Benzinga - by The Critical Metals Report, Benzinga Contributor.

Source: Michael Ballanger 04/09/2024

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the silver market and one copper stock he believes is a Buy.

Yesterday afternoon, shortly after the Comex pit sessions for the precious metals closed, I bit the bullet and decided to open a trading position in silver.

Despite my aversion to silver for most of the move in 2024, the SLV:US is ahead 12.44% year-to-date and is now outperforming gold GLD:US, which is up 10.64% YTD.

This performance by silver confirms the integrity of the new bull market in gold and the miners and is a welcome set-up for continued gains in the seniors and for the eventual recovery and outperformance in the junior developers.

- Bought 25% position SLV May $25 calls at $1.30 (risking $.50 per contract).

Fitzroy Minerals Inc.

Speaking of the junior developers, it appears that Fitzroy Minerals Inc. (OTC: FTZFF) is about to release an update on the Argentina-based Taquetren project where, up until now, exploration efforts have been unremarkable, to say the least.I have always held Taquetren in high esteem largely because of the presence of Daniel Bussandri, the prospector/geologist responsible for the discovery of the gargantuan Navidad Silver deposit in 2001. Sold to Pan American Silver Corp. (NYSE: PAAS) for $600 million in 2009, Navidad contains over 800 million ounces of silver along with copious quantities of lead and zinc and is located (like Taquetren) within the Gastre Fault zone of Patagonia.

However, unlike Navidad, which is located in mining-hostile Chubut Province, Taquetren is located in mining-friendly Rio Negro Province in an area that hosts the Calcatreu gold deposit owned by Patagonia Gold Plc (OTC: HGLD). From what I am able to gather, Bussandri and his team have identified a gold-bearing zone at Taquetren that has caught his (and management's) attention in a rather large way so, with the obvious priorities being the two Chilean copper projects (Caballos and Polimet), this news comes as a pleasant surprise although I do not have any hard information on what has been found other than little snippets of information rather than anything material.

All I can glean is that Daniel Bussandri is excited, so if the man that delivered Navidad likes what he is seeing, that has to be important, making me quite pleased to be a shareholder of a company with multiple irons in the proverbial fire.

From what I am hearing, news on both Caballos and Polimet is pending as they prepare for the upcoming drill programs in the coming months. With copper prices now forging ahead of $4.30/lb., I am exceedingly bullish on the outlook for FTZ and look forward to the establishment of a quantifiable copper resource in 2024. The retail investor group will find the junior copper deals as copper prices continue to advance, making accumulation of FTZ shares a prescient move.

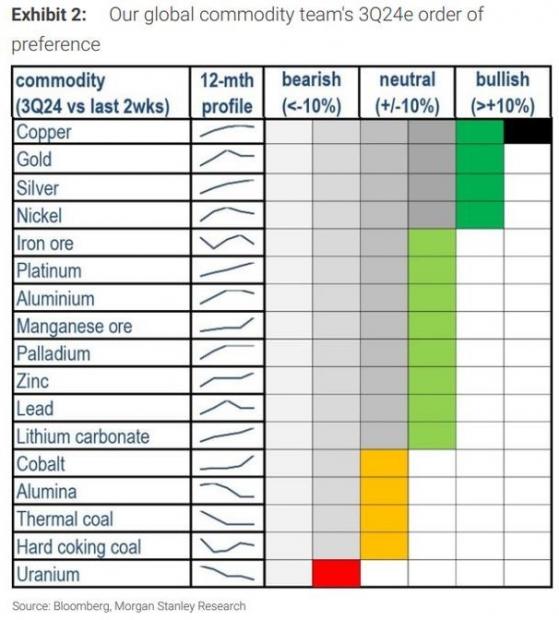

Above is a chart from Morgan Stanley's Research Department ranking the metals for expected performance in 2024. The presence of copper and gold at the top of the list is no surprise to us, although uranium at the bottom and ranked "bearish" is definitely a surprise.

With my holdings dominated by copper and gold developers and explorers, it is good to know that the big institutional wirehouses are of the same opinion.

Important Disclosures:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Read the original article on Benzinga