Proactive Investors -

- FTSE 100 up 5 points but US seen lower

- Sage slips 3% on UBS downgrade to sell

- Nationwide forecasts 5% fall in house prices

12.30pm: FTSE in positive territory

Shares in London have gradually recovered early losses as oil and commodity stocks have moved higher on hopes that China’s reopening will spur increased demand despite a rise in Covid outbreaks.

So much so that London’s blue-chip index has moved into positive territory, up 5 points at 7,366.

The oil price was higher with Brent crude up 0.37% at US$80.146/barrel while WTI prices edged up 0.44% to US$75.81/barrel.

This helped lift oil majors and FTSE 100 heavyweights, BP PLC (LON:BP and Shell (LON:RDSa) PLC, by 0.9% and 1.25% respectively.

Similarly, gains in most metal prices helped support Antofagasta (LON:ANTO), up 1.4%, Glencore PLC (LON:GLEN), up 1.5% while Fresnillo (LON:FRES) added 0.9%.

12.00pm: Weak start expected across the pond

US stocks are expected to open flat to lower on Tuesday with the hoped-for pre-Christmas rally starting to look less likely after an unexpected policy change by the Bank of Japan led to stock market falls in Asia and beyond.

Futures for the Dow Jones Industrial Average (DJIA) rose 0.1% in pre-market trading, while those for the broader S&P 500 index were flat and contracts for the Nasdaq-100 lost 0.2%.

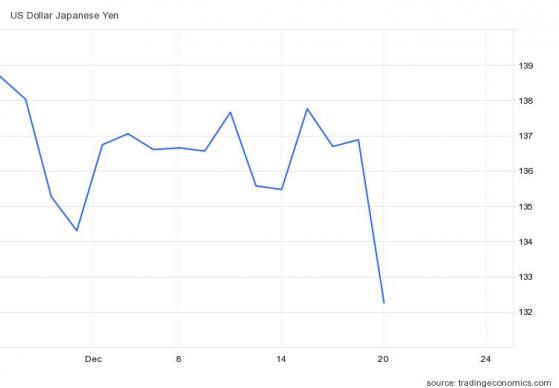

Earlier today, the Bank of Japan delivered a surprise decision to widen the band of its yield curve control to between -0.5% and +0.5%, from +/-0.25% previously. The unexpected move caught markets by surprise and showed that Japan’s rate-setters too are worried about price pressures.

“It also suggests that the Bank of Japan is starting to become concerned about policy lags and inflation becoming more entrenched. It also gives them more flexibility in 2023 in the event they need to start applying the brakes to prevent a significant overshoot in inflation, with the potential that we could see a rate hike before the end of next year,” noted Michael Hewson, Chief Market Analyst at CMC Markets UK.

Over in the US, stocks fell for a fourth day running during the regular session on Monday and look set for more falls again.

“Once again it appears that uncertainty over the Fed’s rate path next year is keeping most people on the side-lines, as investors draw a line under their 2022 portfolios,” added Hewson.

Last week, the Federal Reserve lifted interest rates by 50 basis points and signaled that its fight to dampen inflation is not over despite its year-long spate of rate increases.

On the economic data front, US housing starts data, due out at 8.30am ET will likely get some attention.

11.28am: More travel chaos likely in the New Year

More disruption for train travellers with drivers at 15 rail companies set to stage a fresh strike on January 5 in a long-running dispute over pay.

Trade union Aslef announced the action which will hit Avanti West Coast, Chiltern Railways, CrossCountry, East Midlands Railway, Great Western Railway, Greater Anglia, GTR Great Northern Thameslink, London North Eastern Railway, Northern Trains, Southeastern, Southern/Gatwick Express, South Western Railway (depot drivers only), SWR Island Line, TransPennine Express and West Midlands Trains.

Mick Whelan, general secretary of Aslef, which represents 96% of the train drivers in England, Scotland, and Wales, said: "We don't want to go on strike but the companies have pushed us into this place."

Shares in Trainline PLC (LON:TRNT), which had opened higher, fell 1.5% on the news.

The latest development came as the UK continued to be engulfed by industrial action with nurses England, Wales and Northern Ireland on strike today.

Asked if Britain could face months of strikes, the prime minister Rishi Sunak said "Yeah. Look, I’m going to keep making the same arguments I’ve been making."

"The government is acting fairly and reasonably and will always continue to do so. I’m going to do what I think is right for the long-term interests of the country: combating inflation."

