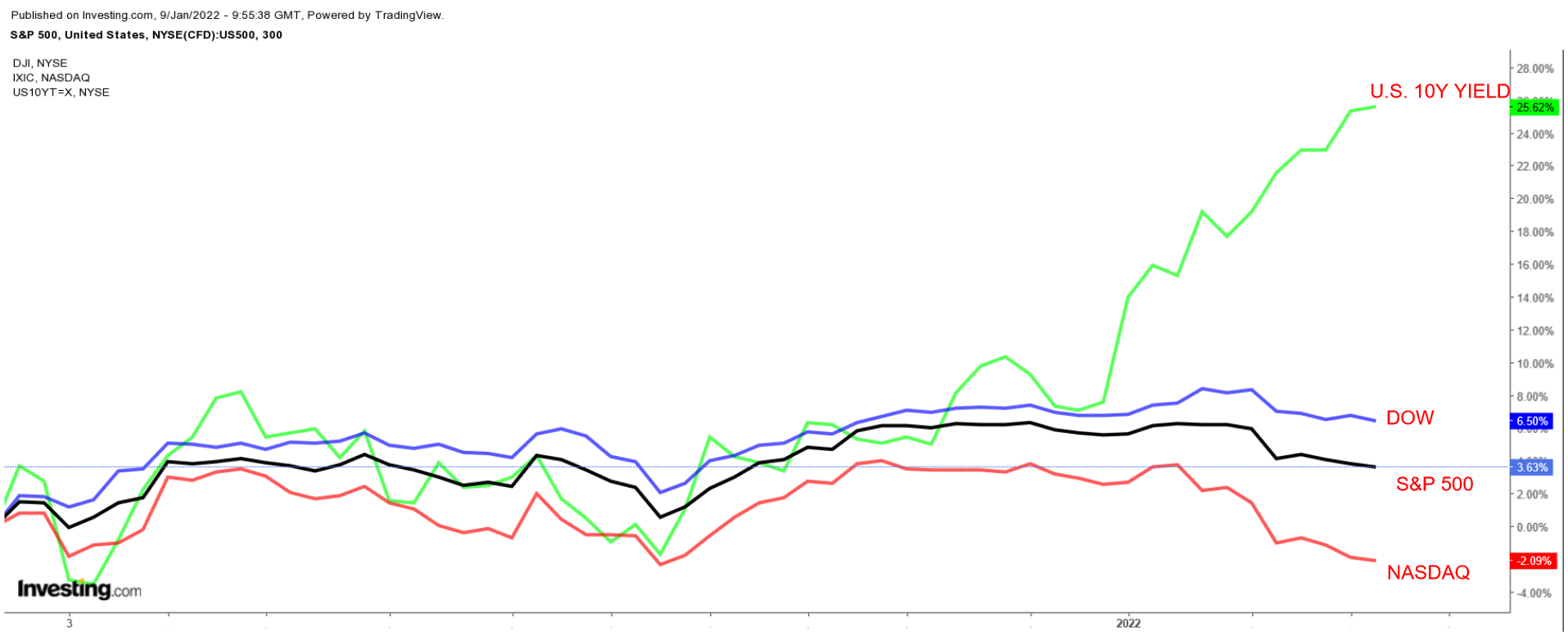

Stocks on Wall Street ended lower to wrap up the first trading week of 2022 on Friday. The NASDAQ suffered its biggest weekly drop in almost a year as soaring Treasury yields sparked a massive selloff in many top-rated tech shares.

The U.S. 10-year bond yield jumped 26 basis points for the week, closing at 1.765%, following the midweek release of hawkish Fed minutes. The benchmark note hit a session peak of 1.801% on Friday, the highest level since January 2020.

The week ahead is expected to be another busy one, given the start of Wall Street’s fourth-quarter earnings season, which sees names like JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), and Delta Air Lines (NYSE:DAL) all report their latest financial results.

There is also important economic data on the agenda, including the latest consumer price inflation report and retail sales figures.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand in the coming days and another which could see fresh losses.

Remember though, our timeframe is just for the week ahead.

Stock To Buy: Goldman Sachs

Given the ongoing surge in rates across the Treasury market resulting from growing bets that Fed interest rates will rise faster-than-expected this year, Goldman Sachs Group (NYSE:GS) shares look like a solid investment in the week ahead.

Higher rates and yields tend to boost the return on interest that banks earn from their loan products, or net interest margin—the difference between the interest income generated by banks and the amount of interest paid out to their depositors. That should bode well for Goldman, which has thrived in recent months thanks to signs of robust investment banking activity, a booming IPO market, and a recovering economy.

GS stock is up 3.9% year-to-date and 37.1% in the last 12 months. It ended Friday’s session at $397.51, not far from a record peak of $426.16 reached on Nov. 2. At current levels, the New York City, New York-based financial services firm has a market cap of roughly $132.6 billion.

Goldman, which smashed expectations for earnings and revenue in the last quarter, is scheduled to report its latest financial results before the U.S. market open on Tuesday, Jan. 18.

Consensus estimates call for the investment banking giant, which has beaten Wall Street estimates for six consecutive quarters, to post earnings per share (EPS) of $11.75 for its fourth quarter, declining 2.7% from EPS of $12.08 in the year-ago period.

Revenue, however, is expected to increase 2.2% year-over-year to $12.0 billion, benefitting from an upbeat performance across its investment banking unit and record asset management fees.

Beyond the top-and-bottom line figures, investors will focus on the Wall Street powerhouse’s continuous efforts to return more cash to shareholders in the form of higher dividend payouts and stock buybacks.

Stock To Dump: Robinhood Markets

Shares of Robinhood Markets (NASDAQ:HOOD) could break down to new lows in the coming days as investors continue to worry over the negative impact of several factors afflicting the popular trading platform.

With rates rising rapidly due to the Fed's prep to tighten monetary policy more aggressively than previously thought, unprofitable technology companies such as Robinhood look set for further losses.

In general, higher yields and expectations of more hawkish Fed policy tend to weigh heavily on high-growth tech stocks with lofty valuations, as it threatens to erode the value of their longer-term cash flows.

HOOD stock—which started trading on the New York Stock Exchange at $38 following the company’s much-hyped IPO in late July—closed Friday’s session at $15.89, more than 80% below its record high of $84.12 touched on Aug. 4. At current levels, the Menlo Park, California-based stock market-trading platform has a market cap of $13.6 billion.

Robinhood next reports earnings after the U.S. market closes on Tuesday, Jan. 25. Consensus calls for a loss of $0.35 per share for the fourth quarter on revenue of $367.5 million.

The financial services company reported disappointing Q3 financial results in late October and warned that lower retail trading activity and seasonal headwinds would likely persist into year-end.