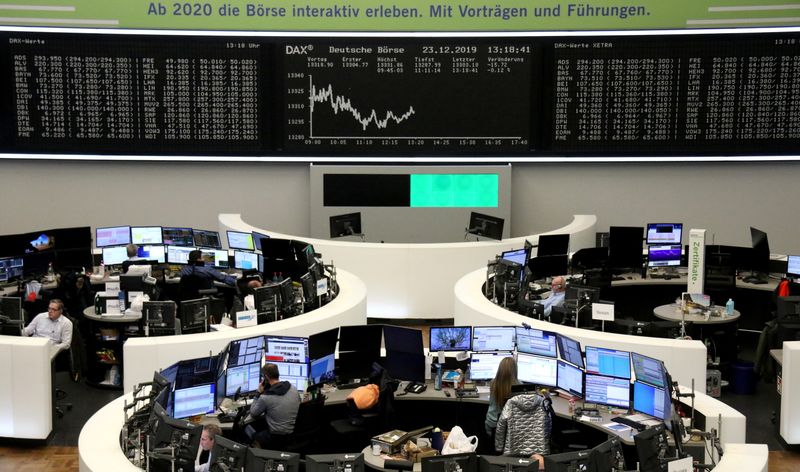

(Reuters) - European shares fell on Monday after a record-setting run that was fuelled by easing fears of a global recession and optimism around a U.S.-China trade truce, with investors now looking for concrete details on the Phase 1 agreement.

The pan-European STOXX 600 index (STOXX) was down 0.3% at 0818 GMT, after striking a record closing high on Friday.

Health care (SXDP) and utilities (SX6P) - commonly considered defensive stocks - led declines among the major subsectors.

European stock markets have followed their global counterparts higher in December as investors cheered the initial Sino-U.S. trade pact.

But with just two days left until the end of the decade, few major updates are expected about the finer details of the Phase 1 deal, giving equities little motivation to move much from current levels.

Among individual stocks, EssilorLuxottica (PA:ESLX) fell 2%, as the company said it had discovered fraudulent activity at a plant in Thailand that was expected to have a negative impact of 190 million euros ($213 million) on the spectacles company.