- CPI inflation data, start of Q2 earnings season in focus.

- Delta Air Lines shares are a buy with upbeat earnings on deck.

- Citigroup’s stock will struggle amid weak profit and revenue outlook.

- Looking for more actionable trade ideas to navigate the current market volatility? InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

- Monthly: Save 20% and gain the flexibility to invest on a month-to-month basis.

- Yearly: Save a jaw-dropping 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Yearly (Web Special): Save an astonishing 52% and maximize your returns with our exclusive web offer.

Wall Street's main indices ended lower on Friday, capping off a losing week as investors digested a U.S. jobs report that failed to shake off fears that the Federal Reserve may start hiking interest rates again later this month.

The U.S. added the fewest jobs in more than two years in June, although persistently high wage growth pointed to still-tight labor market conditions, U.S. government data showed.

For the week, the blue-chip Dow Jones Industrial Average fell roughly 2%, while the benchmark S&P 500 and technology-heavy Nasdaq Composite declined around 1.2% and 0.9% respectively. The small-cap Russell 2000 slumped 1.4%.

The week ahead is expected to be another eventful one as investors continue to gauge the outlook for inflation, interest rates, and the economy.

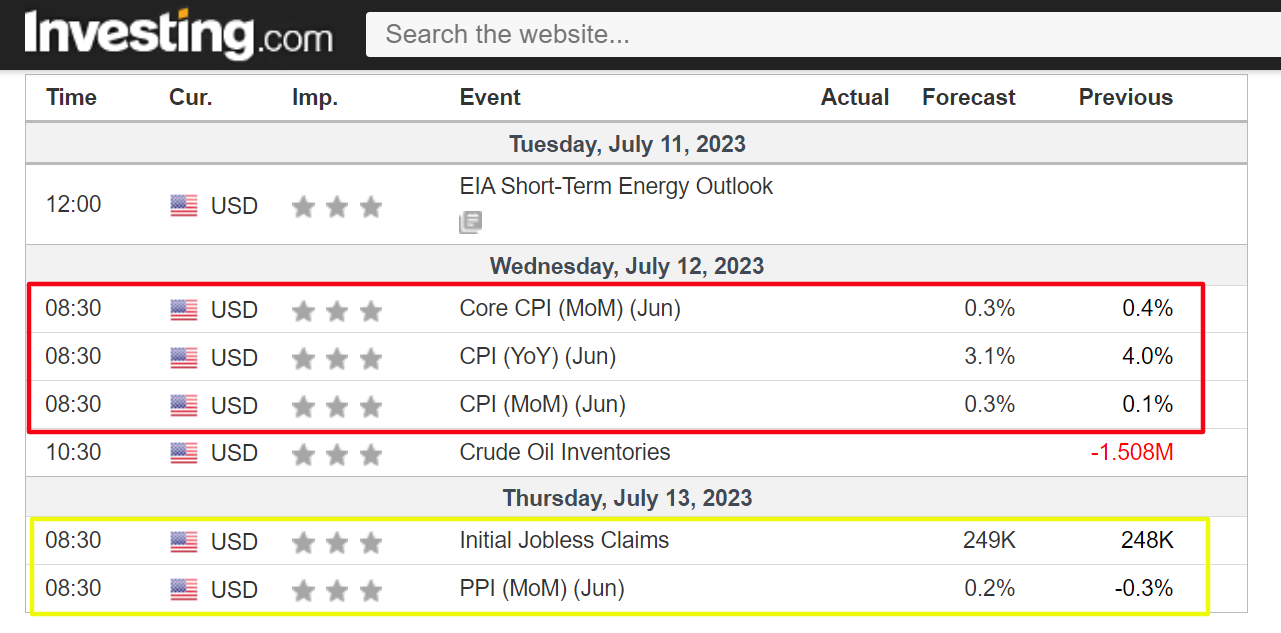

On the economic calendar, most important will be Wednesday’s U.S. consumer price inflation report for June, which is forecast to show headline annual CPI cooling to 3.1% from the 4.0% increase seen in May.

The CPI data will be accompanied by a heavy slate of Federal Reserve speakers, which will surely add to the debate on the U.S. central bank’s next move.

Currently, financial markets are pricing in a 93% chance of a 25 basis point rate hike at the next policy meeting on July 26, according to Investing.com’s Fed Rate Monitor Tool.

Meanwhile, the earnings season officially kicks off on Friday with JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), and UnitedHealth Group (NYSE:UNH) all scheduled to release quarterly results.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see further downside.

Remember though, my timeframe is just for the week ahead, July 10-14.

