Federal Reserve's responsibilities

The US central bank is responsible for the following four macro areas:

- Implementing the monetary policy in order to reach full employment and stable prices

- Regulating banks and financial institutions to guarantee the safety of the banking and financial system and to protect the consumers' credit rights

- Maintaining financial system stability

- Promoting a safe, efficient, and accessible payment system for U.S. dollar transactions

The current Chairman is Jerome Powell.

High inflation and monetary policy

The Federal Reserve has a target to maintain inflation at 2% over a long period.

In 2022 the main focus of the Fed was to combat the high inflation generated during the Covid-19 economic shutdown.

The US inflation has moved up from 7.5% in January to 9.1% in June and the Fed had to implement a series of interest rate hikes of which the latest four of 75 basis points each to reduce inflation.

The latest data available is that inflation in October was at 7.7% and the next data for November will be available on 13 December.

Pivot expectation this month

The next Federal Reserve meeting is on 13 and 14 December 2022.

The Fed pivot occurs when the Federal Reserve change its monetary policy and in this case from tightening to easing.

During a recent speech, Fed President Jerome Powell said that "it makes sense to slow down the increase of the interest rate as soon as the December meeting".

That comment has given the investors hope that the pivot is going to be implemented very soon and the financial market reacted accordingly in a positive way.

Pivot consequences

Historically the pivot is negative for the stock markets and for the economy in general.

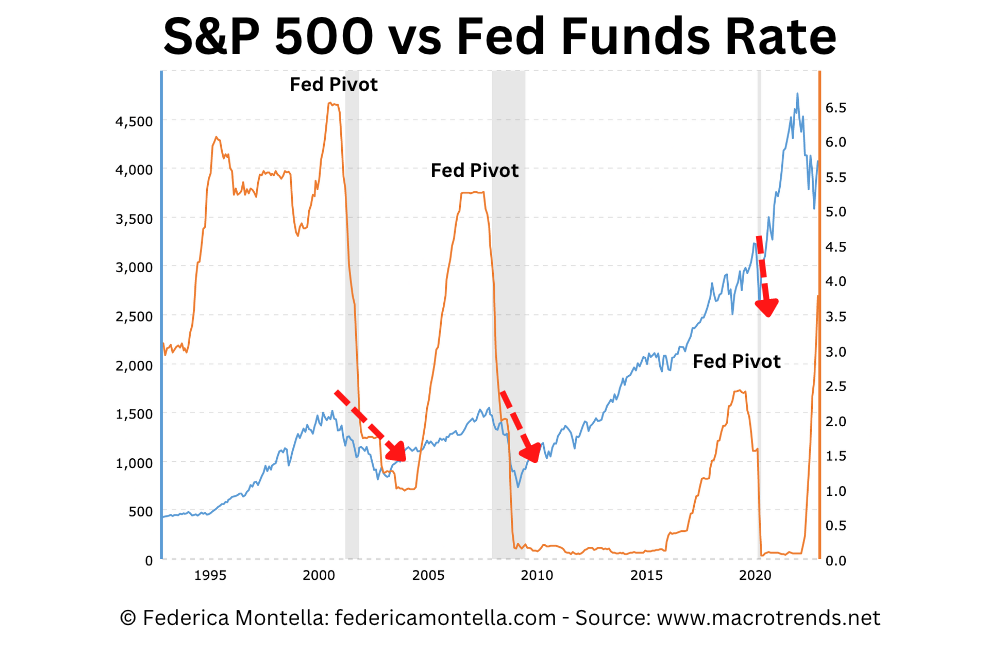

The chart below shows the S&P 500 (blue line) and the Federal Reserve interest rate (orange line).

As you can see from this chart, the stock market declined after the Fed pivot, as happened in the last major bear markets in the 2000 dot-com crash and in the financial crisis in 2008/2009.

Moreover, every Fed pivot in the past has been followed by a recession (grey areas in the chart).

Pivoting is a sign that the Fed has been able to fight inflation successfully or a signal that interest rates are too high and the economy will suffer.

Investors, in this scenario, will expect corporate earnings and stocks to fall.

So, when the Fed will announce the next pivot, stocks will not rally but they will likely drop further.