Gold prices set for weekly gains on dovish Fed outlook; silver near record high

Proactive Investors -

- FTSE 100 climbs another 54 points

- Wheat prices jump after Russia pulls out of deal

- easyJet (LON:EZJ) reports record quarterly profit

Gas and electric prices still coming down

The Office for National Statistics has released another batch of timely "experimental data" and analysis on economic activity and social change.

These faster indicators are created using rapid response surveys, novel data sources and experimental methods, the ONS says.

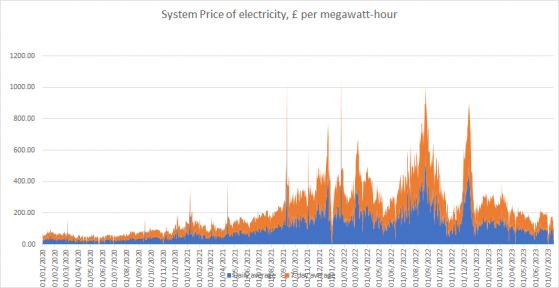

One of them is the system average price (SAP) of gas and electricity, which fell when compared to the previous week, by 18% and 11% respectively.

Both are around 70% lower than the equivalent week of 2022, having trended downwards since the beginning of this year, according to data from the National Gas Transmission and Elexon.

Among the other data, there was an 8% decline in credit and debit card purchases, while retail footfall from Springboard also decreased, to 98% of the previous week. Revolut has also contributed to this scheme, and it revealed card spending from its customers increased by two percentage points.

Online job ads were down 6% compared to a year ago but up 1% from the previous week (via Adzuna), while the average number of daily UK flights was, at 6,160, the highest number since mid-October 2019 and 7% higher than the level seen in the equivalent week of 2022.

Miners top the leaderboard

After yesterday’s spectacular session for UK stocks, Danni Hewson, head of financial analysis at AJ Bell, feels it is "refreshing" to see further gains today.

With the FTSE 100 having added 54 points or 0.7% to 7,642 and its mid-cap sibling putting on 0.3% to 19,384, London's heavy weighting of big miners are paving the way, with Anglo American (LON:AAL) top of the leaderboard, followed by Antofagasta (LON:ANTO), Glencore (LON:GLEN) and Rio Tinto (LON:RIO).

As well as Anglo reporting a surge in copper production, former Footsie constituent BHP also posted record full-year iron ore output and flagged rising costs.

More importantly for the wider sector, prices of most base metals were up, with Reuters reporting that this is on short covering following a report that the Chinese government is looking at supportive measures for the real estate market.

Investors are also continuing to shop for bargains among the housebuilders, says Hewson, with Persimmon PLC (LON:PSN) and Barratt Developments PLC (LON:BDEV) also near the top of the risers table.

"However, market sentiment can turn quickly and investors have a habit of finding things to worry about,” she says.

"The corporate reporting season went into overdrive with updates from a multitude of players large and small across the UK, mainland Europe and the US.

"So far, there have been mixed messages, particularly from the tech sector, and pre-market indicative prices suggest the US market will open in the red later today."

Shares in Tesla and Netflix (NASDAQ:NFLX) are heading lower in pre-market trading, while chip giant TSMC reported its first decline in profit in four years as demand for consumer electronics weakened.

"You can see the effects in one of the big European names as shares in home appliances giant Electrolux sank 14% after swinging to a second quarter loss thanks to a shift in customer habits."

London and Madrid stock markets leading the way

Looking around European markets, London's FTSE and Spain's IBEX are leading the way this morning.

The Footsie is up 55 points or 0.7% now, while the IBEX has risen 0.6%. Germany's DAX and Italy's FTSE MIB are both up 0.2% while France's CAC has added 0.4% so far.

Earlier, most of the continental indices were in the red.

"European markets are diverging," says Neil Wilson at Markets.com, noting that miners, utilities and real estate are leading London moves this morning.

For easyJet he says the fall in the shares of 1.6% "is tiny versus the +47% return YTD – looks like profit taking as strikes create some near-term uncertainty".

Shell (LON:RDSa) gains boost London

Elsewhere in commodities, moves higher in the shares in oil heavyweight Shell PLC (LON:SHEL) and BP (LON:BP) are helping London's progress this morning.

Brent crude oil front-month futures have battled to a roughly flat position this morning at US$79.46 a barrel, with WTI up slightly at US$75.31.

"Oil prices have steadied after a volatile week following the breakout from its two-month range," says Craig Erlam, market analyst at Oanda.

"The break came on the back of output curbs from Saudi Arabia and Russia, initially, but then better inflation data from the US, eurozone and UK which could boost economic prospects.

"Since then, the price has been volatile but importantly held above previous range highs."

Inventory data from EIA yesterday triggered some choppiness but it was "no game-changer", says Erlam, while promises from China's top economic planner to restore and expand consumption "fell on deaf ears a little as they lacked significant detail".

He sees chances for more of a rebound in the second half of the year. "A stronger rebound in China and softer landings elsewhere could be bullish for crude depending on what producers do."