Stock To Buy: Delta Air Lines

I expect Delta Air Lines (NYSE:DAL) stock to march higher in the week ahead, with a potential breakout to a new 52-week high on the horizon, as the legacy air carrier’s second quarter earnings will surprise to the upside in my view thanks to favorable consumer demand trends and an improving fundamental outlook.

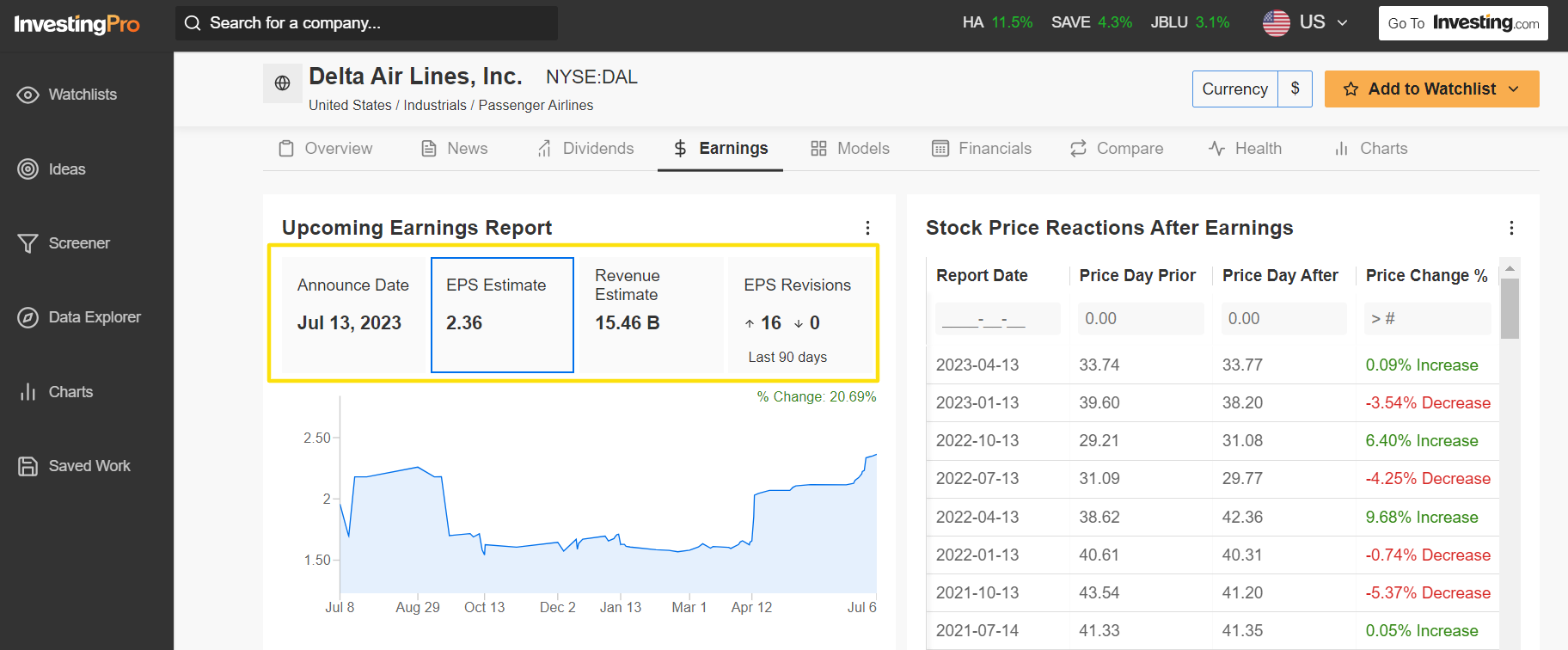

Delta is scheduled to deliver its Q2 report before the U.S. market opens on Thursday, July 13, at 6:30AM ET. According to the options market, traders are pricing in a swing of about 6% in either direction for DAL stock following the update.

Despite a challenging operating environment, I believe Delta is poised to deliver a better-than-expected print as it capitalizes on the ongoing recovery in the travel industry despite recession fears that have sparked concerns about consumer spending.

According to an InvestingPro survey, Delta’s earnings estimates have been revised upward 16 times in the past 90 days, compared to zero downward revisions, as Wall Street analysts grow increasingly bullish on the airliner.

Wall Street sees the Atlanta, Georgia-based company earning $2.36 a share in the June quarter, soaring 63.9% from EPS of $1.44 in the year-ago period, while revenue is forecast to increase 25.6% annually to $15.46 billion.

