- Walgreens' declining profits are fueling bearish sentiment.

- Can the new CEO orchestrate a turnaround?

- Meanwhile, the stock's downward trajectory persists.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Walgreens Boots Alliance (NASDAQ:WBA), a major U.S. pharmacy and drugstore chain, has seen its stock steadily decline over the long term. By the end of last year, it hit its lowest level since 1998.

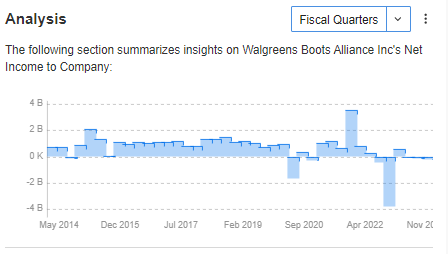

Recent quarters have only exacerbated this situation, with net income showing negative growth and declining figures. As a result, the company announced a reduction in its quarterly dividend from $0.48 to $0.25 per share.

There's a glimmer of hope, though, with the appointment of new CEO Tim Wentworth, a seasoned leader in the healthcare industry.

Investors are eagerly awaiting tomorrow's quarterly results, which, if they align with forecasts, will likely confirm the ongoing downward trend in earnings per share.

Source: InvestingPro

Why Is WBA Stock Falling?

Walgreens requires more cash immediately to support its growth in the healthcare sector. To raise funds, the company has reduced its dividend and sold shares in Cencora for nearly $1 billion.

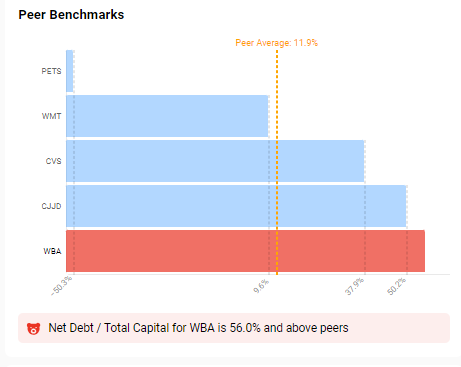

It also intends to sell off Shields Health Solutions and Boots UK, aiming to raise around $12 billion. However, the company's financial condition appears weak due to its high debt burden, currently at a net debt/total capital ratio of 56%.

Source: InvestingPro

What to Expect From Q2 Earnings?

Tomorrow, Walgreens will release its quarterly results for the 2nd quarter of fiscal 2024. The outcome hinges significantly on the strategy implemented by the new CEO, Tim Wentworth.

It appears that the main focus will be on bolstering the company's cash reserves. However, the key to reversing the stock's downward trend will be a return to reporting net profits.

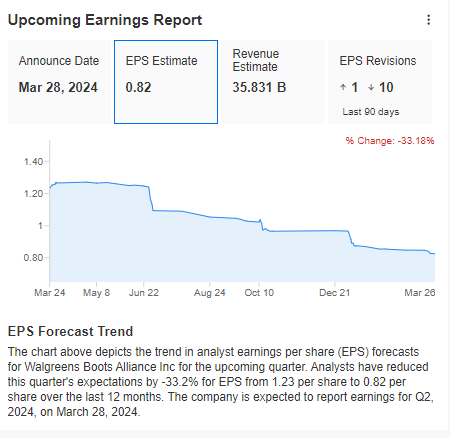

Analysts expect a decrease in earnings per share growth from $1.16 to $0.85 per share compared to the previous quarter.

Source: InvestingPro

The number of downward revisions stands at 10, while only one upward revision has been observed. The technical analysis suggests a potential attempt to challenge last year's lows of around $20 per share.

If the results disappoint, it could lead to further declines. Conversely, if the results exceed expectations, there's a possibility of forming a double-bottom pattern.

Walgreens Stock: Technical View

The Walgreens stock price has been forming a wedge pattern for over two months. This pattern suggests a continuation of the downtrend. It's likely reaching its final stages, especially with the upcoming quarterly results and a test of long-term lows around $20 per share.

The best scenario for movement would be defending the minimum while breaking out from the wedge formation's top. In this case, buyers would target the local high near $24 per share.

However, solid quarterly revenue and earnings per share data are needed for this upward movement. Key developments are expected tomorrow.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

For readers of this article, now with the code: INWESTUJPRO1 as much as 10% discount on annual and two-year InvestingPro subscriptions.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.