Proactive Investors -

- FTSE 100 up 25 points

- JD Sports higher after update

- Direct Line drags down insurers

9.55am: Barratt sees marked slowdown in housing market

The worsening state of the UK housing market has been highlighted by the latest trading statement from Barratt Developments PLC (LON:BDEV).

The firm said the six months to the end of December - the first half of its financial year - had seen a marked slowdown in the UK housing market.It said: "Political and economic uncertainty impacted the first quarter; this was then compounded by rapid and significant changes in mortgage rates which reduced affordability, homebuyer confidence and reservation activity through the second quarter."

Its order book dropped to £2.54bn from £3.79bn from the same time a year ago.

The news has seen its shares lose 1.79%.

AJ Bell investment director Russ Mould said: “The biggest surprise from Barratt Development’s very gloomy statement is that it’s taken this long for collapsing confidence in the housing market to show up fully in its numbers.

“While the extreme dislocation in the mortgage market which followed the mini-Budget can be characterised as a one-off event, higher borrowing costs for purchasers are here to stay.

“The big drop in Barratt’s order book reduces visibility but should not come as a shock. When people are being warned house prices are going to fall by double digits in percentage terms, why wouldn’t they put off any purchase and wait and see if their dream home becomes a bit more affordable.

“Barratt just needs to wait and see how bad things get. The company at least has a strong balance sheet to provide a buffer against weak trading and reward investors for their patience with dividends.”

Victoria Scholar at interactive investor said: “Rising mortgage rates, a slowing housing market, build cost inflation and the fallout from the mini-budget have been key headwinds for Barratt Developments in recent months. Investor sentiment is sour towards the sector after a very tough year on the stock market with shares in Barratt Development down more than 40% over a one-year period. Persimmon (LON:PSN) is nursing an even more painful share price slump, down by over 50% year-on-year.

"Cost-of-living pressures are prompting many potential homeowners to hold off from buying a property as they wait hopefully for mortgage rates and house prices to cool later this year. Although forecasts are for the housing market to soften, a chronic shortage of supply of UK housing is stemming a more aggressive slump.”

8.53am: JD Sports boosted by Christmas performance

Unlike J Sainsbury PLC, a positive update from JD Sports Fashion PLC has been well received by the market.

The sportswear retailer produced an impressive performance over Christmas, with sales up more than 20% in the six week period to the end of December.

It now expects full year profits to be at the top end of market forecasts, which range from £933mln to £985mln. The following year it anticipates profits will top £1bn.

Its shares are up 4.65%, making it the biggest riser in the leading index, closely followed by Sports Direct (LON:FRAS) owner Frasers Group PLC, which is 2.98% better.

Victoria Scholar at interactive investor said: "[JD's] premium brands and North America helped drive the outperformance, highlighting the resilience of consumers at the upper end of the income spectrum to pressures on the cost-of-living. Shares have suffered over the last year weighed down by the challenging macroeconomic headwinds and the broader equity market volatility but are trading at the top of the FTSE 100 today.”

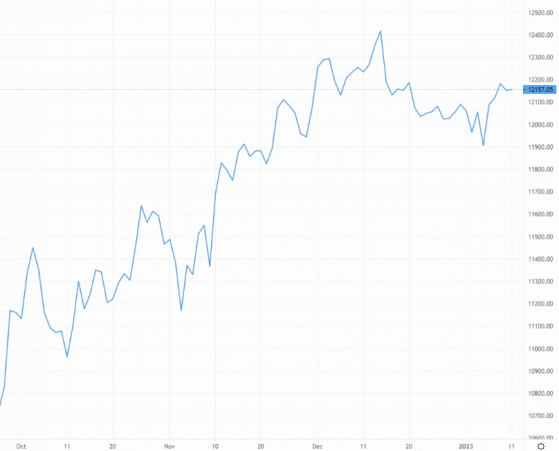

Overall the FTSE 100 has gained more ground and is now up 25.89 points or 0.34% at 7720.38.

8.35am: Direct Line slumps and drags down Admiral and Aviva (LON:AV)

Insurer Admiral Group Plc (LON:ADML), lifted yesterday by a positive note from Deutsche Bank (ETR:DBKGn), is today leading the FTSE 100 fallers.

Its shares are down 15.43% after a downbeat statement from mid-cap peer Direct Line Insurance Group PLC, which said it would not pay a final dividend after difficult trading conditions, and needed to rebuild its balance sheet. Aviva PLC (LSE:AV.) has also been hit by the news, down 4.36%.

Direct Line chief executive Penny James said: "We have seen a volatile and challenging operating environment in the fourth quarter. We have seen a significant increase in claims as a result of the prolonged period of severe cold weather in December...These claims, combined with further increases in motor inflation, have had a significant impact on our underwriting result for 2022. We have also seen reductions in the valuations of the commercial property holdings in our investment portfolio in line with movements in the broader property market."

The company continued: "The dynamics of 2022, and in particular the additional factors in the fourth quarter, have resulted in a capital coverage that is now expected to be at the lower end of our risk appetite range of 140% to 180%. Therefore, the board no longer expects to pay a final dividend for the 2022 financial year.

"The group has a range of management actions that it continues to pursue to rebuild balance sheet resilience."

Direct Line has dropped 26.87%.

Victoria Scholar, head of investment at interactive investor, said: "Traders are selling the stock aggressively on the back of the abandonment of its dividend, adding to the negativity after a tough year for the business, weighed down by higher-than-expected claims, cost inflation and a slowdown in the commercial property market.

