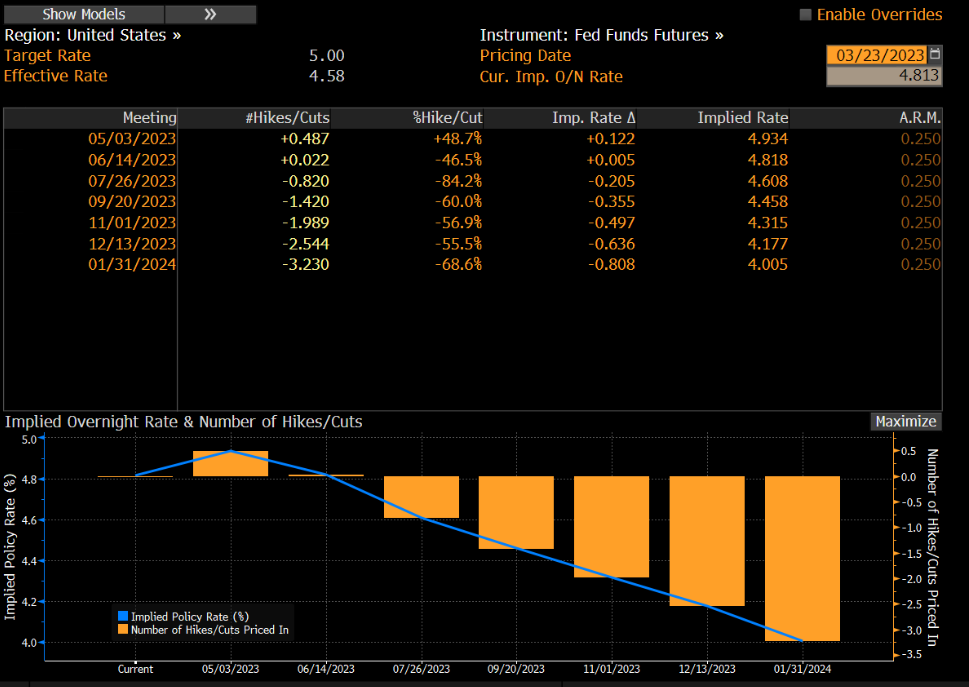

- The markets are anticipating the March interest rate hike being the last.

- Some asset classes hit hard in 2022, such as bonds, gold/silver futures, Bitcoin, and tech stocks, are rebounding.

- As the fed eventually moves on to lowering rates, these assets could rally, making an attractive buying opportunity at current prices.

We do not yet know if the March hike was the last, but the markets already seem to be discounting it.

Not surprisingly, many of the asset classes hit hard in 2022 are slowly rearing their heads. Out of all of them, we have seen an interesting rebound in 4 asset classes:

There are several reasons for this. First, the famous de-correlation from equities seems to have (thankfully) returned for bonds. In times of turmoil, investors flock back to bonds, which are perceived as safer, especially now that yields are higher.

The same is true for gold and silver (plus the former is seen as a safe haven asset). The fact that the Fed has become softer and will first stop raising rates and eventually lower them means that the new environment of lower rates will lower the discount rates used to determine current prices.

Consequently, lower discount rates mean higher values today, and that is another element that markets are starting to price in.

Another useful element is that it becomes cheaper (for an opportunity-cost argument) to move back into equities as bonds rise in price (and thus yields fall).

For example, a U.S. investor who bought a 2-year Treasury bond paying 5 percent per year instead of stocks would consider switching back when stocks begin to rise.

No wonder the entire asset class has rebounded since the SVB Financial Group case broke. The same is true of bitcoin, which is back above 28,000.

Finally, I would like to remind you that despite the fact that investors are still negative and keep talking about 2008-style collapses, the NASDAQ Composite is up 12.7% since the beginning of the year. Too bad no one is talking about it.

As always, people continue to read the news in the newspapers (which have to sell copies, and fear is the best-selling emotion) and look at the markets through the rear-view mirror, suffering from recency bias (last year was negative, so next year will be negative, it's all negative).

Remember, these are just distractions.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, consultation, or recommendation to invest and, as such, is not intended to induce the purchase of any assets. I would like to remind you that any type of investment is evaluated from multiple perspectives and is highly risky and, therefore, any investment decision and the associated risk remain with the investor.