If those figures are confirmed, it would mark the best quarter in Delta’s 98-year history as profitability trends continue to recover from the COVID-19 pandemic amid the ongoing improvement in air travel demand.

As such, I believe Delta’s management will provide strong sales guidance for the rest of the year as the carrier remains well-placed to thrive thanks to robust domestic demand for both leisure and corporate travel while also benefitting from increasing international traffic.

DAL stock ended at $47.88 on Friday. Shares - which have gained 45.7% so far this year - climbed to $48.81 on Wednesday, a level not seen since April 15, 2021.

At current valuations, Delta has a market cap of about $31 billion, earning it the status of the world’s most valuable airline company, ahead of industry peers such as Southwest Airlines (NYSE:LUV), Ryanair (LON:0RYA) Holdings (NASDAQ:RYAAY), United Airlines (NASDAQ:UAL), and American Airlines (NASDAQ:AAL).

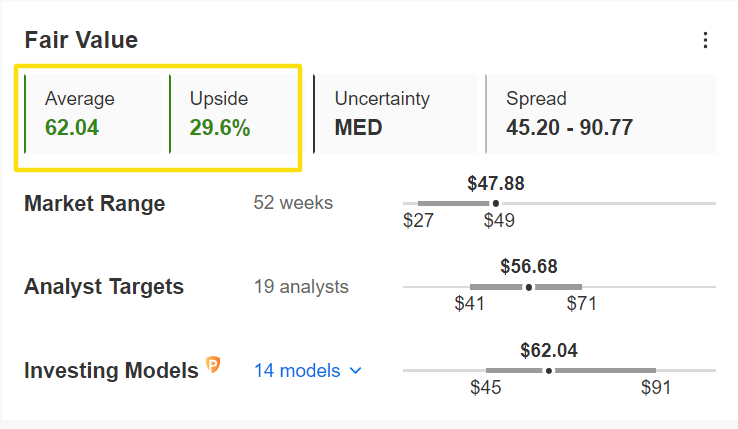

Despite strong year-to-date gains, it should be noted that Delta’s stock appears to be substantially undervalued heading into the earnings print, according to several valuation models on InvestingPro.

The average ‘Fair Value’ price target for DAL stands at $62.04, a potential upside of 29.6% from the current market value.

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

Stock To Sell: Citigroup

I believe shares of Citigroup (NYSE:C) will underperform in the week ahead as the megabank’s latest earnings report will likely reveal another sharp slowdown in both profit and revenue growth due to the difficult economic climate.

Citi’s financial results for the second quarter are due ahead of the opening bell on Friday, July 14 at 8:00AM ET and are once again likely to take a hit from a slowdown in its consumer banking business.

Options trading implies a roughly 5% swing for C shares after the update drops.

