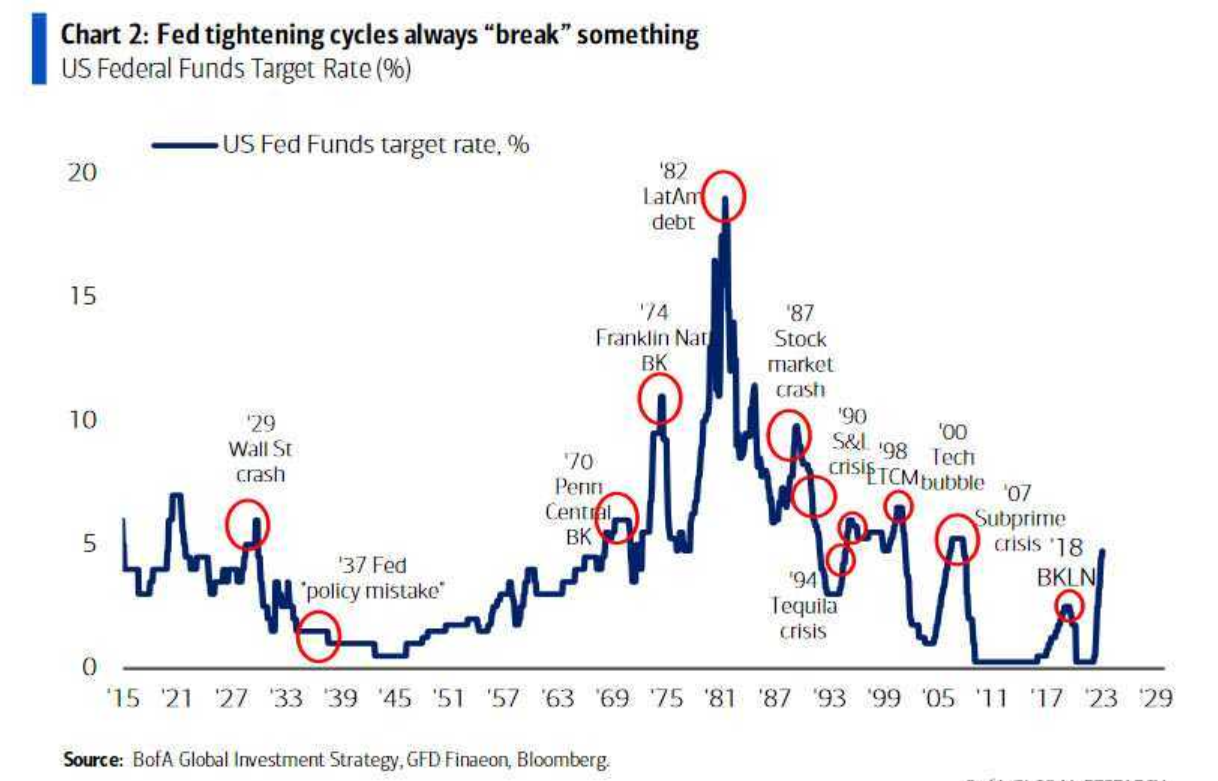

Some investors believe the Fed’s aggressive rate hike cycle has led to cracks in the financial system. As the chart below demonstrates, history shows that the Fed’s monetary tightening campaigns tend to have a negative impact on the global financial system.

Source: BofA/Bloomberg

As the U.S. central bank raises rates, things in the financial system start to “break”, often resulting in a crisis. We had the Latin American debt crisis of the 1980s, the Long-Term Capital Management hedge fund crisis in 1998, the tech bubble bursting in 2000, and the U.S. subprime housing crisis of 2007.

In this case, U.S. regional banks have been under intense pressure since last week, following the swift closures of Silicon Valley Bank and Signature Bank, the second-and third-largest failures in U.S. history.

Then came news that Credit Suisse (SIX:CSGN) may need a bailout after a major Saudi investor said it would not provide more capital to troubled Swiss lender due to regulatory issues. That forced the Swiss National Bank to step in on Thursday morning with a $54 billion lifeline to help shore up liquidity conditions.

Banking sector turmoil continued Thursday afternoon after a group of the largest U.S. financial institutions, including JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Goldman Sachs (NYSE:GS), and Morgan Stanley (NYSE:MS), came to the rescue of embattled First Republic Bank (NYSE:FRC) in the form of $30 billion in uninsured deposits to help stabilize the lender.