"Direct Line is on track for its biggest one-day share price drop in its history, shedding more than a quarter of its market valuation, dragging other stocks in the sector like Admiral and Aviva down with it."

8.12am: Markets positive but movement is not convincing

Leading shares have opened higher after a rebound in the US and a positive performance in Asia, as the speech from US Federal Reserve chair Jerome Powell yesterday did nothing to scare the horses.

But the gains are limited, with the FTSE 100 up just 13.02 points or 0.17% at 7707.51 in early trading.

Michael Hewson, chief market analyst at CMC Markets UK, said: "This week’s US CPI report is now the next focus for markets in the tug of war currently playing out between the market, which thinks the Fed will have to cut rates this year, and Fed officials who insist nothing even close to that will happen.

"Fed chair Jay Powell’s comments yesterday did little to indicate whether the FOMC was inclined to take another step down in its rate hiking cycle when it next meets at the end of the month."

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown (LON:HRGV), said: "While [Powell's speech] won’t have directly given the markets something to digest, there is an element of no news is good news.

"Reports of global supply chain bottlenecks easing, and the reopening of China mean that ultimately, markets are baking in some renewed optimism. There is a ceiling to this good mood, though. Stock markets remain highly sensitive and have been prone to some misdirection in recent trading days."

J Sainsbury PLC is down 2.4% despite a positive update and raised guidance from the supermarket group, with sales up 7.1% over the Christmas period. Investors are concerned about whether the good performance can continue amid a cost of living crisis.

Charlie Huggins, head of equities at Wealth Club, said: "This is a solid performance from Sainsbury's with the group raising its profits and cash guidance for the year, against an intensely competitive market backdrop. It seems that UK shoppers indulged in one final sales splurge in the run up to Christmas, benefitting Sainsbury's and its peers. However, with the slowdown in consumer spending yet to really bite, it's likely the environment will get tougher."

Richard Hunter, head of markets at interactive investor, said: "Sainsbury has guided that the full-year underlying pre-tax profit will be towards the upper end of the £630mln to £690mln range previously advised. This would nonetheless be a decline from the previous year’s showing of £730mln and underlines the scale of the challenges which show few signs of abating...

"The market consensus of the shares has recently deteriorated to a sell, with Tesco (LON:TSCO) remaining the preferred play, although this could be subject to upgrades given the general success of the latest quarter.”

7.55am: Indecision is rife among USD, GBP traders

Per the World Bank’s latest forecast, the global economy is expected to grow by just 1.7% in 2023, down from the bank’s 3% prediction last June.

But even that number is flattered by China’s predicted growth of over 4%, whereas Western economies could more or less grind to a standstill.

Yet Swissquote analysts warned against taking this as a sign of looser economic policy in the US: “Inflation, though easing, remains more than three times higher than the Fed’s 2% target. This means that the Fed will continue hiking rates even if it means slower economic growth.”

It’s all leading to a general lack of direction in the markets, exasperated by Fed chair Jerome Powell’s silence on the bank’s direction.

Tomorrow’s inflation data will surely be hotly anticipated.

The US Dollar Index (DXY) closed flat at 102.89 on Tuesday following three straight days of meaty losses, though the spinning top candlestick pattern showed clear indecision among traders.

Indecision continued in this morning’s Asia trading window. At the time of writing, DXY was a few basis points lower at 102.77, but there was no clear bearish advantage.

Cable was seen higher following a bearish end to Tuesday’s trading session which saw the pair close 30 pips lower at 1.215 before adding 0.2% to 1.217 this morning.

GBP/USD seen higher, yet investor sentiment is mixed – Source: capital.com

The euro maintains a seven-month high against the greenback, with the EUR/USD pair currently changing hands at 1.074.

Benefitting euro bulls, European Central Bank board member Isabel Schnabel made hawkish comments in her Tuesday speech on green policy. “Inflation will not subside by itself”; “To resolve today’s inflation problem, financing conditions will need to become restrictive” and so forth.

EUR/GBP had a strong Tuesday session, closing 30 bps higher at 88.35p, with further upside to 88.38p seen in this morning’s Asia session.

7.00am: Markets set for rebound

The FTSE 100 is expected to open higher following gains in the US and Asia with spread betting companies are calling London’s blue chip index up by around 26 points.

US markets enjoyed a positive session as investors took heart from a speech by Federal Reserve chairman, Jerome Powell, which steered clear of rhetoric on interest rates and inflation and as a result didn’t unnerve market sentiment.

At the close the Dow Jones Industrial Average was up 186 points, or 0.56%, to 33,704, the S&P 500 rose 27 points, or 0.7%, to 3,919 and the Nasdaq Composite advanced 107 points, or 1.01%, to 10,743.

Asian equities were largely on the rise. The Shanghai Composite in China was flat in late dealings, but the Hang Seng in Hong Kong was up 1.2% in afternoon trade. The Nikkei 225 added 1.0% in Tokyo, while Sydney's S&P/ASX 200 rose 0.9%.

In London, food retail heavyweight and household name, J Sainsbury PLC will be in the spotlight as it updates on trading. Anecdotal evidence from the likes of Kantar has suggested sales have been strong in the sector. Whether this has translated into profit will be keenly watched.

Another retailer updating on trading is JD Sports Fashion PLC (LSE:JD.) while Barratt Developments PLC (LSE:BDEV) will give an indication of the state of play in the housing market following a number of downbeat surveys.

Recruiter, Pagegroup PLC (LON:PAGE), will also be in focus following the profits warning by sector rival, Robert Walters PLC (LSE:RWA), yesterday.