Markets spent most of the day in bearish territory, with only the Dow Jones salvaging something into the close.

Nvidia's (NASDAQ:NVDA) 5%+ loss in after-hours on its earnings release won't help the mood, but it could play as a bullish opportunity into today's open.

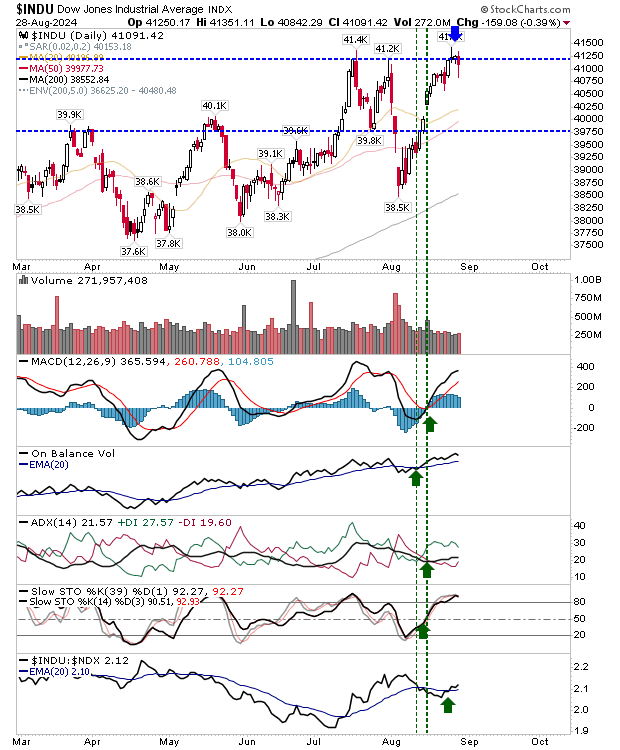

The Dow Jones Industrial Average ($INDU) did well to make back on its losses and it could follow through with an upside today, although Nvidia's results will likely keep a lid on things for a few days.

Technicals are net positive and there is nothing bearish here.

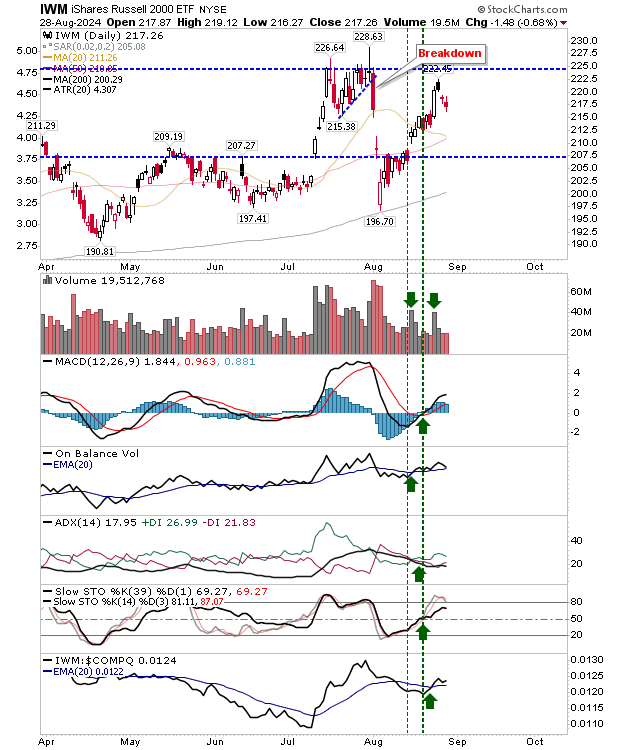

The Russell 2000 (IWM) continues to play off the 'black' candlestick reversal from Monday.

I will be looking for some expansion (further losses) today with support coming on the next test of its 50-day MA. Technicals remain net bullish but watch for a 'sell' trigger in On-Balance-Volume.

