This article was written exclusively for Investing.com

Chairman Powell was again on the tape this week, speaking at an ECB Forum in Sintra, Portugal. It must be nice to have such a plump travel budget even when you’re bad at your job. In Sintra, Powell produced this frameable gem:

“We’ve lived in that world where inflation was not a problem. I think we understand better how little we understand about inflation.”

If by “we” he means “the Fed”, then he’s right. Clearly, at least the people in charge at the Federal Reserve and at other major central banks have no earthly idea how inflation works. It is somewhat surprising that he would be so candid as to admit befuddlement, since we are always hearing about how important it is that investors and consumers have confidence in the Fed and how that really is the whole game.

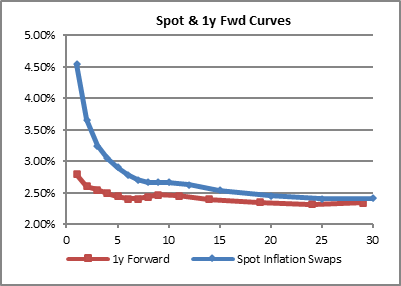

However, on that latter point, the Chairman probably feels fairly confident at the moment. The story of this past week, really, was about the utter collapse in inflation expectations despite no evidence (outside of a mild slide in gasoline prices and a weakness in some other raw commodities) of slowing price increases. Ten-year inflation swaps fell 18bps on the week. Two-year inflation swaps dropped 40bps. And, remarkably, just like that the 1-year forward inflation curve shows that investors think this will all be behind us one year from now (see chart, source Bloomberg with Enduring Investments calculations).

The 1-year inflation swap dropped from 5.15% to 4.55%. This seems cavalier when median inflation is still rising, but there’s no accounting for short-term trading in inflation. But 1-year inflation, 1-year forward is at 2.75%, and after that, the curve is flat at around 2.25%. In other words, market pricing suggests the Fed will absolutely stick the landing, despite the Chairman stating that they really have no idea how inflation works.

And hey, if those curves are a fair reading of consumer inflation expectations, and inflation itself is anchored somehow to inflation expectations, then maybe we will get lucky and this plane will swoop gently to the runway despite the fact that the pilots are telling us they don’t know what they’re doing.

That’s charitable.

A different interpretation might be drawn. There are two reasons that a tug-of-war rope isn’t moving at any given point in time. One reason is that everyone agrees that the tug-of-war is pointless, so no one is pulling on it. The other possibility is that there are very strong forces on both sides, but they offset. Perhaps—and I have no way of evaluating if this is the true state of affairs—we just have two diametrically opposed camps and they are suddenly in balance.

On one side are the people (like myself) who think that the inflation rate will likely decline over the balance of this year and into 2023, but not get anywhere near the Fed’s target. On the other side are people who recognize that we are either in a recession right now, or will be in a recession sometime in the next year, and think that means inflation will rapidly drop back to normal or even threaten us with deflation.

The “recession” people have been getting plenty of data lately supporting their thesis with respect to growth, even if they haven’t been getting any data supporting the idea that prices will decelerate (or even decline). Home sales have abruptly weakened, manufacturing surveys and consumer confidence have been weakening at a sickening pace, and the Atlanta Fed GDP Nowcast on Friday fell to an estimate of -2.1% for the quarter we just finished.

Now, I’m in the camp that expects inflation to stay sticky and uncomfortable, but I have also been very clear that a recession is virtually guaranteed when you get rapidly increasing energy prices alongside rising interest rates.

How can I hold both views?

Well, because growth and inflation aren’t linked at the hip, and people who do understand a lot about inflation know that.

I know that people think that excess growth causes inflation. I know the models we were all taught in college and graduate school assume that is true. But here is the evidence. Quarterly observations from 1970, using the most-flattering lag of growth (real GDP) onto core inflation (Core CPI). The R-squared is 0.075. If you only look at 1970-1992, the R-squared shoots up to a nosebleed 0.121. Note that there are plenty of periods where growth was, say, 0.5% annualized or below, but core inflation was at or above 4%. In fact, the average core inflation for all such quarters of slow or negative growth was 3.5%. Hmmmm.

Taking a Step Back…

Let’s play a game called “What to do if you know that you don’t know how it works”.

Suppose you confront a big, complex machine. However, there are only two or three controls on it, and the one thing you know for sure is “we don’t know how this works”. The machine is running very fast, and it seems like it is overheating and you need to stop it. What’s your play?

If you really don’t know how it works, then doing something is as likely to worsen the situation as to make it better. But if you do nothing, then the machine will overheat!

What you really should do, probably, is ask someone who knows what they’re doing. But if such a person isn’t available, another reasonable approach would be to try something small, evaluate the effect, then do either more of that thing or less of that thing. If there is a dial, turn it a wee bit to the right, and then based on what happens, either turn it more to the right or reverse it to the left. What you would probably not want to do is rip the dial violently to one side, and to keep spinning it before you know what happens.

That’s what the Fed is doing, effectively. I noted recently that monetary policy currently is experimental because never before has the central bank attempted to restrain meaningful inflation with interest rates alone. It seems crazy to me that policymakers have chosen to drive with aggressive speed down an unknown road. I suppose what I am saying is that I don’t think the Fed really thinks that they don’t know. They may be saying “we don’t understand inflation” so that their past errors (“transitory”, e.g.) don’t seem as egregious – but they are behaving as if they are very confident in what they are doing.

If that’s the case, then what message do they draw from the last couple of weeks? Growth-related asset markets have dropped (8.5% stocks, 10.4% commodities), economic growth itself seems to be weakening, and inflation expectations (at least, market-based measures thereof) strongly signal that inflation is under control. Central bankers may conclude that these are signs that the inflation fight is nearer to being finished than they thought, and that they can therefore slow down and tighten more slowly. The interesting thing is that this is also the correct approach if policymakers recognize that they don’t really understand the machine, and so waiting to see what happens as the result from prior actions has some inherent value.

Either way, they are almost certainly wrong—the inflation fight is not close to being finished. But if they are going to be wrong anyway, it probably would be better if they were wrong slowly.