- Social media company Snap has fallen out of favor with investors amid a plethora of macroeconomic and fundamental headwinds.

- SNAP stock is down 77.5% year-to-date and 87.3% from its Sept. 2021 record peak.

- I expect more pain ahead for Snap investors as Q3 earnings to reveal widening losses, shrinking revenue.

It's been a tough year for Snap (NYSE:SNAP). The Santa Monica, California-based company has lost over two-thirds of its value amid a toxic combination of recession fears, slowing digital-advertising spending, and increased competition from companies like TikTok.

The ad-reliant social media company, which was one of the big pandemic winners, has also struggled in the face of Apple's (NASDAQ:AAPL) crackdown on ad tracking across iOS apps and the impact of the ongoing war in Ukraine.

After rallying to a record high of $83.34 in September 2021, SNAP stock tumbled rapidly to a low of $9.34 on July 28. Snap shares have since staged a modest rebound, closing at $10.58 on Thursday, but they still stand roughly 88% below their all-time peak and down a whopping 77.5% year-to-date.

At current levels, the Santa Monica, California-based company has a market cap of $17.5 billion. At its peak, valuation reached $136 billion.

Despite the sharp reset in its valuation, I believe that SNAP is vulnerable to further losses in the weeks ahead, which could see the stock potentially fall to its pre-pandemic low.

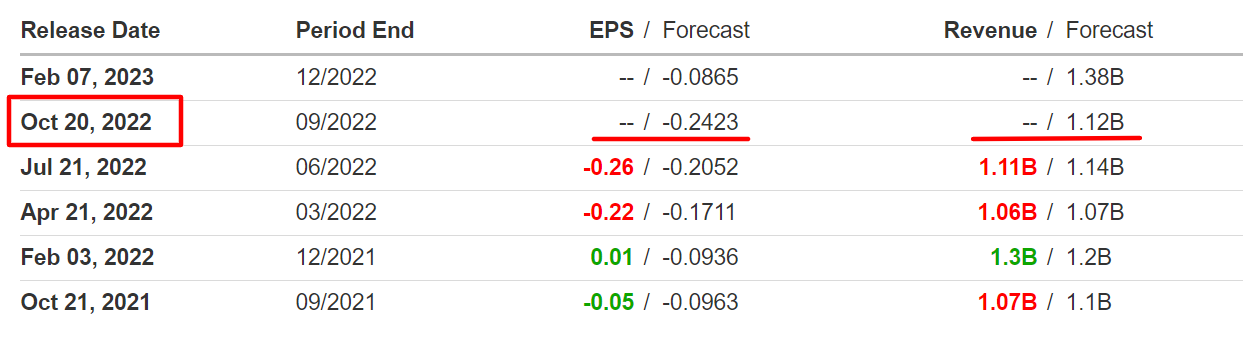

The next major downside catalyst is expected to arrive when Snap reports third-quarter financial results after the U.S. market closes on Thursday, October 20.

Consensus estimates call for the Snapchat parent company—which has managed to turn a profit only once since going public in 2017—to deliver a loss of $0.24 per share. That compares to a loss per share of $0.05 in the same quarter last year.

Revenue is forecast to rise just 4.6% year-over-year to $1.12 billion as corporations and small businesses continue to cut back on ad spending. If confirmed, that would mark the slowest pace of annualized sales growth on record.

Snap badly missed profit and sales growth expectations when it released Q2 results in July amid weak performance in its core ads business and growing competition from Chinese video-sharing app TikTok.

On top of that, management failed to provide future guidance because allegedly, "forward-looking visibility remains incredibly challenging."

The social media company then followed that up with an announcement in late August that it plans to lay off approximately 20% of its 6,400 employees as it looks for ways to cut operating costs.

Snap's advertising sales unit was also shaken-up with chief business officer Jeremi Gorman leaving to run ads for Netflix (NASDAQ:NFLX). Head of ad sales for the Americas, Peter Naylor, also departed as part of the restructuring, joining Gorman at the video-streaming company.

Gorman, who arrived at Snap in 2018, is a well-respected executive who previously spent six years at Amazon (NASDAQ:AMZN). Her hiring was aimed at bringing credibility to Snap's ad-sales business. Naylor was Hulu's senior vice president of ad sales for six years before joining Snap in 2020.

The departure of the two senior ad executives is seen as a negative and adds to investor concerns over the future of the social media company's advertising business.

Bottom Line

I expect headwinds in the advertising market to persist throughout the rest of the year and into early 2023 as advertisers shift spending to higher-performing channels amid a challenging economy.

That does not bode well for Snap's monetization efforts, which will likely prolong its path to profitability and heighten its execution risk.

Despite the months-long selloff, Snap's stock is still overvalued as it trades at more than 28 times this year's sales, making it a less attractive option amid the current market environment.

Disclosure: At the time of writing, Jesse has no position in any stock mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.