By Joice Alves

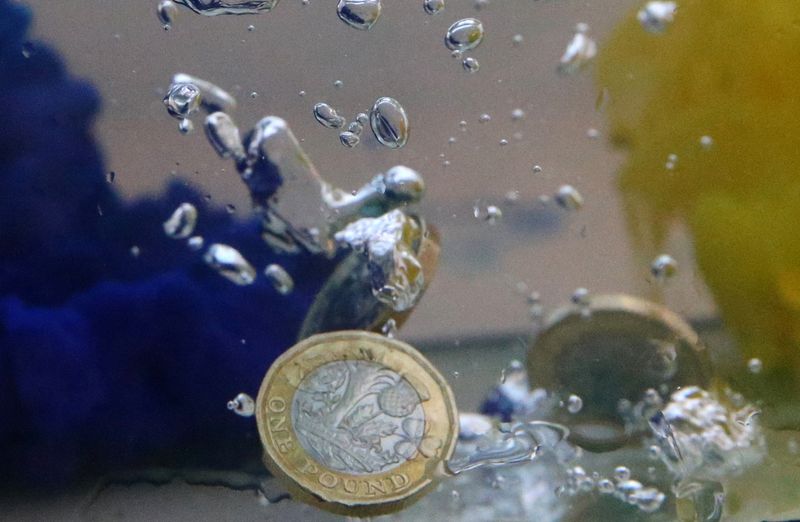

LONDON (Reuters) - Sterling surged on Thursday after data showed British borrowers increased demand for loans, while a separate business survey showed a more resilient than feared economic picture.

Bank of England (BoE) data showed on Thursday net borrowing by British consumers was the highest in nearly seven years in November and lenders approved the most mortgages since June, in a sign households were mostly coping with high interest rates.

A separate survey, the final S&P Global/CIPS UK Services Purchasing Managers' Index (PMI), showed Britain's services firms grew more strongly in December than initially thought and optimism hit a seven-month high.

The composite PMI, which combines the services survey with a weak reading of the manufacturing sector published on Tuesday, reached its highest since May in December, rising to 52.1 from 50.7 in November.

Jeremy Stretch, head of G10 FX Strategy at CIBC Capital Markets, said sterling found some comfort as "early BoE rate cut expectations (are) continuing to be pared."

The large increase in monthly consumer credit, combined with an upgrade to final services PMI "provides a more constructive UK macro backdrop," he said.

Sterling was last up 0.23% against the dollar at $1.2690

It rose as much as 0.5% to $1.2728 after the data release, having fallen 0.87% on Tuesday to a three-week low, in its biggest one-day drop since mid-October.

Traders expect around 140 basis points of rate cuts in 2024, according to money market pricing, not far off the roughly 150 expected from the Fed and the European Central Bank, but they are split on the timing of the first BoE cut.

British business leaders have called on the BoE to start cutting interest rates in early 2024.

Prime Minister Rishi Sunak, who is expected to call an election later this year, promised to get the economy growing more strongly but official data published last month suggested it could already be in a mild recession. The opposition Labour Party, which is far ahead of Sunak's Conservatives in opinion polls, has accused him of overseeing a slump in the country's growth.

The central bank raised interest rates to a 15-year high of 5.25% in August and has said it expects to keep them elevated for "an extended period of time" to ensure that the risks posed by the surge in inflation in 2022 are snuffed out.

Inflation in the UK fell more than expected in November to 3.9%, from 4.6% in October.