Welcome to the Investing.com UK weekly FTSE 100 latest update, designed to keep investors informed on the newest UK stock market movements and key developments. In this weekly report, you'll find a summary of the last week's significant news, and trends affecting the FTSE 100 index, helping you stay ahead with timely insights for your investment decisions.

We update every Friday during London Stock Exchange (LSE) market opening times between 8:00am-4:30pm UK local time (GMT+1).

FTSE 100 Share Price Opening 14th October 2024

The closing share price for the start of this week, Monday 14th October, was 8,292.66, which sat +0.47% higher than at close on Friday 20th September, suggesting a modestly positive start in an attempt to make up for the previous week’s losses.

Investor Sentiment This Week For FTSE 100 Predictions

The FTSE 100 started the week with a +0.47% boost on Monday, with further improvements happening on both Wednesday and Thursday. After a surprisingly solid September (when compared to previous years), October still seems to be struggling to make noticeable progress.

Inflation Lowers, But At What Cost?

For the first time since April 2021, headline UK consumer prices have dropped below the Bank of England’s target of 2%. In September, the annual inflation rate fell to 1.7%, which is quite a bit lower than the anticipated 1.9% and a significant drop from 2.2% in August.

The core inflation rate (that is, the rate without the fluctuating prices of food and energy, which are known to swing widely) came in at 3.2%, again lower than the anticipated figure, which was down from 3.6% the previous month.

This dip in inflation aligns with earlier reports this week revealing that British pay growth is at its slowest in over two years. This slowing trend may give the UK’s central bank the confidence it needs to lower interest rates as early as next month.

In essence, these developments may be good news for borrowers and investors because lower inflation and a potential cut in interest rates often lead to more affordable borrowing costs and can stimulate economic activity. Keep an eye on the Bank of England’s upcoming decisions, as they could influence the market’s trajectory moving forward.

Calls For Higher Capital Gains Tax

A group known as "Patriotic Millionaires" is advocating for an increase in the UK's capital gains tax (CGT) to align with the top income tax rate of 45%, up from the current 28%. This proposal, supported by the Institute for Public Policy Research (IPPR), aims to create a fairer tax system that could lead to greater investment in the UK's future without hindering investment or entrepreneurship. Mark Campbell, co-founder of Higgidy, stresses the importance of those who have benefited most from the current system contributing more to ensure a robust society and economy.

Pranesh Narayanan from IPPR counters concerns that such changes would damage the economy, dismissing them as overblown. The movement suggests that higher taxes on capital gains are necessary to foster long-term prosperity, signalling a shift in sentiment among the wealthy towards supporting fairer taxation. For investors, this development highlights the ongoing debate about tax policy and its potential impact on the UK's economy.

Boardroom Diversity Takes A Step Back

Gender diversity in UK corporate leadership is seeing a setback, as the proportion of women in top roles within FTSE 350 companies has declined for the first time in eight years. According to The Pipeline's 2024 Women Count report, women's presence on executive committees dropped from 33% to 32%. More worrying is the underrepresentation of women in key positions like CEOs and CFOs, with only 9% and 18% representation, respectively.

For investors, this isn't just a social issue; it's a financial one. The Pipeline's findings suggest companies with gender-balanced executive teams are 22% more likely to experience profit growth. The decline in women holding commercial roles, vital for future leadership, highlights gaps in cultivating female talent. Investors should be aware that companies lagging in gender parity might miss potential profitability and long-term strategic advantage, necessitating urgent actions to bridge these gaps for future stability and growth.

While October doesn’t seem to have had the energy to really get going yet, long-term investors, (as always) are keeping an eye on the index and snapping up value buys wherever they can.

Want to know whether specific FTSE 100 stocks fit your investment strategy? Use InvestingPro and win on your decisions. Sign up TODAY for less than £9 per month and get up to an additional 10% off your 1-year plan!

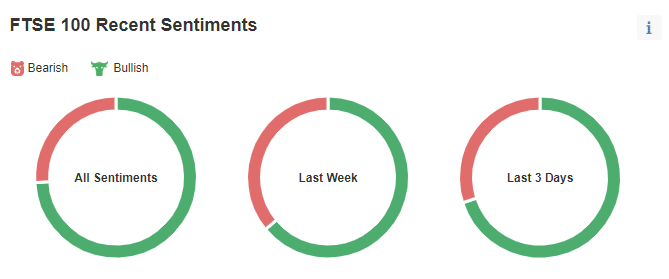

We can see that the Investing.com UK community’s sentiment towards the FTSE 100 index has been entirely consistent this week with a continued 30-70 Bearish-Bullish split.

Notable FTSE 100 Movements & Stock Market News

Here are some of the top stories from the footsie 100 constituents over the past 5 days.

Whitbread 's Ambitious Recovery Plan

Whitbread PLC (LON:WTB) is tackling post-pandemic challenges with a bold new strategy. Since selling Costa Coffee to Coca-Cola (NYSE:KO) in 2019 for £3.9 billion, the company has relied on its Premier Inn business, facing obstacles like rising interest rates and inflation. Despite a 16% share decline over five years, recovery signs are emerging.

The pandemic created opportunities as many independent hotels closed, allowing Premier Inn to thrive and dominate the UK market with a 12% share. Whitbread aims to replicate this success in Germany, with its division expected to break even soon, following a 22% rise in accommodation sales. Whitbread's five-year plan targets at least £300 million in pre-tax profit and £2 billion for shareholder distributions by 2030.

Whitbread remains confident with a £100 million share buyback and an increased dividend yield of 3.2%. Shares have recovered some losses, and the company is viewed as a 'buy' by the market, as it moves into its next growth phase.

Rentokil Shaky But Optimistic

Rentokil Initial PLC (LON:RTO) has maintained its full-year guidance but reported challenges with integrating its Terminix acquisition in North America, leading to a delay in expected cost synergies (ie, reducing expenses through efficiencies such as consolidating operations, eliminating duplicate roles, or better purchasing power - therefore enhancing overall profitability by lowering costs) by two to three months. The company plans to pilot new pay structures and satellite branches, prompting a review.

For the third quarter, Rentokil reported stable revenue, with a 3.8% increase at constant exchange rates and an organic growth rate of 2.6%, slightly below the first half's 2.8%. Their pest control silo, which generated 80% of last year's revenue, saw an organic growth of 2.2% consistent with the first half, while North America showed improvement with a 1.4% growth in the third quarter, exceeding the second quarter's 1.0% and aligning with management's guidance.

Investors should note these developments as the company navigates integration challenges and continues to drive growth in its core pest control operations.

Today's FTSE 100 Close

The above investor sentiment and factors driving this week's ‘Footsie’ volatility meant that today the FTSE 100 is likely to close at a price which sits slightly higher than the weekly FTSE 100 opening price of 8,253.65.

Best FTSE 100 Shares To Buy

Investors can also use our free stock screener to filter top FTSE 100 companies according to their investment strategy, and add them to a watchlist today.