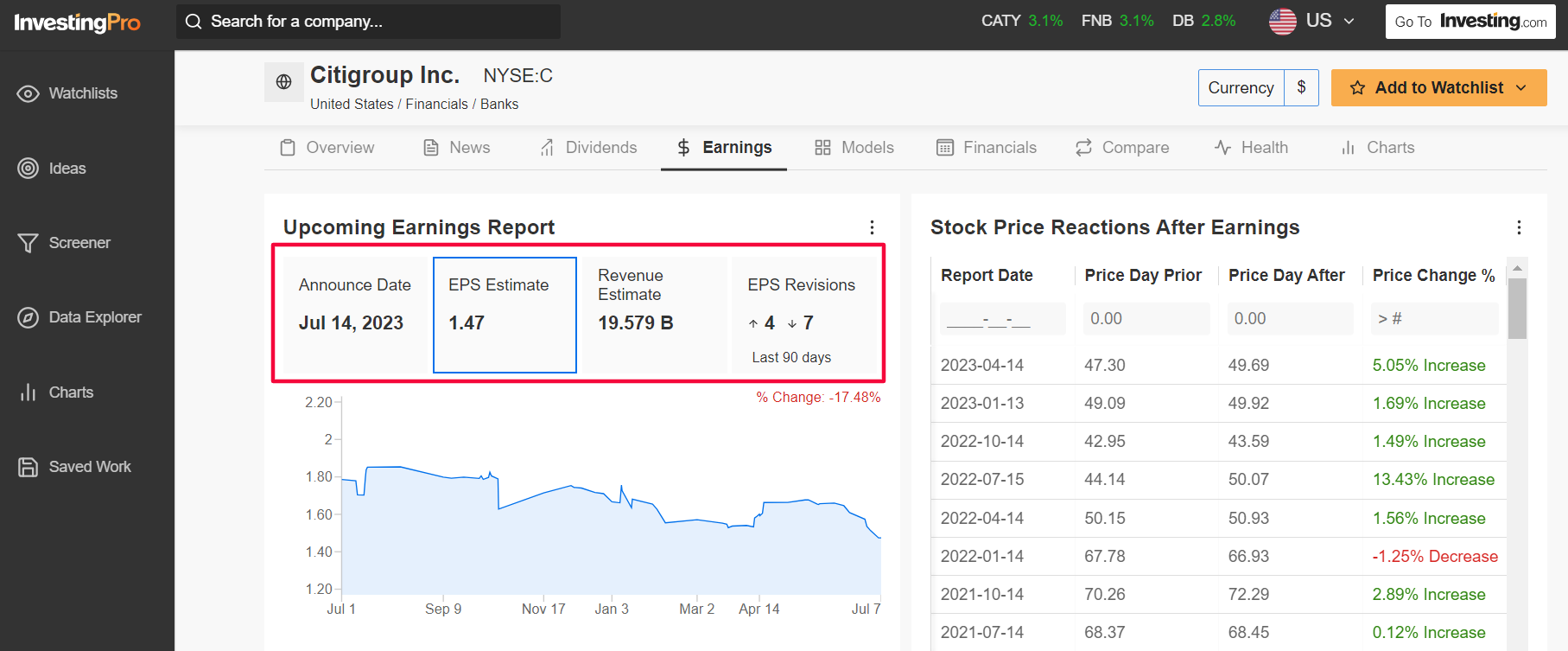

Underscoring several headwinds Citigroup faces amid the current backdrop, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the report, with analysts cutting their EPS estimates seven times in the last 90 days, compared to four upward revisions.

Consensus calls for the New York-based lender to deliver earnings per share of $1.47, declining 32.8% from EPS of $2.19 in the year-ago period.

Revenue expectations are equally concerning, with sales growth predicted to slip about 1% year-over-year to $19.57 billion due to a sharp slowdown in its consumer banking unit.

Beyond the top-and-bottom line figures, comments from CEO Jane Fraser should offer further guidance on how she expects the bank to perform throughout the rest of the year amid lingering macroeconomic headwinds and worries over deposit stability.

C stock ended Friday’s session at $45.74, earning the financial services company a market cap of $89 billion. At its current valuation, Citigroup is the fourth-largest banking institution in the United States, behind JPMorgan Chase, Bank of America (NYSE:BAC), and Wells Fargo.

Citigroup shares have underperformed those of the other big banks this year, gaining just 1.1% in 2023, amid lingering worries over the health of the financial sector in the aftermath of the regional banking crisis.

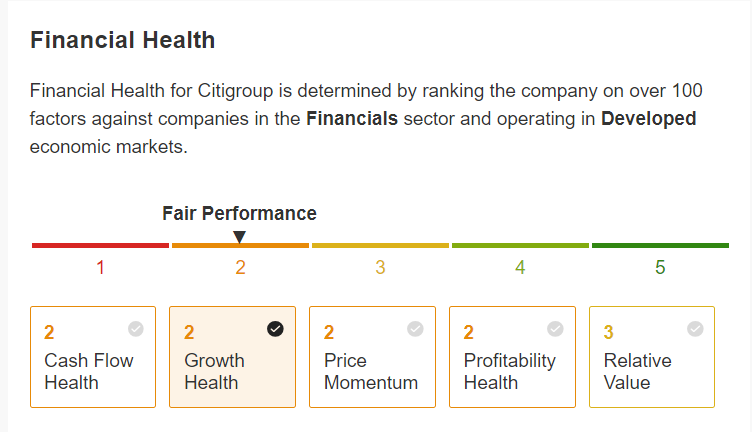

Not surprisingly, Citi currently has a below average InvestingPro ‘Financial Health’ score of 2.2 out of 5.0 due to concerns on profitability, growth, and free cash flow. The Pro health metric is determined by ranking the company on over 100 factors against other companies in the Financials sector.

Despite hiking its dividend following the Fed's stress test last month, Citi said its stress capital buffer (SCB) requirement will increase this year, contrasting with industry rivals whose SCB dropped.

The size of the SCB, which refers to an additional layer of capital introduced in 2020 that sits on top of banks' minimum capital requirements, reflects how well a bank performs on the test.

Looking for more actionable trade ideas to navigate the current market volatility? InvestingPro helps you easily identify winning stocks at any given time.

As part of the InvestingPro Summer Sale, you can now enjoy incredible discounts on our subscription plans for a limited time:

Don't miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, Summer Sale won't last forever!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.