By Lisa Twaronite

TOKYO (Reuters) - Asian shares reversed earlier losses on Thursday as crude oil prices pulled away from their deep overnight lows, while the Australian dollar grabbed the spotlight and surged after a much stronger-than-expected employment report.

European shares were expected to take their cue from Wall Street, which ended a choppy session lower as a sharp drop in oil prices knocked energy stocks.

Financial spreadbetters expected Britain's FTSE 100 (FTSE) to open down as much as 0.19 percent, Germany's DAX (GDAXI) to fall as much as 0.08 percent, and France's CAC 40 (FCHI) to drop around 0.06 percent,

"With little in the calendar in the way of data, attention today is likely to be on various speeches by central bankers, starting with ECB President Mario Draghi this morning when he talks to the European Parliament," Michael Hewson at CMC Markets in London said in a note to clients.

MSCI's broadest index of Asia-Pacific shares outside Japan (MIAPJ0000PUS) was up about 0.7 percent, erasing its early modest losses.

U.S. crude futures (CLc1) steadied in Asia after tumbling 3 percent overnight on worries about higher crude inventories. They were last up about 0.6 percent at $43.18 (28 pounds) a barrel. Brent crude (LCOc1) added 0.5 percent to $46.04 though was still not far from its lowest levels since August.

Prices of other commodities also weakened after the previous session's downbeat Chinese industrial output data, which continued to pressure shares in resource-rich Australia. The S&P/ASX 200 index (AXJO) eked out a 0.1 percent gain, helped by the jobs report's upside surprise.

Employment jumped 58,600 last month, driving the jobless rate down to a five-month low of 5.9 percent and beating the market consensus for a 15,000 rise and a steady unemployment rate of 6.2 percent.

The Australian dollar

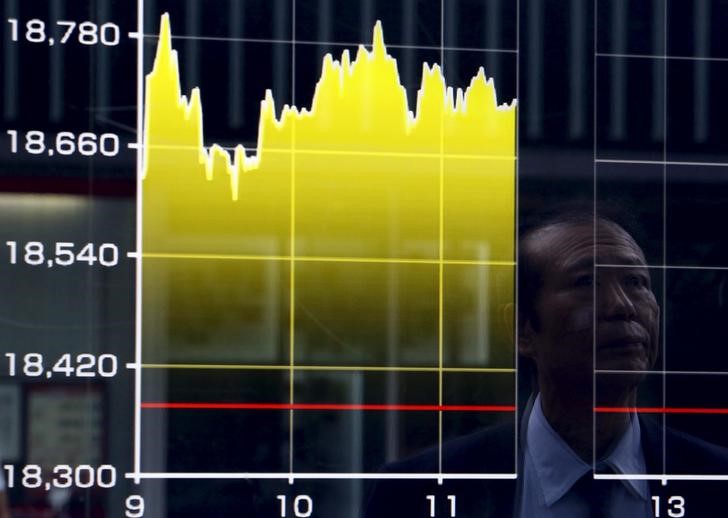

Japan's Nikkei stock index (N225) ended slightly higher, erasing earlier losses.

Data released before the market opened showed Japan's core machinery orders rose 7.5 percent in September, marking the first increase in four months, though orders were down sharply in the third quarter.

"Companies are taking a very cautious stance towards capital expenditure," said Norio Miyagawa, a senior economist at Mizuho Securities.

"The health of overseas economies, particularly China, is one factor. Also, it's difficult for companies to have the conviction that the domestic economy will grow rapidly."

South Korean shares (KS11) were down 0.2 percent. Earlier on Thursday, the Bank of Korea kept rates steady for a fifth straight month as expected.

The U.S. bond market was closed for Veterans Day on Wednesday, and while other markets were trading, activity was lighter than usual.

With no directional guidance from U.S. Treasuries, some investors took profits after the dollar's recent rise in the wake of last Friday's stellar U.S. employment report that led many to increase their bets that the Federal Reserve was on track to raise interest rates at its meeting next month.

U.S. data will be increasingly important to markets ahead of the Fed's December policy review.

The dollar index (DXY), which tracks the greenback against a basket of six major peers, edged down 0.2 percent to 98.863, below a seven-month peak of 99.504 scaled on Tuesday.

The dollar edged up to 122.90 yen