Proactive Investors -

- FTSE 100 makes late festive charge, up 21 points

- Car production rises 5.7% in November

- Next jumps 2% as Stifel adds to buy list

10.15am: Abrdn says Stephanie Bruce is still CFO

Abrdn PLC (LON:ABDN) reaffirmed today that Stephenie Bruce is still chief financial officer despite reports suggesting she had decided to step down.

The asset manager was responding to press comment regarding succession planning for her role which cited a company spokesperson confirming Bruce had decided to leave.

"The board regularly reviews succession planning with and for the executive team" ABrdn said today but it added "no decisions have been taken regarding any change while succession planning is underway."

Meanwhile the FTSE 100 has finally entered the festive spirit, up 21 points now.

9.40am: Next lifted by Stifel upgrade but Boohoo downgraded

On what is forecast to be the busiest day in the retail trading calendar, retailers were in focus at Stifel with the broker upgrading Next PLC (LSE:NXT), downgrading Boohoo Group PLC (AIM:BOO) and retaining a negative stance on ASOS (LON:ASOS) PLC.

On Next, analyst Caroline Gulliver pointed out the share price has fallen 32% in 2022, which actually makes it one of the better performers in the UK retail sector.

“Although UK consumer confidence is still close to record lows, and we forecast declines in UK discretionary income in 2023, we believe NEXT can thrive in these difficult times, given its multi-channel, multi-brand offer and its profit margin and cashflow discipline.”

Stifel said the group was trading on only 10.8x its 2023 EPS forecast and offers a 8% free cash flow yield, hence the upgrade to buy from hold with an unchanged price target of 6,500p.

The news helped push the shares 2% higher.

But shares in Boohoo Group PLC (AIM:BOO) fell 0.8% as the broker went the other way, downgrading the online retailer to hold from buy.

“With UK consumer confidence still at very low levels and numerous macroeconomic headwinds in 2023, combined with the lack of a US DC, we have concluded that there is neither the profitability nor cash flow in FY24E to support our buy rating in the near term.”

The broker lowered its target price to 40p alongside the rating downgrade.

The broker was even less bullish on ASOS PLC (LSE:ASC), which remained on the sell list.

“Management is writing off up to £130mln of stock and has renegotiated its RCF but we see little relief for ASOS heading into 2023” it said.

"Hence, we forecast that a profit turnaround will be delayed until FY24, as management seeks to put the business on a sounder financial footing.”

9.10am: Oil price jumps as Russia suggests it could output

Oil prices have risen after Russia’s deputy prime minister Alexander Novak indicated the country could cut oil production in response to the EU’s punitive price cap on Russian oil.

Victoria Scholar, head of investment, interactive investor noted “Russia could cut its oil output by 5% to 7% or 500,000 to 700,000 barrels per day with the potential constraints to supply pushing WTI and Brent crude prices into the green.”

“The threat of retaliation from the Kremlin follows the EU’s attempt to sanction Russia’s energy markets, its most important economic engine which has helped fund its invasion of Ukraine” she pointed out.

Brent crude prices rose 1.22% to US$81.97/barrel while US West Texas Intermediate prices advanced 1.46% to US$78.62/barrel.

8.55am: Marginal gains

London’s blue chip index is marginally higher but volumes are low and news is thin on the ground ahead of the festive break.

Matt Britzman, equity analyst at Hargreaves Lansdown (LON:HRGV) (HL) said: “The FTSE 100 opened flat on the last trading day before Christmas, and there isn’t much sign of a Santa rally taking off again with much speed.”

“UK investor confidence among HL clients took a fall in December, alongside confidence in economic growth which isn’t far off its lowest levels of the year.”

“Investors are clearly concerned as they see headlines suggesting the UK’s already in a recession and feel the pinch of higher costs in all aspects of day-to day spending.“

Stocks on the move included Abrdn which fell a further 1.2% on reports that CFO, Stephanie Bruce will leave the company.

But shares in easyjet PLC and British Airways owner, International Consolidated Airlines, were little moved as strikes by border force staff started today.