My take is that whatever the Fed does, it’s in a lose-lose ‘damned if you do and damned if you don’t’ situation. The U.S. central bank appears to be walking a tightrope, with the potential for a major policy error at each side.

My personal inclination is that Powell and company will decide to raise rates by 25bps at the upcoming meeting and signal that further hikes are on hold for the time being. That would effectively end the Fed’s year-long monetary tightening cycle, considering the troubling circumstances in the global financial system.

In addition, I believe policymakers will note that they are watching signs of more instability across the financial sector very carefully, with Powell ready to provide further liquidity measures if necessary.

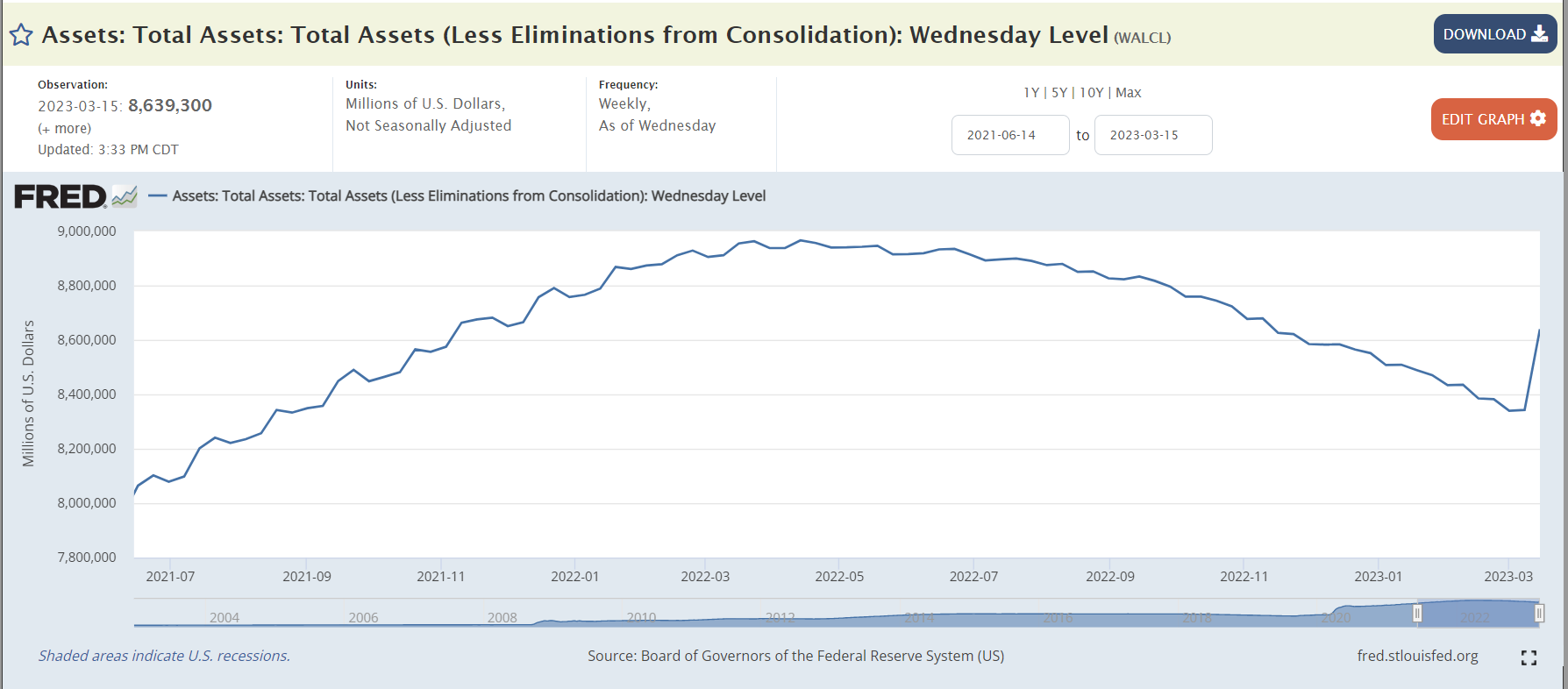

As seen below, the Fed’s balance sheet ballooned by $297 billion this week, undoing four months of quantitative tightening, as emergency loans to cash-strapped banks spiked to a new record. Source: St. Louis Fed

