Proactive Investors -

- FTSE 100 seen higher ahead of US PCE

- IAG back in profit, seals Air Europa deal

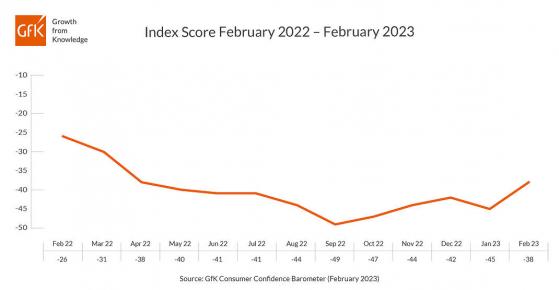

- Consumer confidence improves in February - GfK

Consumer confidence improves - GfK

GfK’s long-running consumer confidence Index increased seven points in February to -38. All five measures were up in comparison to the January 20th announcement.

Joe Staton, client strategy director, GfK said, “despite widely reported headwinds of inflation continuing to outstrip wage rises, and the ongoing household challenge from the cost-of-living crisis, consumers have suddenly shown more optimism about the state of their personal finances and the general economic situation, especially for the coming year.”

“While it's too early to talk about ‘green shoots of recovery’, the uptick across all measures should be welcomed. “

But he cautioned, “the headline consumer confidence score is still severely depressed and the mood as well as the economy remain a long way off pre-lockdown levels, but a little consumer resilience might be what we need to soften any downturn in 2023.”

Confidence in the general economic situation over the next 12 months is up by 11 points but remains at negative 43 while confidence in personal finances looking ahead to the next 12 months increased by nine points to negative 18, which is four points lower than this time last year.

The major purchase index, an indicator of confidence in buying big ticket items, is up three points to negative 37 – 22 points lower than a year ago.

CVS reports solid growth in profits and revenue, sees full-year in line

CVS Group PLC reported on Friday solid growth in half-year revenue and profit and remained confident the outcome for the full-year would be in line with market expectations.

The providers of integrated veterinary services said revenue in the six months to December 31 rose 8.2% to £296.3mln from £273.7mln a year ago while pre-tax profit totalled £28.0mln compared to £22.9mln in the same period in 2021. Earnings per share were 29.6p against 24.7p.

Organic growth has continued with 7.5% like-for-like sales1 growth, within the organic revenue growth ambition of between 4% and 8%, the company said in a statement.

Adjusted EBITDA margin improved to 19.5%, a like-for-like improvement of 0.5 percentage points, while membership of its preventative healthcare scheme, Healthy Pet Club increased to 481,000, up 4.3%.

CVS said demand for our high-quality veterinary services remains robust and the positive performance of the first half has continued into the first month of the second half.

“The board remains confident that full year results will be in line with market expectations,” the statement said.

Chief Executive Richard Fairman said, “The robust performance in H1 2023 has continued into the second half of the year and we look forward to reporting further growth in the future."

BA owner swings back into profit, buys rest of Air Europa

British Airways owner, IAG, has reported a healthy improvement in profits and revenue and a much anticipated deal to kick Friday off. For the year to December 31 pre-tax profits were EUR431mln compared to a loss of EUR2.93bn in 2021 as revenue jumped to EUR23.07vbn from EUR8.46bn.

The results came as the FTSE 100 listed airline agreed to EUR400mln to Spain's Globalia for the remaining 80% of airline Air Europa it does not already own.

“The board of IAG believes that the acquisition remains strategically important for the group and positions it to benefit from growth opportunities in the Latin America and Caribbean market, as well as to increase connectivity to Asia,” the company said.

IAG also gave guidance for 2023. The airline forecast full year 2023 capacity of around 98% of the 2019 level, with the first quarter seen at about 96% of the quarter one level in 2019.

Full year 2023 operating profit before exceptional items is seen in the range of EUR1.8bn to EUR2.3 billion, with most of the improvement over 2022 in the first half of the year.

In quarter one, 2023 an operating loss of around EUR200mln is expected assuming no further setbacks related to COVID-19 or material impacts from geopolitical developments.

“We are transforming our businesses, with the intention of returning IAG to pre-COVID levels of profit within the next few years, through major initiatives to improve customer experience and operational performance,” said Luis Gallego, IAG Chief Executive Officer.

Bright start in London

FTSE 100 is expected to make a bright start to the final day of the trading week ahead of a key inflation reading in the US.

Spread betting companies are calling London’s lead index up by around 26 points.

The early focus will be results British Airways owner, International Consolidated Airlines Group SA, and encouraging figures from GfK which showed a rebound in consumer confidence in February.

The mood should also be lifted by gains in the US which ended the day in the green. The Dow closed Thursday up 109 points, 0.3%, at 33,154, the Nasdaq Composite added 83 points, 0.7%, to 11,590 and the S&P 500 improved 21 points, 0.5%, to 4,012.

Attention will then shift to US January core PCE deflator numbers, which is the Fed’s preferred inflation measure, and which has fallen back sharply in the last few months from 5.2% in September, falling to its lowest level since October 2021 in December at 4.4%.

Michael Hewson at CMC suggested given “given the strength of recent economic data, today’s January numbers may call time on the trend of lower prices, with expectations that the PCE core deflator could fall only modestly from 4.4% to 4.3%.”

In Asia on Friday, the Nikkei 225 index closed up 1.3%. Japan's consumer prices rose 4.2% in January from a year earlier, a level not seen since September 1981, fuelled in part by higher energy bills. In China, the Shanghai Composite was down 0.5%, while the Hang Seng index in Hong Kong was down 1.2%.

Read more on Proactive Investors UK