Stocks fell on Friday, but Wall Street’s major averages still managed to score weekly gains amid renewed hopes for another fiscal stimulus package and optimism over COVID-19 vaccine progress.

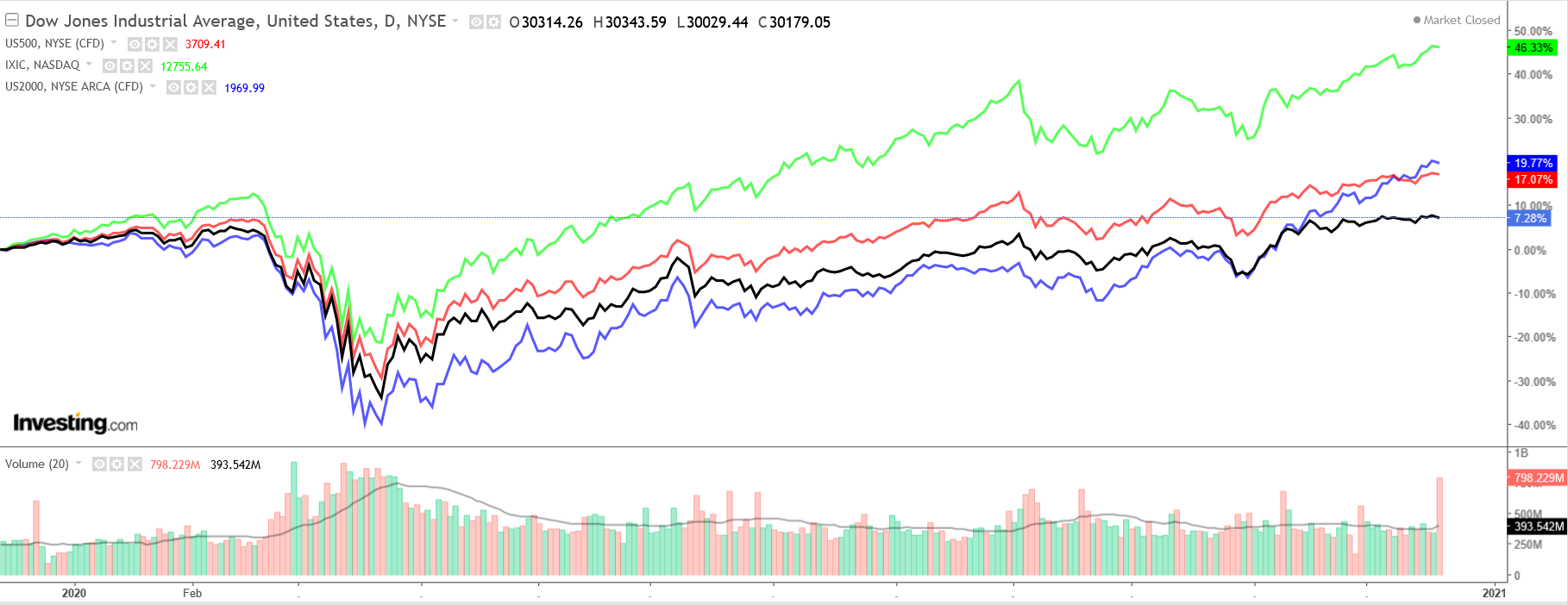

For the week, the Dow rose 0.4%, while the S&P 500 tacked on 1.3%. The NASDAQ and the Russell outperformed, with both notching a gain of 3.1% over that time frame.

Investors should expect more volatility in the holiday-shortened Christmas week ahead as they monitor fresh developments on the stimulus and vaccine front.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand in the coming days and another which could see additional losses.

Stock To Buy: JPMorgan Chase

JPMorgan Chase & Co (NYSE:JPM) shares are likely to see increased buying activity in the week ahead after the largest U.S. bank by assets said that it approved a $30 billion stock buyback program starting in 2021.

In the same announcement, which was made shortly after the Federal Reserve released the results of its second bank stress test of 2020 on Friday afternoon, JPMorgan also declared that it would maintain its regular quarterly dividend of $0.90 per common share.

"We will continue to maintain a fortress balance sheet that allows us to safely deploy capital by investing in and growing our businesses, paying a sustainable dividend, and returning any remaining excess capital to shareholders," CEO Jamie Dimon said in Friday’s statement, which came after the market closed.

The Fed had previously prohibited banks from buying back stock and limited dividend payouts following the first round of bank stress tests in June, in order to help them build capital reserves due to the negative impact of the ongoing COVID-19 health crisis.

Shares of the Dow giant, which were down by as much as 45% at one point earlier this year, have bounced back in recent weeks, trimming their year-to-date losses to 14.6%.

Outperforming industry peers such as Bank of America (NYSE:BAC), Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC), JPM stock closed at $119.08 on Friday, not far from the best level in almost nine months, valuing the New York City-based lender at roughly $363 billion.

We anticipate the news of the $30B share repurchase plan will likely push JPM stock higher in the coming week as the plan is more crucial for the banking industry than almost any other sector.

Stock To Dump: Intel

Investors may want to stay away from shares of chipmaker Intel (NASDAQ:INTC) this week as they await further developments following a report that Microsoft (NASDAQ:MSFT) plans to develop its own in-house processors for its servers and Surface PCs.

That does not bode well for Intel, which has seen more and more rival Big Tech companies, such as Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN), opt to develop their own chips and microprocessors recently.

Intel shares have cratered nearly 21% year-to-date, compared to the NASDAQ Composite’s roughly 42% gain over the same timeframe, with investors becoming concerned by the struggling chipmaker's future prospects.

Once widely-considered the undisputed leader in the computer processors industry, Intel has been steadily losing market share to smaller rivals such as Advanced Micro Devices (NASDAQ:AMD) and NVIDIA (NASDAQ:NVDA) in recent years.

INTC stock, which is now just 8% away from reaching a new 52-week low, closed the week at $47.46, giving the Santa Clara, California-based semiconductor company a market cap of approximately $194.5 billion.

From a technical standpoint, Intel stock has fallen below its 50-day, 100-day, and 200-day moving averages, which usually signals more selling pressure ahead.

Taking this into consideration, INTC shares look set to remain on the backfoot in the days ahead due to the growing threat to its all-important chip business—the company’s most profitable source of revenue.