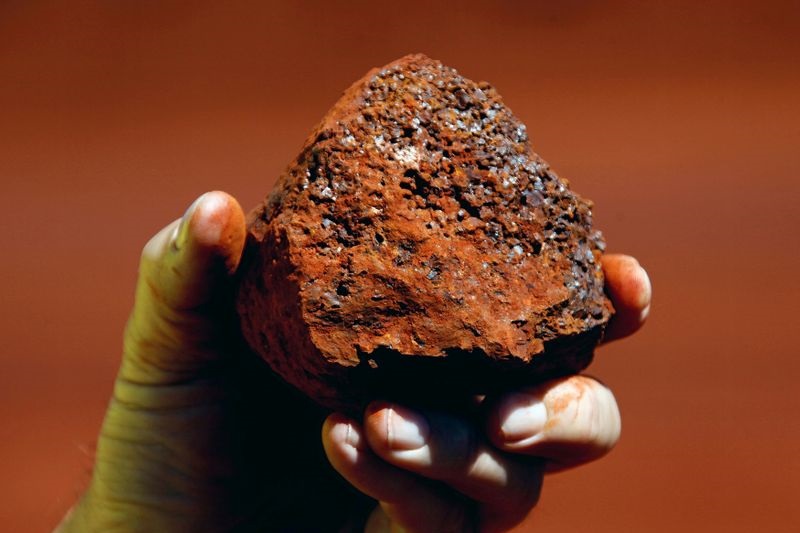

Morgan Stanley (NYSE:MS) is out with its latest iron ore price outlook in which the firm’s strategists said they expect a return of more sustained upside and are targeting $120/t in Q3.

They said that iron-ore is seeing resistance at $100/t, a level at which previous moves have been short-lived relative to costs, and price risk is now skewed upwards as “mood improves on China demand and slippages to supply come amid an already balanced market.”

“We see little room for a further leg downwards… in fact, since 2006 price has traded on average at a 55% premium to this cost level,” said the strategists in a note Thursday.

The firm’s iron ore price outlook points to data from China which suggests underlying demand is better than sentiment suggests with CISA’s 10-day average steel output improving 3.6% and property sales “sequentially less negative” at -19% vs -38% previously.

The World Steel Association projects robust global demand growth of 1.7%, while softer exports from India and production issues in Australia and elsewhere mean supply slippages could emerge.

In addition, costs are high, including ocean freight costs and capex costs, while operating costs continue to rise.

“Our recent price deck reflects a closely balanced market for the full year (-19Mt), underpinning our view that prices will see sustained upside return by H2. We particularly watch for further upside surprises on China which may bring forward timing, and expect volatility to remain high,” added the strategists.