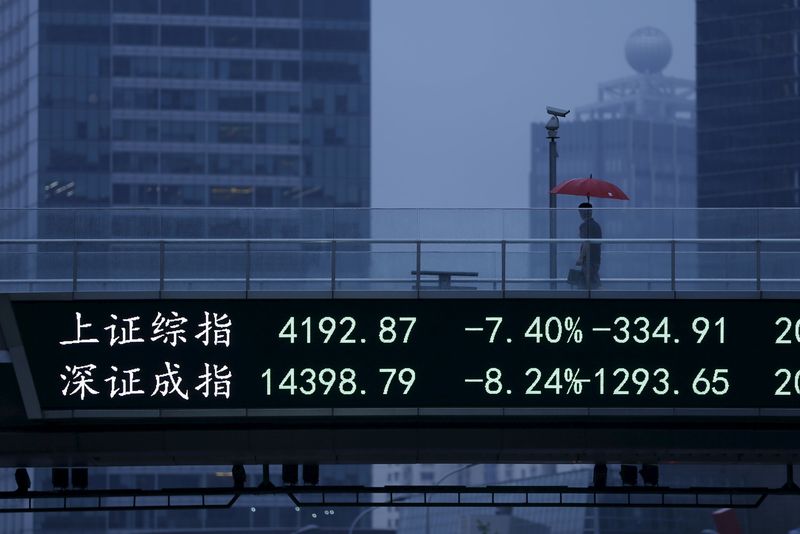

Investing.com – China equities were lower at the close on Monday, as losses in the Telecoms, Mobile and Travel & Leisure sectors propelled shares lower.

At the close in Shanghai, the Shanghai Composite declined 8.46% to hit a new 6-month low, while the SZSE Component index lost 7.83%.

The biggest gainers of the session on the Shanghai Composite were Kibing Group (SS:601636), which rose 10.00% or 0.890 points to trade at 9.790 at the close. Ningbo Fubang (SS:600768) added 7.39% or 1.480 points to end at 21.500 and Jiangzhong Phm (SS:600750) was up 6.47% or 2.490 points to 41.000 in late trade.

Biggest losers included Nanjing Steel (SS:600282), which lost 10.09% or 0.430 points to trade at 3.830 in late trade. Wuhan Steel (SS:600005) declined 10.07% or 0.540 points to end at 4.820 and Xinke Material (SS:600255) shed 10.07% or 0.610 points to 5.450.

The top performers on the SZSE Component were XCMG Construction Machinery Co Ltd (SZ:000425) which rose 10.03% to 11.08, Sichuan Jinlu Group Co Ltd (SZ:000510) which was up 5.03% to settle at 10.02 and Beihai Yinhe Industry Investment Co Ltd (SZ:000806) which unchanged 0.00% to close at 26.90.

The worst performers were BOE Technology Group Co Ltd (SZ:000725) which was down 10.11% to 3.29 in late trade, Shanxi Taigang Stainless Steel Co Ltd (SZ:000825) which lost 10.08% to settle at 4.55 and Haima Automobile Group Co Ltd (SZ:000572) which was down 10.06% to 6.53 at the close.

Declining stocks outnumbered rising ones by 953 to 6 on the Shanghai Stock Exchange.

The CBOE China Etf Volatility, which measures the implied volatility of Shanghai Composite options, was up 11.51% to 40.51 a new 1-month high.

In commodities trading, Gold for December delivery was down 0.27% or 3.10 to $1156.50 a troy ounce. Meanwhile, Crude oil for delivery in October fell 3.25% or 1.31 to hit $39.13 a barrel, while the October Brent oil contract fell 2.69% or 1.23 to trade at $44.23 a barrel.

USD/CNY was up 0.11% to 6.3959, while EUR/CNY rose 0.94% to 7.3417.

The US Dollar Index was down 0.59% at 94.28.