Proactive Investors -

- FTSE 100 little changed, rival bid for Network International

- Retail sales fall more than expected in March

- Consumer confidence picks up - GfK

FTSE muted at the open after weak retail sales

The FTSE 100 made a tentative start to proceedings on Friday with weak retail sales figures adding to the subdued mood as concerns over economic growth rise.

At 8.15 am London’s lead index stood at 7,901.63, down 0.98 points, or 0.012%, while the FTSE 250 edged lower to 19,122.99, down 12.88 points, or 0.067%.

Deutsche Bank said: “The last 24 hours have seen a stronger risk-off move in markets, thanks to another round of weak data releases that strengthened fears of a US recession once again.”

Richard Hunter, head of markets at interactive investor, agreed: “Mixed company earnings and softening economic data are keeping a lid on sentiment, as investors ponder the timing and depth of a potential recession."

Denting the mood in London were UK retail sales figures for March which showed a 0.9% decline, more than the 0.5% fall the City had expected.

But more encouragingly, sales volumes rose by 0.6% in the three months to March when compared with the previous three months; the first three-month on three-month rise since August 2021.

Gabriella Dickens at Pantheon Macroeconomics said: “The renewed decline in retail sales in March proves the recovery in January and February was a false dawn and suggests that consumers still are grappling with very high CPI inflation and mortgage rates.”

She expects retail sales to benefit from the 10.1% increase in most benefits in April and the likely fall of households’ energy bills in July but predicts only a gradual recovery over the coming months.

The EY Item Club was a little more optimistic pointing out March's weakness was probably partly driven by unseasonably wet weather, and that more fundamental drivers of retail performance are looking healthier.

The economic forecaster pointed out the jobs market remains resilient, household energy bills are set to fall from the summer, and consumer confidence has picked up.

Martin Beck, chief economic advisor to the EY ITEM Club, said: “2023 should prove a better year for retailers than 2022, when the sector felt the effects of the energy price shock and a post-pandemic shift in spending from goods back to services.”

ING Economics agreed. “Pressure on real wages is set to ease over coming months and consumer confidence has risen from its lows. That suggests the worst is behind us for the UK high street, despite a fall in March sales,” it commented.

The improving confidence referred to was shown in figures from market research firm, GfK.

GfK's Consumer Confidence Index rose for the third month in a row to -30 in April, up six points from March and the highest reading since February last year, just before Russia invaded Ukraine and spurred a surge in energy costs in most of Europe.

April's reading was also above the -35 reading forecast by economists.

Joe Staton, GfK's client strategy director, said there had been a "sudden flowering of optimism" among households.

In company news, and news of a competing bid for Network International Holdings PLC (LON:NETW) pushed shares in the payments company 11% higher to 400.40p.

The firm revealed it had received a 400p per share approach from Canada’s Brookfield Asset Management (TSX:BN_pfj) only days after a 387p per share proposal from a consortium comprising CVC Advisers and Francisco Partners Management.

With the share price sitting above the level of the latest approach investors are expecting this battle to hot up.

Mining companies were in focus. Glencore PLC (LSE:LON:GLEN) fell 1% despite reporting first-quarter figures in line with its forecasts and holding full year production guidance.

Shares in Sureserve Group PLC (LON:SURS) soared 37% after it reached an agreement with Cap10 4NetZero Bidco, a company indirectly owned by Cap10 Partners, on an all-cash takeover for the energy services provider.

Cap10 will pay 125p for each Sureserve share valuing the firm at £214.1mln.

Consumer confidence picks up - GfK

While retail sales may be falling a survey of consumer confidence in the UK suggests people are more upbeat than before.

GfK's long-running consumer confidence survey showed consumers were their most upbeat in more than a year this month, despite the surging cost of living, as they took a more positive view of their finances and the health of the wider economy.