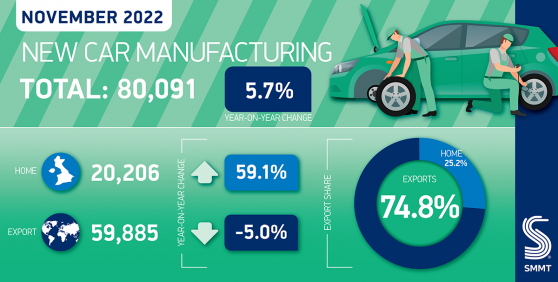

8.30am: UK car production grows again in November

UK car production grew for the second consecutive month in November, up 5.7% to 80,091 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

Mike Hawes, SMMT chief executive, said: “These figures bring some Christmas cheer to UK car makers in what has been another incredibly tough year.”

The rise means UK car manufacturing output has grown in six of the past seven months demonstrating how, even amid global chip shortages and supply chain constraints, factories are doing their best to meet demand for new cars at home and overseas.

Despite the overall rise in output, November’s performance was still down against historic levels, -44.1% off the pre-pandemic five-year average for the month and -25.7% off 2019’s total of 107,744 units.

This reflected the impact of Covid lockdowns overseas, recently in China, structural and product changes, the long-running squeeze on semiconductor supply and wider turmoil resulting from war in Ukraine.

8.15am: Bah Humbag

FTSE 100 was in a “bah humbag” mood as it made a subdued start to a shortened trading session as another wave of industrial action disrupted the UK.

At 8.15am London’s lead index was down 1 point at 7,468 while the FTSE 250 slipped 7 points 18,755.

Planes, trains, driving lessons and postal deliveries are set to be disrupted by walkouts as employees at the National Highways, Driver and Vehicle Standards Agency (DVSA) and Royal Mail (LON:IDSI) take industrial action today.

As they continue their strike into Saturday, they will be joined by rail workers represented by the RMT, Abellio London bus workers, and Environment Agency employees, who will launch separate waves of action.

Back in the markets and on a quiet day of corporate news Inchcape PLC (LSE:INCH) slipped 1% despite the positive update that its £1.3bn acquisition of Derco should be completed by the end of the year.

Peel Hunt said the news was “a positive, if largely expected, development.”

“As previously flagged and in line with guidance, we expect to increase FY23E EPS by 16% and FY24E EPS by 21%” the broker said.

UK renewables income fund Bluefield Solar Income Fund Limited rose slightly after buying a 46.4 MWp UK portfolio of two large ground mounted solar assets for £28.7mln from Fengate Asset Management plus assumed debt of £27.3mln.

The acquisition will be funded through existing facilities and take the company's total outstanding debt to £537mln and the total installed capacity of its portfolio has grown to 813 MWp.

John Scott, Chairman of Bluefield Solar, said: “the acquisition underpins the board's confidence in delivering our FY 2022/23 target dividend of not less than 8.40pps."

7.40am: Green light for Inchcape's Derco deal

Little in the way of corporate news so time for dealers to go through their Christmas TV guides and munch a mince pie.

Auto distributor Inchcape PLC (LSE:INCH) said it expects to complete the acquisition of Derco by the end of the year after Peruvian authorities cleared the deal.

The £1.3bn takeover of the largest independent automotive distributor in Latin America was announced in July.

The green-light follows approval from Inchcape's shareholders last week. Derco runs sites in Chile, Peru, Colombia and Bolivia.

7.00am: FTSE 100 seen higher in shortened session

FTSE 100 is expected to open higher as US markets closed off their worst levels although volumes are expected to be thin on what is a short trading day in London ahead of the festive break.

Spread betting companies are calling the lead index up by around 18 points.

Wall Street’s three leading indices closed down sharply on Thursday, but higher than intra-day lows, conceding Wednesday’s gains as stronger than expected GDP figures renewed concerns about rising interest rates while poor results from Micron (NASDAQ:MU) Corp. knocked sentiment amongst tech stocks.

At the close the Dow was 348 points lower, or 1.04%, to 33,028, the S&P 500 was down 56 points, or 1.44%, at 3,823 and the Nasdaq Composite declined 233 points, or 2.18%, to 10,476.0

Fawad Razaqzada, market analyst at City Index and FOREX.com said: ““Yesterday’s gains, gone. Sentiment, bearish. Once again, the market showed no upside follow-through. It is trapping the bulls. It appears as though Santa Rally is not happening this year.”

“The economic outlook is not going to change overnight, which means much of the issues we are facing right now could well be with us well into 2023.“

In Asia on Friday, the Japanese Nikkei 225 index closed down 1.0% while in China and Hong Kong markets are also lower.

Read more on Proactive Investors UK

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI