Proactive Investors -

- FTSE 100 extends falls, down 81 points

- UK retail sales fall 0.4% in November

- PMI improves in December but manufacturing struggles

11.07am: FTSE slides further, oil price weakens on growth concerns

No signs of the seeling pressure easing in the equity markets.

The FTSE 100 is now down 81 points at 7,345 while the FTSE 250 is 294 points lower at 18,600.

“Risk-off” remains the dominant theme according to Fawad Razaqzada, market analyst at City Index and FOREX.com.

Investors are fretting that the hawkish statements from central banks which accompanied the interest rate rises will push the global economy into recession.

Worries over economic growth have sent the oil price lower too.

Brent crude prices fell 2.4% to $79.208/barrel while WTI prices slid 2.8% to $73.96/barrel.

The market is already facing turmoil following an EU ban on imports of Russian oil and a G7 cap on the price of Russian oil at $60 a barrel.

Meanwhile, the Telegraph reported that dozens of oil tankers were stuck in Turkey for days.

10.35am: Manchester United seeks news shirt sponsor

Manchester United PLC are seeking a new front-of-shirt sponsor after agreeing to end their deal with German company TeamViewer.

A five-year deal was only signed with TeamViewer for the company to replace Chevrolet in March 2021.

But in a statement the Premier League club said “"United will be taking the opportunity to commence a focused sales process for a new shirt front partner in a normalised market."

The Glazer family, which owns the club, are looking to sell up after 17 years of ownership.

10.26am: Games Workshop soars on Amazon deal

The tie-up between Games Workshop Group PLC (LON:GAW) and Amazon to produce TV and films associated with the Warhammer universe “is potentially huge” for the company according to Russ Mould, investment director at AJ Bell.

Peel Hunt agreed “This is major news for Games Workshop and all Warhammer fans.”

Mould pointed out “a lot of the excitement around the stock in recent years has been built around the licensing opportunities associated with Games Workshop’s intellectual property, which has a large and very loyal fanbase.”

“Developing in this area has several upsides for Games Workshop. It generates extra revenue and cash flow for a relatively limited extra cost and, while Amazon will be granted the relevant merchandising rights.”

“It could deepen fans connections with Games Workshop’s table-top gaming products and bring them to a wider audience” he added.

The market certainly warmed to the deal marking shares 15% higher at 8,409p.

9.49am: PMI improves in December but manufacturing remains under pressure

The downturn across UK business eased slightly this month, apart from for manufacturers, according to the latest PMI figures.

The UK S&P Global Composite Purchasing Managers' Index (PMI) rose unexpectedly to 49.0 from 48.2 in November, although it remained below the 50 threshold denoting growth.

????????According to latest Flash #PMI data, the #UK’s private sector downturn was the softest in 3 months in December. Staffing levels, however, fell for the first time since February 2021. pic.twitter.com/7HVcauJhUs— S&P Global PMI™ (@SPGlobalPMI) December 16, 2022

City expectations were for a further fall in the reading to 48.0.

The report said the falls in business activity and new orders were the least severe since September.

Nevertheless, companies took a more cautious stance with regards to staffing levels, with overall employment falling for the first time since early 2021.

The flash services PMI registered 50.0, a three-month high, against 48.8 in November but the flash manufacturing PMI hit a 31-month low at 44.7 compared to 46.5 in the previous month.

Chris Williamson, chief business economist at S&P Global Market Intelligence said: “The December data add to the likelihood that the UK is in recession, with the PMI indicating a 0.3% GDP contraction in the fourth quarter after the 0.2% decline seen in the three months to September.”

“For now, the downturn looks to be relatively mild, and the easing in the rate of decline in December is encouraging news, as is the further marked cooling of inflationary pressures.”

“However, the fact that the downturn has moderated compared to the turmoil created in the immediate aftermath of the botched "mini budget", most notably in financial services, is no real cause for cheer.”

“It is especially worrying to see business confidence and order book indicators remain so low by historical standards, with both of these key gauges signalling heightened degrees of economic stress.”

9.25am: Sainsbury and Tesco (LON:TSCO) up as food sales buck weaker trend

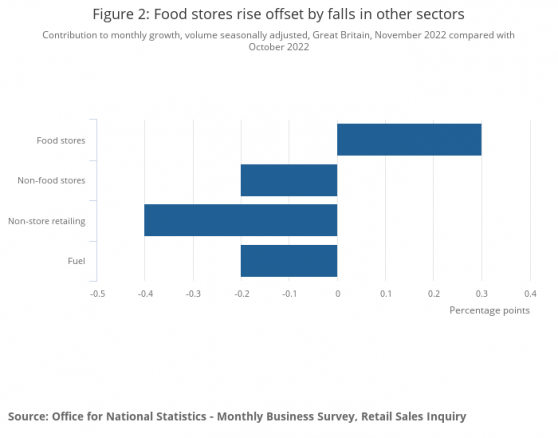

Food retailers J Sainsbury (OTC:JSAIY) PLC and Tesco PLC bucked the weaker market reflecting one of the bright spots in today's retail sales figures.

As Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown (LON:HRGV) pointed out; "There were some areas of optimism though, with food store sales increasing 0.9% as customers stocked up for Christmas."

" While this is certainly good news, it will be important to assess how that increased spending has been split across the economy" she added.

"It’s still likely that some mid-range grocery chains have struggled this year, with discounters likely to be seeing increased activity"

9.15am: Consumer confidence improves

Some better news as British consumer confidence edged higher in December although it still remains close to all-time low levels as households see their incomes eroded by high inflation.

The data came from market research firm GfK which said its monthly consumer confidence index rose in December to -42 from November's -44 after hitting a record low -49 in September.

December's reading was the highest since July and the third consecutive monthly improvement in the index.

But Joe Staton, client strategy director at GfK, said the eight months of readings at -40 or worse was the first time such a run had occurred in the survey's nearly 50-year history and added to signs of recession.

"The outlook for our personal financial situation over the next 12 months is stuck at -29, and concerns about our economic future remain acute," Staton said.

"With scant seasonal joy at present and no immediate prospect of fiscal good news, it is unlikely we will see a rebound in confidence anytime soon," he added.

9.02am: Retailers in focus after weak sales figures

Retail share prices have been marked a touch lower in early trading following the weaker-than-expected UK retail sales numbers.

A fall of 0.4% in November was against City expectations for a 0.3% increase and reflected a decline in online sales which slipped 2.8%.

Shares in Next PLC fell 0.8%, ASOS (LON:ASOS) PLC dipped 0.6% and Marks and Spencer Group PLC (LON:MKS) declined 0.6%.

Economists think there are further falls ahead too.

Martin Beck, chief economic advisor to the EY ITEM Club “expects the pressure on household budgets will remain severe in the near-term, with wage growth continuing to run well below inflation, signs that weak activity is beginning to cause a rise in unemployment, and the reduction in the generosity of the cap on energy bills next spring.”

“Given this weak outlook, the EY ITEM Club expects to see another large fall in retail sales volumes in 2023.”

Not even Black Friday came to the rescue noted AJ Bell financial analyst, Danni Hewson.

She commented “Retail’s fairy godmother has failed to wave her magic wand and despite Black Friday promotions and a rush by households to spread the cost of a Christmas feast, sales are down.”

“It could be people are waiting until they’ve got their Christmas paycheques in their hands and with the big day on a Sunday there is still plenty of time for tills to ring out their merry tune” she suggested.

“But cost is the X-factor looking at sales numbers from the three-month period a year ago and comparing them to the last three months the story is pretty easy to read.”

“People are paying a whole lot more to buy a whole lot less and that’s hurting consumers and retailers alike” she concluded.

8.28am: Rank falls after profit warning

Grosvenor casino and Mecca Bingo owner, Rank Group (LON:RNK) PLC, was an early faller after it warned of poor trading at its Grosvenor casinos.

The group said it now expects group like for like underlying operating profit for the year to June 30, 2023 to be in the range of £10mln to £20mln.

“Due to the high operating leverage within Grosvenor, and its relative importance to the group as a whole, movements in its NGR will have a significant impact on the group's operating profit for the year” Rank said.

Broker Peel Hunt slashed forecasts as a result lowering its pre-tax profit forecast to a mid-range £14mln from £43mln and cut its EPS estimate to 0.5p from 5.7p.

“It is taking longer than we expected for customers to return to casinos and spend per head remains subdued” it noted.

8.15am: FTSE resumes downward path

FTSE 100 has resumed its downward path on Friday as more gloomy economic news and heavy falls in the US and Asia dampen the mood.

At 8.15am the lead index was down 22 points at 7,404.

Gabriella Dickens, senior UK economist, at Pantheon Macroeconomics said the fall in retail sales was a sign “consumers are tightening their belts in the face of surging prices.”

She suggested retailers are likely to endure a further drop in demand in December due to the heavy snowfall pointing out sales volumes fell by 2.1% month-to-month during the December 2010 snowstorms.

“And the outlook next year is equally as gloomy, as households’ real disposable incomes are pummelled by rising energy prices and falling employment” she noted.

She forecast a “1.7% year-over-year decline in households’ real expenditure next year, with retail sales falling to a similar extent as services spending.”

Coming on the back of the hawkish words from the Federal Reserve and the ECB and the Bank of England’s rate increase yesterday and investors are understandably downbeat.

“Any thoughts of a Santa rally have all but evaporated, with previous hopes of peak inflation and interest rates being soundly rejected” noted Richard Hunter, head of markets at interactive investor.

News that BT Group PLC (LON:BT.A) is to merge its Global and Enterprise units which will save the telco £100mln left the shares little changed.

But Games Workshop Group PLC (LON:GAW) jumped 11% as it announced it has reached an agreement with Amazon to develop the group's intellectual property into film and television productions and for Games Workshop to grant Amazon associated merchandising rights.