Source: St. Louis Fed

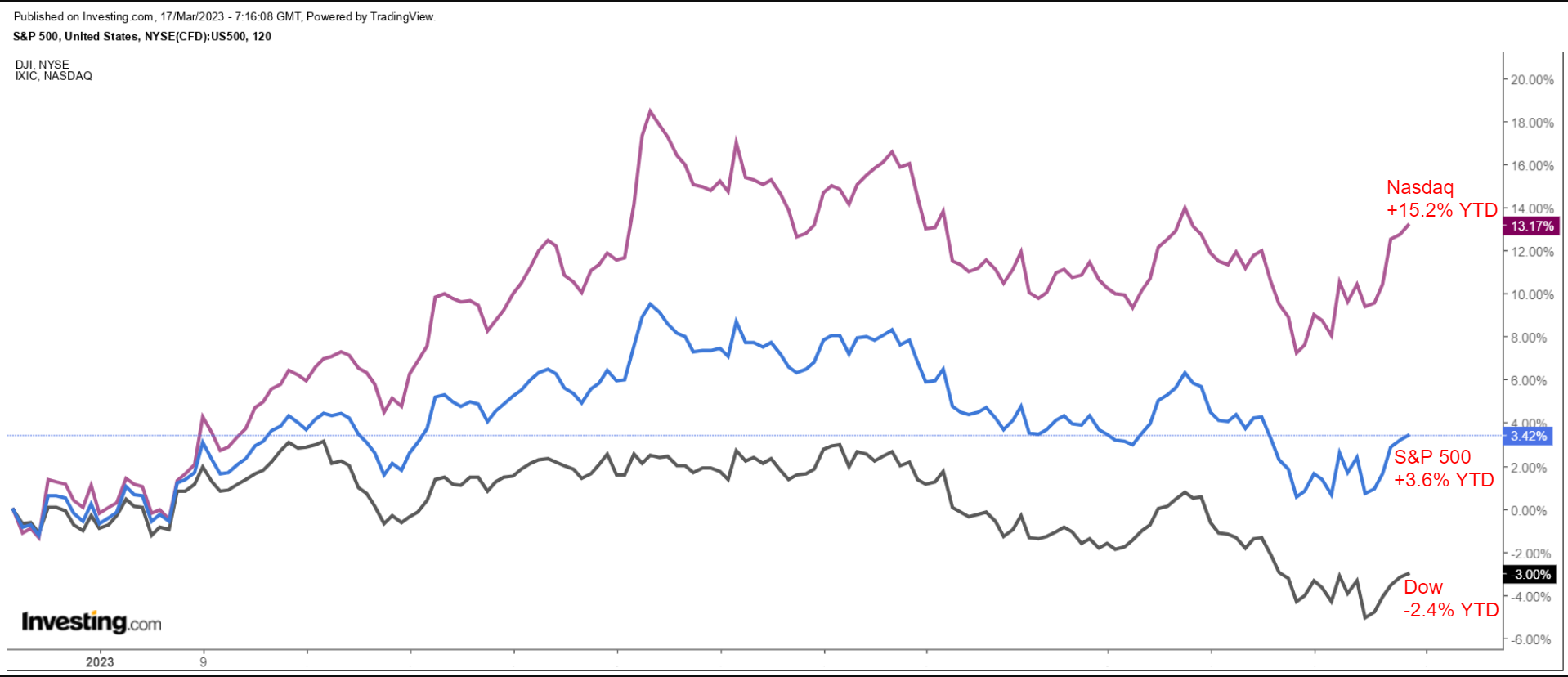

After a strong start to the year in January, the major U.S. averages have seen their rally melt away, with the blue-chip Dow Jones Industrial Average now down -2.4% on the year.

Meanwhile, the benchmark S&P 500 and the tech-heavy Nasdaq Composite have trimmed their year-to-date gains to +3.6% and +15.2% respectively, having pulled back from their 2023 highs reached in early February.

As always, long-term investors should remain patient, and alert to opportunity amid another expected bout of Fed-induced volatility next week.

***

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 via the SPDR Dow ETF (DIA), the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.