By Lisa Twaronite

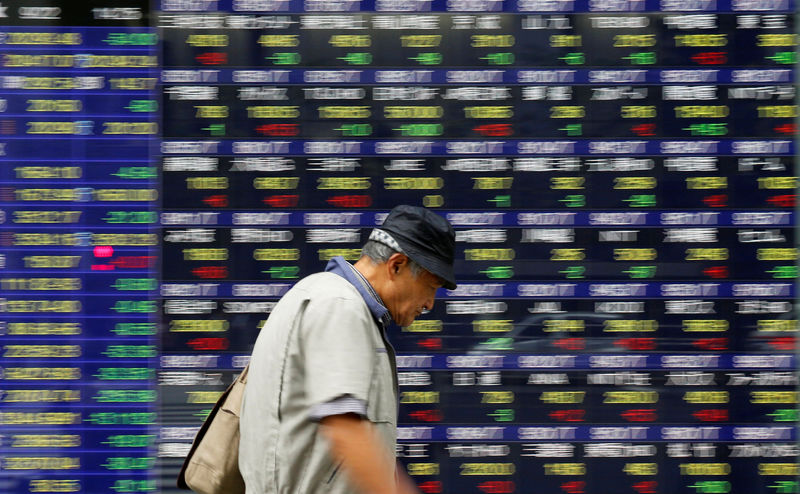

TOKYO (Reuters) - Asian shares rose on Tuesday, shrugging off modest losses on Wall Street, while expectations of another U.S. interest rate increase this year continued to underpin the dollar.

Futures suggested a more subdued start to the European trading day, with the Eurostoxx 50 (STXEc1) and Germany's Dax futures (FDXc1) both down 0.1 percent. France's Cac futures (FCEc1) and FTSE futures (FFIc1) were both slightly lower.

MSCI's broadest index of Asia-Pacific shares outside Japan (MIAPJ0000PUS) was up 0.6 percent.

Japan's Nikkei stock index (N225) reversed early losses and finished 0.6 percent higher, as markets reopened after a public holiday on Monday.

China stocks retreated from the previous session's 21-month highs as investors took profits on recent gainers and awaited third-quarter economic data and earnings reports. The bluechip CSI300 index (CSI300) fell 0.3 percent while the Shanghai Composite Index (SSEC) was down 0.1 percent.

China's Statistics Bureau on Tuesday said that the country will have no problem meeting its economic growth target of around 6.5 percent this year, and may even beat it. Such an outcome had been widely expected after a robust start to the year.

Offshore Chinese yuan

Korean shares (KS11) rallied 1.6 percent on their first day of trading this month, as tech shares led by Samsung Electronics (LON:0593xq) Co Ltd (KS:005930) caught up with gains made by global stock markets after a long break.

Seoul markets were closed last week and on Monday for public holidays.

"Global stock markets marked strong gains while Seoul markets were off, and the price of semiconductors continued to rally," said Lee Seung-woo, a stock analyst at Eugene Investment & Securities.

Tensions on the Korean peninsula continued. Russian Foreign Minister Sergei Lavrov told U.S. Secretary of State Rex Tillerson in a phone call on Monday that an escalation was unacceptable.

Russia and China both called for restraint on North Korea on Monday after U.S. President Donald Trump warned over the weekend that "only one thing will work" in dealing with Pyongyang, hinting that military action was on his mind.

Investors were particularly wary on Tuesday, when Pyongyang celebrated the founding of its ruling party, which loomed over other market factors.

"We are expecting a December Fed rate hike, so we are expecting the trend to be dollar strength and yen depreciation, though whenever North Korean risks rise, that pushes down the dollar," said Harumi Taguchi, principal economist at IHS Markit in Tokyo.

Interest rate futures are now pricing in nearly a 90 percent chance that the U.S. Federal Reserve will rise rates again in December.

The dollar was steady on the day against its Japanese counterpart at 112.67 yen

The perceived safe-haven yen typically rises when investors try to reduce their risk exposure because the currency is often used as a funding source to buy riskier, higher-yielding assets.

Japan is also the world's largest net creditor nation, and at times of uncertainty, traders assume Japanese investors' repatriation from foreign countries will outweigh foreign investors' selling of Japanese assets.

The dollar index, which tracks the greenback against a basket of six major rivals, edged down 0.2 percent to 93.533 (DXY), moving away from Friday's peak of 94.267. That was its loftiest level since July 20, after data showed a stronger-than-forecast increase in U.S. average hourly earnings in September.

The euro added 0.3 percent to $1.1770

Also helping the euro were comments from a European Central Bank Executive Board member, who called for the central bank to reduce its asset purchases next year. The ECB is due to decide on Oct. 26 whether to continue its bond buying in 2018.

Crude oil prices edged slightly higher, underpinned by OPEC comments signalling the possibility of continued action to restore market balance in the long-term.

But gains were seen as limited as oil production platforms in the Gulf of Mexico started returning to service after the latest U.S. hurricane forced the shutdown of more than 90 percent of crude output in the area.

Brent crude (LCOc1) inched up 1 cent to $55.80 a barrel. U.S. crude (CLc1) added 2 cents to $49.60.

Gold prices hit their highest in more than a week, though gains were capped as expectations of another Fed rate hike this year supported the dollar. Spot gold