- Dow Jones outperforms other US stock indices in the face of Donald Trump's election

- The index, with its strong industrial component, is loaded with stocks likely to benefit from Trump's protectionist policies

- What are the best Dow Jones stocks to keep on your radar in the coming weeks?

- Benefit from cutting-edge stock market tools and AI strategies with InvestingPro, on sale up to -55% for Black Friday!

As the dust settles following Donald Trump's election, Dow Jones Industrial Average stands out as the major US index that has made the most progress in the face of the event.

The Dow Jones rose by over 5.3% between the close of November 5 and Monday's record, while the S&P 500 gained just over 4% over the same period, and the Nasdaq by 5%.

The composition of the Dow Jones, loaded with industrial stocks likely to benefit from Donald Trump's planned policies (including universal tariffs), positioned the index ideally to outperform in the face of his election.

Against this backdrop, it seemed appropriate to take stock of Dow Jones equities, to determine which might represent the best investment opportunities over the coming months.

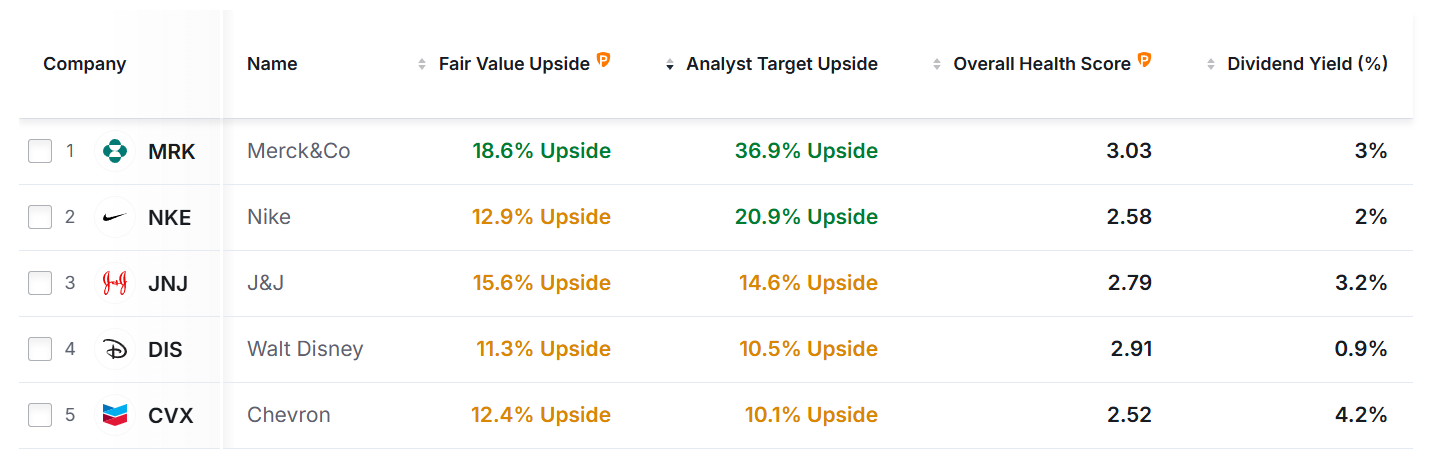

To this end, we turned to the Investing.com screener to identify Dow Jones stocks that meet the following criteria:

- Bullish potential according to analysts greater than 10%.

- InvestingPro Fair Value bullish potential greater than 10%.

- InvestingPro Financial Health Score above 2.5/5

The InvestingPro Fair Value is an intelligent synthesis of several recognized valuation models for each stock on the market. The health score, on the other hand, is based on several key metrics to assess the risk aspect of stocks.

This research enabled us to identify the following 5 stocks:

Based on the criteria taken into account, the pharmaceutical company Merck (NS:PROR) & Company Inc (NYSE:MRK) stands out, considered undervalued by analysts and Fair Value alike.

On average, analysts give the stock a 36.9% upside potential, while Fair Value values it 18.6% above the current price.

Merck also has the best financial health score of the 5 stocks on the list.

This contrasts with recent share price trends, which have seen the stock lose more than 10% over the last month, with a break below the $100 mark earlier this week, which could attract buyers.

Nevertheless, the other stocks on the list also deserve the interest of Dow Jones-focused investors over the coming weeks, and we invite investors to study these cases in greater depth.

This AI-managed strategy identifies the best Dow Jones opportunities currently

There's another way to identify the best opportunities in the Dow, with the help of Artificial Intelligence. InvestingPro's ProPicks AI Dominate the Dow strategy adopts Dow Jones stocks as its investment universe, and provides InvestingPro subscribers with a monthly list of the index's stocks to consider or avoid.

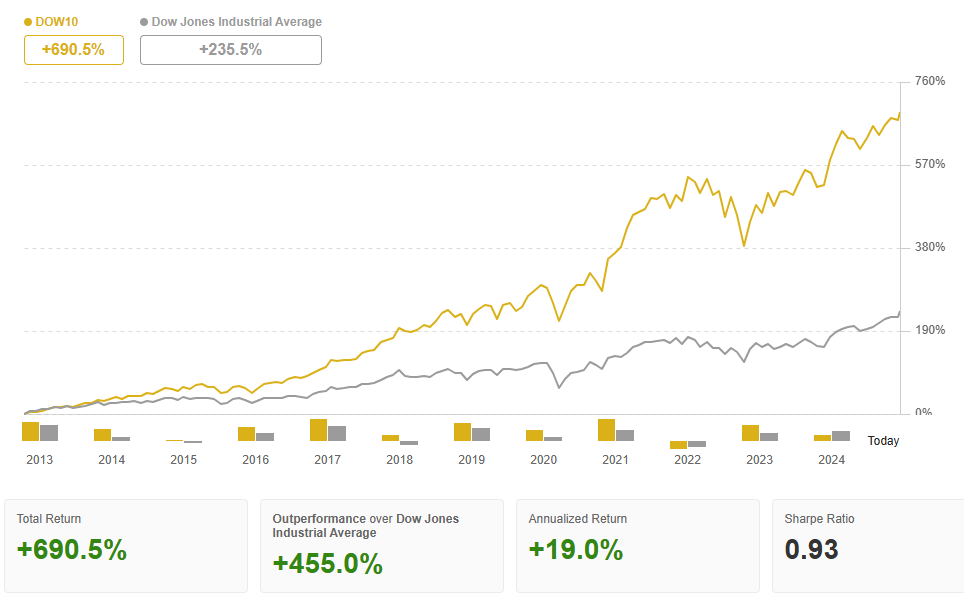

The strategy, which includes 10 stocks in its portfolio, boasts a long-term performance of 690.5%, or 455% more than the Dow Jones over the same period.

InvestingPro's ProPicks AI also includes 5 other thematic strategies, including one focused on high-potential technology stocks, and another on Warren Buffett stocks.

Now, with the current electric mood in the markets and rising volatility, there's never been a better time to start taking advantage of outperforming stock picks, thanks to AI.

The best part is that ProPicks AI strategies and all InvestingPro services are on sale for up to -55% on Black Friday... Click here to take advantage before it's too late!

***

Disclaimer: This article is for informational purposes only. It is not intended as a solicitation, offer, advice, or recommendation to purchase any asset. All investments should be evaluated from multiple perspectives, and it is important to remember that any investment decision and the associated risks are the sole responsibility of the investor. Additionally, no investment advisory services are provided.