Ethical concerns are an increasingly pressing consideration for many investors seeking to put their money into companies that align with their views and values.

As terms like "environmental, social and governance (ESG)" and "socially responsible investing (SRI)" enter the mainstream, we have seen the emergence of more exchange-traded funds (ETFs) that integrate social responsibility with investing.

Below we will take a closer look at ethically focused investing and ETFs worth considering:

Measuring ESG Investing Criteria

More businesses and investors are becoming aware of the environmental and social impact of their choices in both their professional and personal lives. Yet shareholders may have different lines in the sand when it comes to ethical investing.

For example, some may avoid so-called sin stocks—companies involved in segments like tobacco, alcohol, gambling or firearms. Others may shun businesses that could potentially transgress controversial human rights issues like animal testing, nuclear energy development or intensive, eco-unfriendly farming. Corporations that damage the environment understandably make the news headlines regularly.

Political leanings may also influence portfolio choices. And some may prefer companies with overall positive social behavior rather than excluding stocks solely based on specific products or practices.

Since ethical investing can be viewed through the lens of what companies do practice, as well as what they don't practice, there are various definitions with significant differences.

The principles of corporate social responsibility (CSR) should be expressed in measurable variables, but as there is no single concept of sustainability, for example, nor is there one commonly accepted method of measuring it either.

Worldwide, different initiatives or not-for-profit membership organizations have also been introducing guidelines to ensure consistency in the disclosure of environmental information. Still, at present, these standards are not perfectly standardized.

There are a wide range of investing options, like the FTSE4Good Index Series, which was launched in 2001 and measures the performance of businesses with ESG practices. A complete list of these indexes can be found on the website of FTSE Russell.

The total assets under management worldwide at the end of 2019 using one or more sustainable investing strategies were over $30 trillion. With all that in mind, let's take a closer look.