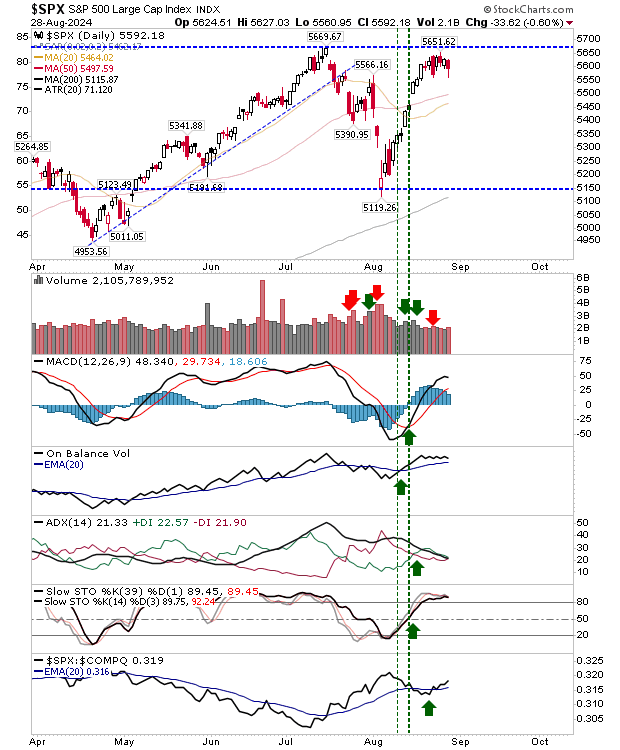

The S&P 500 is in a similar position to the Dow Jones, although it didn't gain as much ground as the latter index by the close of business yesterday. Despite this, the index continued to outperform the Nasdaq, and will likely continue to do so today.

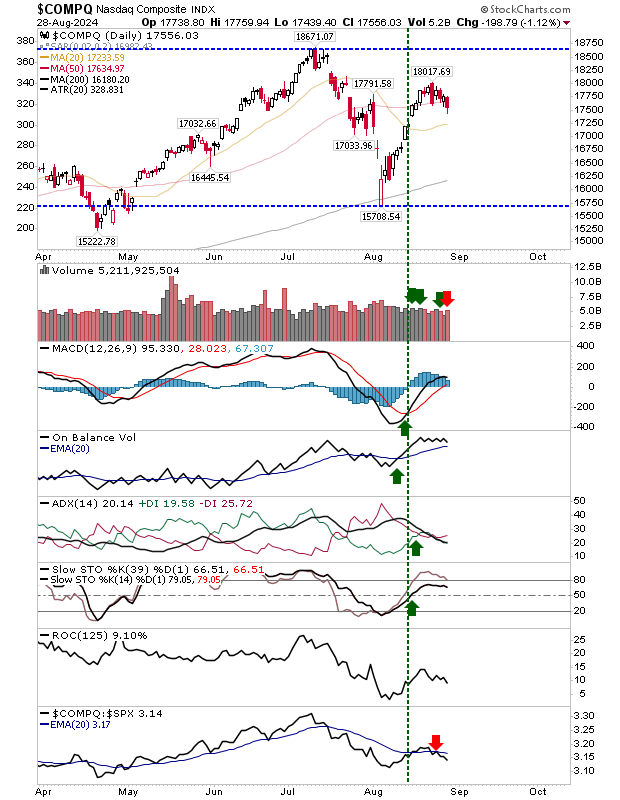

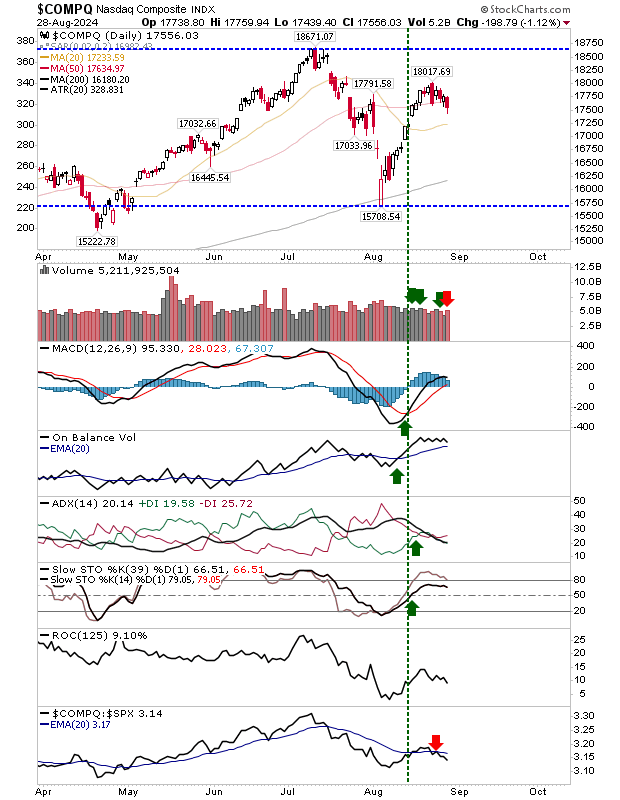

The Nasdaq had the worst of yesterday's action, undercutting its 20-day MA, although neither it nor its 50-day MA offered much in the way of support on its last test. Volume climbed to register as distribution. I will be looking for more of the same today.

With Nvidia's results to influence things today, look for a test of the 200-day MA in the Semiconductor Index. Although having already tested this moving average this month I wouldn't be expecting the second such test to hold.

For today, Nividia will dominate the action, but most of the damage is likely to be done pre-market, so watch for a rally off the inevitable opening gap lower.