By Geoffrey Smith

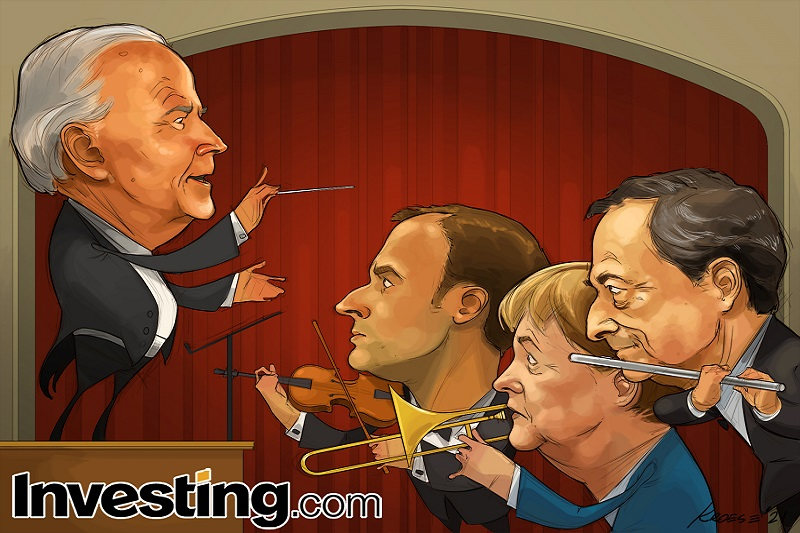

Investing.com -- International discussions are rarely harmonious, and any sort of discussion about tax even less so.

But the willingness of the U.S. to re-enter a global discussion about ending harmful tax competition has struck a chord. It may yet end in a significant redistribution of income away to governments and away from private shareholders.

For many, such a development seems overdue: multinational companies in particular have managed to depress their effective tax rates consistently over the last four decades, strengthening their competitive advantage against smaller businesses wherever they operate. The trend has taken on grotesque dimensions as specifically the new breed of digital giants has skillfully diverted the vast bulk of its profits to low-tax jurisdictions, hollowing out the tax base of states everywhere.

Over the last 40 years, the rate of tax paid by companies had fallen almost continuously – from over 40% in 1980 to around 24% in 2020, according to the Tax Foundation, a U.S.-based think-tank.

So what, say others. A light and flexible taxation system has been essential to underpin unprecedented growth in global cross-border trade and investment that has lifted hundreds of millions out of poverty in that time, creating jobs in new industries as older ones have died.

There is, of course, no single way to reconcile all the conflicting perspectives involved in the debate. However, the ideas floated last week by Janet Yellen for a global minimum tax – warmly welcomed by global finance ministers at the spring meeting of the International Monetary Fund – make it much more likely that a destructive and open-ended dispute over corporate taxation, which has been brewing since the last financial crisis, can be avoided.

Yellen’s proposal builds on what the previous U.S. administration implemented in 2017, when Donald Trump persuaded America Inc. to repatriate trillions of untaxed earnings stashed offshore by levying only a 10.5% tax on it.

At the same time, the Trump administration had cut the statutory U.S. tax rate and ended a handful of exemptions. The move was rocket fuel for the stock market, allowing companies to buy back hundreds of billions of dollars of stock (they were less keen to use it for its stated purpose of raising investment).

To a degree, what Secretary Yellen is now proposing is a claw-back of that specific giveaway – one that seems all the more urgently needed in view of the damage done to public and household finances by the pandemic, and the need to fund economic reconstruction. Yellen wants a minimum tax rate of 21% - double the level set by her predecessor.

However, it goes well beyond that. In proposing a global minimum tax, Yellen is hoping to persuade countries in Europe and elsewhere to drop their plans for digital service taxes, that would be levied overwhelmingly on U.S.-based Internet platform companies such as Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), Alphabet (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN). Those taxes had ratcheted up a cycle of retaliation across the Atlantic that had also included import duties on European products and generally soured relations between the world's richest democracies.

That backdrop made it harder for Trump to build a broader alliance to contain Chinese economic expansionism. The new administration - perhaps optimistically - thinks that Europe will more likely to fall in with anti-Chinese measures if this long-running dispute can be settled.

Certainly, agreement on a global minimum tax will allow progress on another parallel initiative, led by the Organization of Economic Cooperation and Development, to eradicate so-called “Base Erosion and Profit-Shifting”. That unwieldy term refers to the practice whereby multinationals divert as much of their profit as possible to jurisdictions with low tax rates, such as Ireland, or a handful of British overseas territories such as the British Virgin Islands.

According to Reuters, the minimum tax is expected to make up the bulk of the $50 billion-$80 billion in extra corporate tax that the OECD estimates companies will end up paying globally if deals on both efforts are enacted. The BEPS initiative has been effectively frozen for the last year, since Steven Mnuchin informed the OECD that the U.S. couldn't agree to key elements of it. If there is mileage in Biden's efforts at rapprochement, that is the next place one would expect to see progress.