8.07am: GBP remains volatile against USD, but in all the wrong ways for Sterling

Yesterday it was reported by Pantheon that the British pound has been particularly volatile against the US dollar in recent weeks.

That was certainly proved accurate by session’s closed when GBP/USD closed 1.8% lower at 1.219- the biggest daily dip since November 3.

Bearish price action continued in this morning’s Asia trading window, with the pair creeping down to 1.218.

Cable’s bearish reversal followed a 50 bps rate hike from the Bank of England. This was widely expected, but more surprising were the two votes to leave rates unchanged, even though inflation is still in the double digits.

Cable’s volatility streak continues – Source: capital.com

The pound also contended with a surge on the dollar following a pretty hawkish tone emerging from the US Federal Reserve, even though the 50 bps rate hike yielded no surprises.

The US Dollar Index (DXY) added a full percentage point to close at 104.17. DXY is currently sitting at 104.07 in the opening Friday hours.

Sterling also fell sharply against the euro, with EUR/GBP jumping 1.5% to 87.34p. The pair continued to rise in today’s Asia session, and at the time of writing was changing hands at 87.34p.

The pound could be expected to keep falling, given this morning’s pretty rough retail numbers. Sales in the UK decreased 5.9% year on year in November, fairly worse than the 5.6% predicted by the market.

Eurozone inflation figures are due later today, with 10% the going forecast. Anything softer than that could see the euro cool off a bit.

7.40am: BT to merge two units in £100mln cost savings push

BT Group PLC is to combine its Global and Enterprise units into a single B2B unit, called BT Business in a move that will drive cost savings of at least £100mln by the end of fiscal year 2025.

BT Business will create a B2B focused telecoms and technology business which in 2022 generated pro-forma revenues of approximately £8.5bn and EBITDA of over £2bn, the company said in a statement.

“The combined unit will enhance value for all our B2B customers, strengthen our competitive position, and deliver material synergies” BT added.

The FTSE 100 listed telco noted the move would allow it to develop and deliver market-leading products and services for its B2B customers, create a single interface for corporate customers and public sector institutions as well as deliver the cost savings.

The latter would be achieved through consolidation and rationalisation of management teams, support functions, product portfolios and systems and will form part of the group’s plans to deliver £3bn in annual savings.

BT Business will be led by Bas Burger the current CEO of BT's Global unit.

BT chief executive Philip Jansen said: "By combining the two units, BT Business will bring the group's combined assets, products, capabilities and brand to the service of all of our 1.2mln business customers who will benefit from faster innovation and delivery.”

7.16am: Retail sales fall 0.4% as online sales decline

UK retail sales volumes fell 0.4% in November hit by a sharp decline in online sales.

The figure was worse than City forecasts which had pencilled in a modest increase of around 0.3% but followed a rise of 0.9% in October (revised from an increase of 0.6%) when there was a bounce back from the impact of the additional Bank Holiday in September for the State Funeral.

Retail sales volumes fell by 0.4% in November 2022, following a rise of 0.9% in October.Retail remains 0.7% below its pre #COVID19 level.

➡️ https://t.co/xiheHmindu pic.twitter.com/MUpeSJBiph

— Office for National Statistics (ONS) (@ONS) December 16, 2022

Online sales volumes fell by 2.8% in November, continuing a downward trend seen since early 2021, while automotive automotive fuel sales volumes fell by 1.7%.

Non-food stores sales volumes fell by 0.6% in November and were 1.8% below February 2020 levels, while food store sales volumes rose by 0.9% with anecdotal evidence from retailers suggesting that customers stocked up early for Christmas.

7.00am: FTSE set to open higher

FTSE 100 expected to open higher on Friday, despite heavy falls in the US and Asia, as investors digest the rate rises and actions of central banks over the past few days.

Spread betting companies are calling the lead index up by around 22 points.

US equities were savaged once more as weak retail sales figures increased worries that the Federal Reserve’s pursuit of lower inflation through higher interest rates would result in recession.

At the close the Dow Jones Industrial Average was 764 points lower, or 2.25%, at 33,202, its worst day for three months, while the S&P 500 slumped 100 points, or 2.5%, to 3,896 and the Nasdaq Composite tumbled 360 points, or 3.23%, to 10,811.

Big tech stocks fell heavily with Amazon.com (NASDAQ:AMZN), Meta Platform Inc, Microsoft Corp (NASDAQ:MSFT). and Apple Inc (NASDAQ:AAPL) all sharply lower while bank shares also declined as fears of a recession increased.

In Asia on Friday, the Japanese Nikkei 225 index was down 1.9%. In China, the Shanghai Composite was down 0.2%, but the Hang Seng index in Hong Kong was up 0.7%.

Back in London and it is another busy day of economic data with UK retail sales figures, the GFK consumer confidence survey plus a number of PMI reports.

On retail sales and the PMIs Micheal Hewson at CMC Markets said “forecasts are for a modest slowdown from the 0.6% gain in October with gains of 0.3%, while flash manufacturing and services PMIs are expected to come in at 46.5 and 48.5 respectively.”

Read more on Proactive Investors UK