GfK's Consumer Confidence Index rose for the third month in a row to -30 in April, up six points from March and the highest reading since February last year, just before Russia invaded Ukraine and spurred a surge in energy costs in most of Europe.

April's reading was also above the -35 reading forecast by economists.

All measures were up over March, with consumers' expectations for Britain's economy in the next 12 months at a 15-month high and they saw the prospects for their personal finances as the brightest since February 2022.

While the country's economy is expected to avoid a recession this year, the broader picture remains weak with double-digit inflation proving harder to tame.

However, Joe Staton, GfK's client strategy director, said there had been a "sudden flowering of optimism" among households.

"The brighter views on what the general economy has in store for us ... could even be seen as the proverbial 'green shoots of recovery'," Staton said.

Rival approach for Network International

A battle for Network International Holdings PLC has broken after the payments company revealed a second bid approach.

The company confirmed it has received a “highly preliminary” 400p a share cash offer from Canada's Brookfield Asset Management.

The offer for the FTSE 250 firm trumps a proposal from a consortium comprising CVC Advisers and Francisco Partners Management worth 387p per share announced on Monday.

“The board of Network is currently evaluating the Brookfield Proposal with its financial advisers and a further statement will be made in due course,” the company said in a statement.

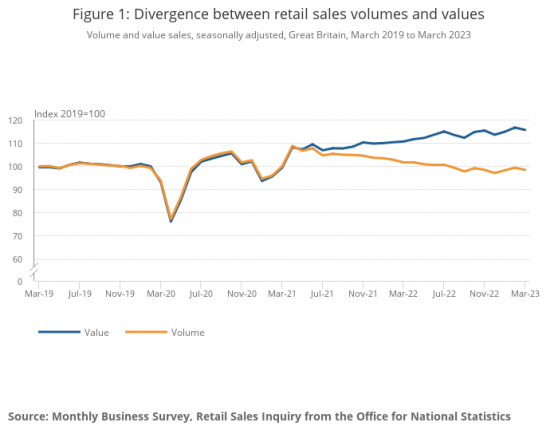

Retail sales fall more than expected

Retail sales fell in March by more than City commentators expected after the bounce back in February, according to the Office for National Statistics.

The fall of 0.9% in March, compared to consensus expectations of a 0.5% decline, and followed February’s rise of 1.1% (revised from a rise of 1.2%).

More encouragingly, sales volumes rose by 0.6% in the three months to March when compared with the previous three months; the first three-month on three-month rise since August 2021.

Non-food stores sales volumes fell by 1.3% in March following a rise of 2.4% in February, with feedback from retailers that poor weather conditions throughout most of March affected sales.

Food store sales volumes fell by 0.7% in March following a rise of 0.6% in February.

Non-store retailing (predominantly online retailers) sales volumes fell by 0.8% in March, following a rise of 0.3% in February.

Automotive fuel sales volumes rose by 0.2% in March, following a fall of 1.2% in February; sales remain 8.5% below their pre-coronavirus (COVID-19) February 2020 levels.

Subdued start seen in London

FTSE 100 is expected to open flat ahead of retail sales figures which will give a further indicator as to the confidence levels of UK consumers.

Spread betting companies are calling London’s lead index down by around 2 points.

On Wall Street, stocks ended lower as disappointing earnings from AT&T (NYSE:T) and heavy falls in Tesla (NASDAQ:TSLA) weighed on equities.

The Dow Jones Industrial Average closed down 110.46 points, or 0.3%, at 33,786.55. The S&P 500 declined 24.71 points, or 0.6%, at 4,129.81, while the Nasdaq Composite slipped 97.67 points, or 0.8%, to 12,059.56.

In Asia, markets fell. The Nikkei 225 index was down 0.3%. the Shanghai Composite was down 1.4%, while the Hang Seng index in Hong Kong was down 1.2%.

Back in London, the early focus will be retail sales figures while a slew of PMI prints is due later today in the UK, EU, and US.

Read more on Proactive Investors UK