11.10am: Nationwide forecasts 5% dip in house prices in 2023

High street lender Nationwide has suggested a relatively soft landing may still be achievable in 2023 but expects UK house prices to fall, perhaps by around 5%.

But Robert Gardner, Nationwide Building Society’s chief economist cautioned “the risks are skewed to the downside.”

“It will be hard for the market to regain much momentum with economic headwinds set to strengthen, as real earnings fall further, the Bank of England moves interest rates higher and with the labour market widely projected to weaken as the economy shrinks” he forecast.

He said while the labour market is expected to soften, most expect the deterioration to be modest and he also pointed out that household balance sheets “remain in good shape with significant protection from higher borrowing costs” noting around 85% of mortgage balances on fixed interest rates.

Last week, Halifax painted a more gloomy outlook suggesting prices would fall by 8%.

10.58am: Sage dented by UBS downgrade

Shares in The Sage Group PLC (LON:SGE), dipped 3% today as analysts at UBS put the accountancy software provider on its sell list.

“While Sage enjoys a defensive top-line profile entering FY23 we believe ongoing margin pressures were masked last year by bad debt provision reversals and the benefit of a major restructuring round.”

It said the recently concluded acquisitions of Lockstep in August and and Brightpearl in January enhance the offering but bring losses which will see a full year impact in fiscal year 2023.

UBS also thinks investors are set to be disappointed on profitability and growth is likely to decelerate as the year progresses given the headwinds facing many of Sage's small and medium-sized business customers.

The broker noted consensus forecasts expect sales growth of 8% with margins reaching 21.5% through to 2025.

“Even absent future M&A we see this as challenging and are at 20.5%; 110bp below consensus” it said.

Further factors which could hinder profitability are an increase in bad debt provisions, pressure on employee costs in 2023, a gradual mix-shift to commission-based partner payments from a net revenue model and continuing competitive pressures notably with the recent launch of Quickbooks Online Advanced in the UK.

In light of this UBS has lowered its fiscal year 2025 margin forecast by 90bp to 20.5% (consensus 21.5%) meaning EPS forecasts have been reduced by 7%.

Moving the stock to sell the broker also cut its price target to 720p from 745p.

10.30am: Serica Energy dips after acquisition, Sage down on UBS downgrade

FTSE 100 has steadied the ship after the early falls, now down just 6 points. But the underlying mood remains cautious although volumes are expected to stay thin heading into the holiday period.

“A lot can change in a few weeks on the markets and investor optimism has now turned to pessimism thanks to central banks being stubborn with their monetary policy. The prospect of further interest rate rises has put equities into reverse and raised the prospect of a deeper recession than previously thought,” said Russ Mould, investment director at AJ Bell.

Movers and shakers in the market today included Serica Energy PLC (LON:SQZ) which slipped 4.8% after it announced the £367mln acquisition of fellow North Sea oil firm Tailwind Energy Investment.

The natural gas producer will provide a £58.7mln cash payment and issue over 111mln shares representing as much as 28.9% of its share capital.

The total price will amount to £367m, based on Serica’s latest closing price of 278p per share on 19 December.

Another share on the way down was Sage Group (LON:SGE) PLC which fell 3% as UBS downgraded the stock to sell citing ongoing margin pressures.

9.53am: Xpediator jumps as former boss plots bid

Shares in Xpediator PLC, the London-listed logistics company, surged 22.3% after it said it had received a bid proposal from a consortium including the investment vehicle of its former boss, Stephen Blyth.

The consortium’s proposal is a bid at around 42p per share in cash with a partial loan alternative.

Xpediator said the consortium has secured backing from shareholders representing around 27.1% of the group’s share capital.

The company said it was evaluating the proposal but remained “confident in the company's prospects as a stand-alone listed business.”

But it added “As matters currently stand, the board of Xpediator is minded to recommend the cash element of the proposal to shareholders” it said.

Shares were trading around 37p, a discount to the proposed offer level, but still sharply higher.

9.34am: New Petrofac boss has his "work cut out"

Petrofac Limited has extended its falls, now down 9.3%, after warning of a profits shortfall at its engineering and construction arm.

Derren Nathan, head of equity research at Hargreaves Lansdown (LON:HRGV) said it “certainly seems that incoming CEO Tareq Kawesh has his work cut out.”