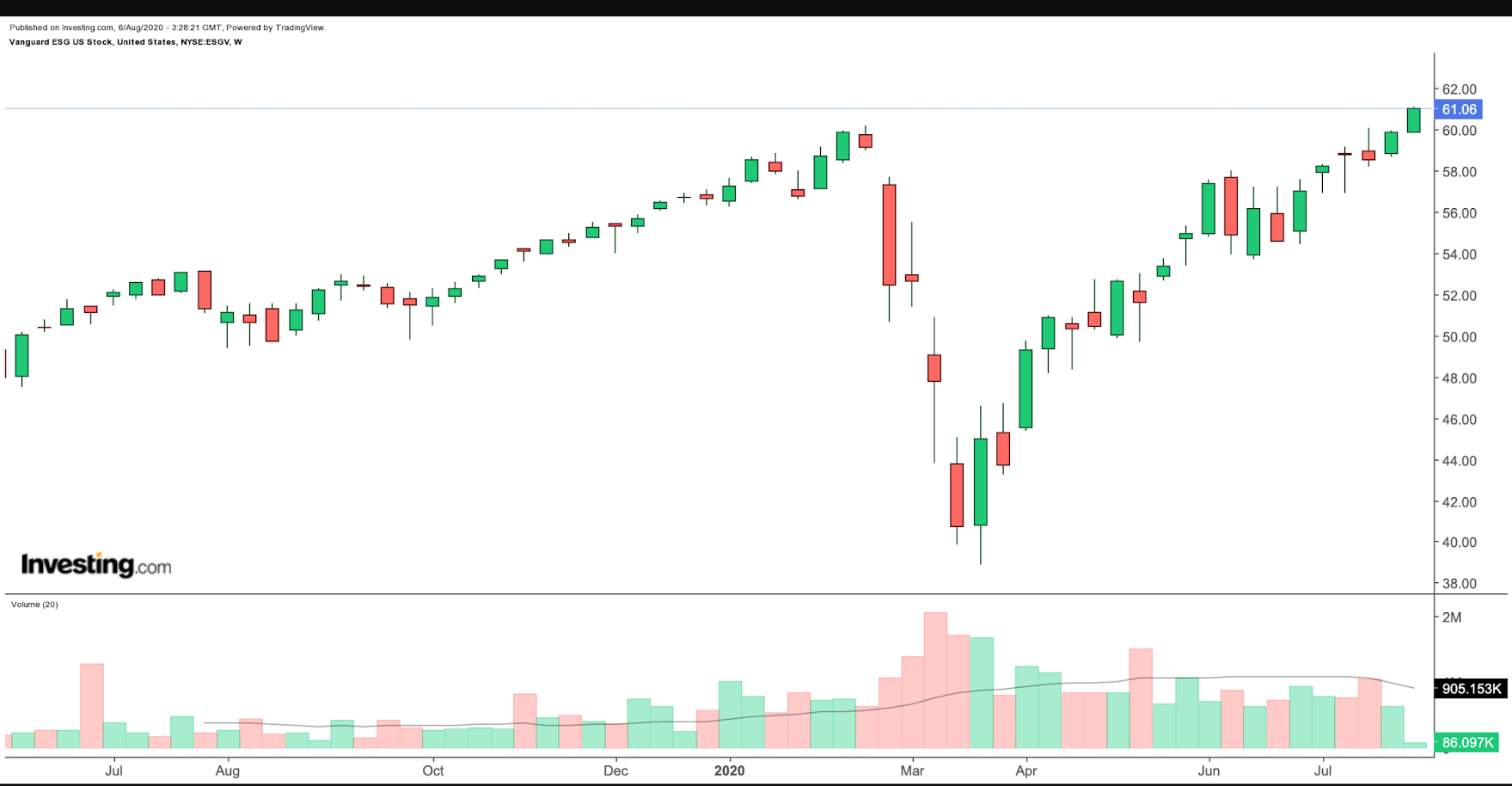

1. Vanguard ESG US Stock ETF

- Current Price: $61.06

- 52-Week Range: $38.85 - 61.08

- Dividend Yield (TTM-Trailing Twelve Month): 0.94%

- Dividend Distribution Frequency: Quarterly

- Expense Ratio: 0.12 % per year, or $12 on a $10,000 investment

The Vanguard ESG US Stock Fund (NYSE:ESGV), which has 1,464 holdings, seeks to track the performance of the FTSE US All Cap Choice index.

The fund is screened for certain ESG criteria and specifically excludes stocks of companies in the following industries: adult entertainment, alcohol, tobacco, weapons, fossil fuels, gambling and nuclear power. Additionally, stocks of individual companies that do not meet certain diversity criteria as well as the principles of the United Nations Global Compact are not included.

The most important sectors (by weighting) are Technology (30.90%), Financials (16.70%), Consumer Services (15.40%), Healthcare (14.60%) and Consumer Goods (8.10%). These five sectors comprise over 85% of the fund.

The top ten holdings make up 27.5% of total net assets, which are around $1.6 billion. ESGV's top three companies are Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN).

Year-to-date (YTD), the fund is up over 7%. On Aug. 5, it hit an all-time high of $61.08.

2. iShares MSCI Global Impact ETF

- Current Price: $75.35

- 52-Week Range: $50.42 - 76.08

- Dividend Yield (TTM-Trailing Twelve Month): 1.14%

- Dividend Distribution Frequency: Semi-annually

- Expense Ratio: 0.49% per year, or $49 on a $10,000 investment

iShares MSCI Global Impact ETF (NASDAQ:SDG), which includes 120 stocks, follows the MSCI ACWI Sustainable Impact index.

This benchmark index is composed of positive impact companies that derive a majority of their revenue from products and services that address at least one of the world's major social or environmental challenges as identified by the United Nations Sustainable Development Goals, such as education or climate change.

The most important sectors (by weighting) are Consumer Staples (18.50%), Healthcare (17.75%), Industrials (17.46%), Consumer Discretionary (16.95%) and Materials (11.01%). These five sectors comprise 82% of the fund.

The top ten holdings make up 40.5% of total net assets, which are around $145 million. SDG's top three companies are Tesla (NASDAQ:TSLA), Nio (NYSE:NIO) and Vestas Wind Systems (CSE:VWS).

YTD, the fund is up over 14%. Earlier in July, it hit an all-time high of $76.08.

Bottom Line

The investing community is increasingly considering environmental, social, and corporate governance criteria to generate long-term competitive financial returns while having a positive societal impact.

We believe that socially responsible investing has strong staying power and this discourse and the number of related ETFs is likely to grow in the coming years.