Proactive Investors -

- FTSE 100 up 20 points at 7,620

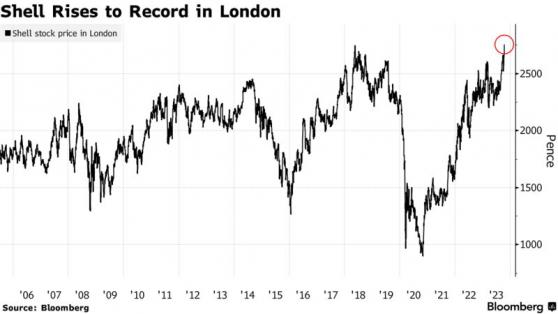

- Shell (LON:RDSa)'s share price hits all-time high

- Ocado (LON:OCDO) falls as Barclays (LON:BARC) downgrades

Bright start on Wall Street

US stocks pushed ahead in early exchanges ahead of a busy week of US earnings.

Shortly after the opening bell, the Dow Jones Industrial Average was up 229.40 points, 0.7%, at 33,899.69, the S&P 500 was up 24.15 points, 0.6%, at 4,351.93 and the Nasdaq Composite was up 85.66 points, 0.6%, at 13,492.89.

Investors were closely monitoring diplomatic efforts in the Middle East in the hope that a further escalation of the crisis could be avoided.

US President Joe Biden is considering a trip to Israel as part of a global diplomatic push to prevent the war from spreading in the Middle East.

Efforts also saw US Secretary of State Antony Blinken return to Israel Monday, following talks with Arab officials, and German Chancellor Olaf Scholz prepare for a visit Tuesday.

Here’s a quick recap of the top risers and fallers on the market today

Surface Transforms jumped 15% as it announced a £100 million contract for its carbon ceramic brake discs.

Cerillion PLC shares jumped 8.7% after the company said it expects full-year profit to be “meaningfully” ahead of consensus forecasts after trading remained strong in the second half of the year.

Shares in Corcel PLC (LON:CRCL) climbed 8.5% after the mining company announced the sale of its interest in the Mambare nickel-cobalt project following a revised offer.

Orosur Mining Inc (LON:OMIN) jumped almost 6% after announcing an entry into Nigeria for lithium exploration.

Tertiary Minerals PLC got a handy leg-up following soil sampling results from the C1 target area at its Mushima North copper project in Zambia.Shares rose 7% to 0.15p.

Shares in Wildcat Petroleum plc fell by 54% after the company announced it is selling 375 million new shares at a heavily discounted price of 0.12p, raising £450,000. After expenses, the company will receive £393,750.

Shares in Hipgnosis Songs Fund Limited, the music investment company, sank over 11% after management confirmed parts of its royalties are set to be materially lower than expected, causing the group to cut its interim dividend.

UK to avoid recession but growth sluggish

The UK should still avoid a recession, although GDP growth is set to remain sluggish for the remainder of 2023 and into 2024, according to the EY ITEM Club’s new autumn forecast.

It expects the UK economy to grow 0.6% in 2023, up from the 0.4% growth projected in July’s Summer Forecast.

However, GDP growth expectations for 2024 have been downgraded slightly from 0.8% to 0.7%, as the impact of the recent interest rate rising cycle continues to feed through.

Subdued growth for the UK economy as 2023 closes, led by a stronger start to the year than expected.➡️ 0.6% UK GDP growth forecast for 2023, with 2024 forecast growth reduced to 0.7%

➡️ Interest rates likely to have peaked

➡️ Inflation to fall to 4.5%#EYITEMClub

— EY UKI (@EY_UKI) October 16, 2023

Inflation is expected to fall to around 4.5% by the end of 2023, before declining to the Bank of England’s 2% target in the second half of 2024.

Oil prices, frozen income tax thresholds, inflation, and a deteriorating labour market are all expected to put pressure on consumer spending.

But business investment growth prospects for 2023 have been significantly upgraded, despite the higher cost of debt.

The economy is still forecast to grow 1.7% in 2025 as lower inflation lifts real incomes and interest rates are cut.