“Whilst legacy issues at Engineering and Construction should have less of an impact going forward, it seems that the division won’t return to profitability next year.”

“And the units that performed well this year are not expected to generate the same returns in 2023.”

That said Nathan pointed out the pipeline of potential projects across the group is “very strong” at $68bn, “but as ever the key will be not just conversion, but also securing strong commercial terms.”

“Pricing discipline is essential, to avoid a race to the bottom” he explained.

He also noted “Petrofac remains highly leveraged to the oil and gas market.”

“The recent drop in prices means it will be making lower profits from its own production, and any further deterioration could see its clients in the industry think hard about commissioning new projects” he suggested.

9.01am: FTSE 100 off lows

FTSE 100 has recovered some of its poise, now down 18 points, after earlier being down nearly 60 points.

Victoria Scholar, head of investment at Interactive Investors, commented: "It looks like Father Christmas has failed to bring about his much-anticipated Santa rally this year with last week’s central bank bonanza preventing markets from pushing higher."

"Volumes are also typically much lighter around this time with many traders and investors away for Hanukkah and Christmas, which can exacerbate any market moves in either direction."

ING Economics has reflected on the shock move by the Bank of Japan to adjust its yield curve control policy which it said had come a lot earlier than it thought - ING had pencilled in the end of 2023 for such a move.

The move sent the yen soaring against the US dollar, up 3.25%.

ING said “We think today's decision has undermined the BoJ's credibility on future policy guidance.”

“Despite the denials, we think Governor Kuroda is trying to pave the way for policy normalisation before stepping down.”

“He may be right that monetary policy should remain accommodative until a stable 2% inflation target is met and that the policy review is not needed in the short term. But, with today's tweak, his successor will have more flexibility to deploy monetary policy in the future.”

Back in London and AIM-listed Velocity Composites plc shot higher, soaring 56%, after signing a five-year agreement with GKN (LON:GKN) Aerospace in the US which is expected to be worth in excess of US$100mln in revenue over five years.

Andy Beaden, chairman of Velocity, said: “"This is a major milestone for Velocity as we make a permanent entry into the US market and expand our long-standing relationship with GKN Aerospace.”

8.35am: British Airways (LON:ICAG) grounded

Shares in International Consolidated Airlnes Group SA have slipped further, down 2%, as the owner of British Airways was forced to apologise after flights leaving the US were grounded for several hours.

The airline said it was urgently investigating a technical issue with its third-party flight planning supplier.

BA passengers have reported waiting for hours in airports.

@British_Airways what’s going on with your flights worldwide? Apparently the 8.10pm from JFK to London is “on time” but I’m sat in JFK and it’s 9.34pm and there has been zero communication from anyone. Abysmal experience and customer service— Charlie Scott (@charliefscott) December 20, 2022

The airline said it aimed to get planes departing as quickly as possible, adding it was sorry for any disruption to its customers' plans.

In a statement, British Airways said: "Our flights due to depart the USA tonight are currently delayed due to a technical issue with our third-party flight planning supplier, which we are urgently investigating.”

"We're sorry for any disruption this will cause to our customers' plans, our aim is for these flights to depart as quickly as possible."

8.15am: Christmas cheer is short supply

No signs of the festive spirit in London as shares resumed their downward path at the open.

The falls in Asian markets after the surprise move by the Bank of Japan haven’t helped while ongoing fears of a global recession continue to weigh.

At 8.15am the FTSE 100 was 40 points lower at 7,322 while the FTSE 250 dipped 131 points, or 0.7%, to 18,518.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown pointed out there were ‘a sackful of concerns about the prospects for global growth are still being lugged around by investors and are weighing down sentiment on financial markets.”

On the move by the Bank of Japan she said “a tiny tweak in the Bank of Japan’s ultra-loose monetary strategy surprised investors, prompting a jump in the yen and a share sell-off.”

“The shift in policy was slight; the yield of its 10-year bond is being allowed to move 0.5% away from its 0% target, instead of the previous 0.25% range limit set, but even so it triggered sharp market movements.”

“The decision is being read as a sign of testing the water, for a potential withdrawal of the stimulus which has been pumped into the economy to try and prod demand and wake up prices.”

On a quiet of morning of corporate news Petrofac Limited (LSE:PFC) was a notable mover, falling 6.3% after it forecast a full year EBIT loss in its Engineering and construction unit of around US$190mln for 2022, meaning a total group EBIT loss of around US$100mln.

This reflected adverse commercial settlements, further unrecovered cost overruns in the legacy portfolio and cost increases on the Thai Oil Clean Fuel joint venture contract, the group said.

Broker Peel Hunt noted the US$100mln figure was below its “bottom of the range estimate of a US$44mln.”

The broker pointed out Petrofac now expects EBIT to fall in 2023 compared to its forecast of a small increase.

International Consolidated Airlns Grp SA was under some early pressure as well, down 1%, after the airline apologised after British Airways flights due to depart from the US were grounded for several hours.

In a statement, British Airways said: "Our flights due to depart the USA tonight are currently delayed due to a technical issue with our third-party flight planning supplier, which we are urgently investigating.”

7.48am: Bunzl (LON:BNZL) rejigs portfolio

Bunzl PLC has sold its UK healthcare division and bought four new businesses in a series of deals which are expected to be profit neutral and generate a small cash inflow for the business.

“They reflect Bunzl's ongoing discipline around returns focused capital allocation and portfolio optimisation” it said.

The group has sold its UK healthcare arm, which in 2021 generated revenue of £216mln, to Mediq alongside the acquisitions of Toomac Ophthalmic & Solutions, a distributor of ophthalmology products in New Zealand, and GRC, an exclusive distributor of innovative medical technology devices in Australia.

The company has also bought VM Footwear, a distributor of personal protection equipment based in the Czech Republic, PM Pack, a distributor of packaging products in Denmark.

Frank van Zanten, chief executive officer of Bunzl, said: "The announced acquisitions are highly complementary, expand our product offering in each country, and all achieve double digit margins, with their profits offsetting the expected profit contribution from the announced disposal.”

7.30am: FCA fines TSB £48.65mln for IT failings

The Financial Conduct Authority (FCA) and the Prudential (LON:PRU) Regulation Authority (PRA) have fined TSB Bank plc £48.65mln following IT failures in 2018.

In April 2018 the bank updated its IT systems and migrated the data for its corporate and customer services on to a new IT platform.

But technical failures in the system ultimately resulted in customers being unable to access banking services.

All of TSB’s branches and a significant proportion of its 5.2mln customers were affected by the initial issues.

Mark Steward, FCA Executive Director of Enforcement and Market Oversight said: “'The firm failed to plan for the IT migration properly, the governance of the project was insufficiently robust and the firm failed to take reasonable care to organise and control its affairs responsibly and effectively, with adequate risk management systems.”

7.00am: FTSE 100 seen lower after surprise move by BoJ

FTSE 100 expected make a weak start to trading following a surprise move by the Bank of Japan which sent Asian markets lower.

Japan's central bank tweaked its longstanding monetary easing programme, in a surprise decision that saw the yen strengthen against the dollar, while the Nikkei 225 fell.

"The bank will expand the range of 10-year JGB yield fluctuations from the target level: from between around plus and minus 0.25 percentage points to between around plus and minus 0.5 percentage points," it said in a statement.

Michael Hewson chief market analyst at CMC Markets UK commented: “Asia markets have also plunged after this morning’s surprise move by the Bank of Japan to tweak its monetary policy settings by widening the band on its yield curve control policy by 25bps.”

“Even before this morning’s events it seemed improbable given the uncertain rate backdrop that we were likely to get any sort of so-called Santa rally this late in the day.”

“The reality is that anyone who’s made any money this year will be content to hang onto their winnings, while the rest are unlikely to want to compound their 2022 misery with more potential losses.”

“Consequently, we can expect to see European markets open sharply lower in the wake of this morning surprise move by the Bank of Japan to tweak its yield curve control settings.”

Back in London and spread betting companies are calling the lead index down by 33 points.

US markets also failed to get into the festive mood heading downwards for a fourth day in a row as investors continued to fret that higher interest rates will dent economic growth.

At the close the Dow Jones Industrial Average was down 164 points, or 0.5%, to 32,757, the S&P 500 slipped 35 points, or 0.9%, to 3,817 and the Nasdaq Composite declined 159 points, or 1.5%, to 10,546.

“As we near the end of December, investors are still waiting on that Santa Claus Rally, with stocks coming off back-to-back down weeks for the first time since September,” said Chris Larkin, managing director of trading at E*Trade from Morgan Stanley (NYSE:MS) told CNBC.

Read more on Proactive Investors UK