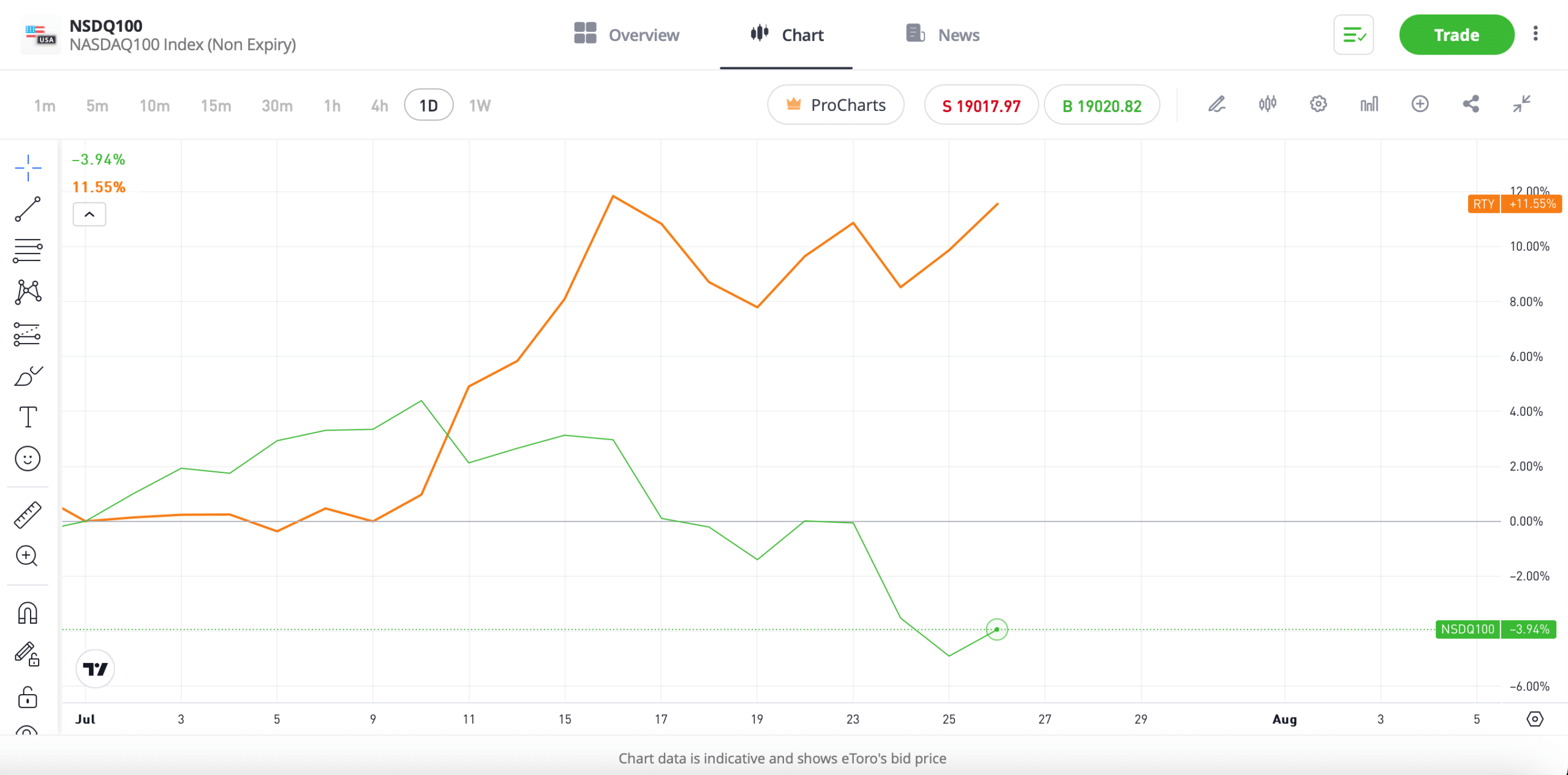

In an unprecedented shift in market dynamics, the tech-heavy NASDAQ Composite and the small-cap Russell 2000have experienced the largest performance gap on record, a divergence spanning three decades. This disparity is largely influenced by the political landscape and the recent economic trends.

Political Winds Favor Small Businesses

The election of Donald Trump and the potential for a Republican sweep across both the House and Senate have generated optimism for small businesses. Trump’s policies, which include lower taxes and reduced regulations, are perceived as advantageous for smaller companies, traditionally the backbone of the American economy. This political shift has spurred a notable rotation from large-cap tech stocks into small caps.

Earnings Performance: Big Tech vs. Small Caps

Big Tech has delivered impressive earnings results in recent quarters, propelling the NASDAQ to new heights. According to JPMorgan’s strategy team, another "monster quarter" is expected, with estimates projecting a 9.7% growth in S&P 500 earnings for the second quarter—the highest annualized growth since late 2021.

In contrast, the Russell 2000 has faced weak earnings over the past five quarters. Although there are forecasts for improved profits among small caps in the latest cycle, these gains are unlikely to sustain the recent rally in small-cap stocks. The substantial earnings gap underscores the performance disparity between the NASDAQ and the Russell 2000.

Market Liquidity and Economic Indicators

With liquidity on the rise and robust earnings from large-cap tech stocks, the markets could see continued upward momentum following a brief pause. Both the NASDAQ Composite and the S&P 500 benefit from their heavy weighting in tech giants. However, upcoming economic indicators, such as Friday's Personal Consumption Expenditures (PCE) and next week's jobs report and Federal Reserve testimony, will be critical in determining market direction. These reports will provide key insights into inflation, economic health, and future guidance.

Shift in Market Trends

The recent market selloff, driven in part by a rotation into small caps, was anticipated due to the overbought conditions in tech-heavy averages. The attempted assassination, which dramatically increased the likelihood of a Republican-controlled Congress and Presidency, marked the beginning of this shift. Historically, smaller companies thrive under Republican leadership, which often prioritizes business-friendly policies.

Additionally, the ongoing trends in Quantitative Easing (QE) continue to fuel inflation. The utility of AI and the high probability of a Republican victory in the upcoming election year further support the current market dynamics.

Federal Reserve and Global Liquidity

With lower inflation and rising unemployment, the Federal Reserve is expected to cut rates, as indicated by the CME FedWatch, which anticipates three rate cuts by the end of the year. This trend suggests that global liquidity, which has slowed in 2024, will likely rise later this year. Central banks may need to increase liquidity to address economic challenges, reinforcing the trend of growing market liquidity.

In summary, the record-breaking performance gap between the NASDAQ Composite and the Russell 2000 reflects a complex interplay of political developments, earnings disparities, and market liquidity. As the markets navigate these dynamics, the ongoing influence of big tech and the potential for a Republican-led government will be pivotal in shaping future trends.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Biggest Performance Difference Ever: NASDAQ and Russell 2000 Divergence

Published 26/07/2024, 12:24

Biggest Performance Difference Ever: NASDAQ and Russell 2000 Divergence

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.