By Jesse Cohen

As Q3 2015 earnings season winds down, and with investor awareness mostly focused elsewhere for the duration--on global growth concerns and prospects of a Fed rate hike—this third-quarter earnings season appears to have slipped somewhat under the radar.

But for those paying attention, there were some notable surprises and disappointments, and perhaps a few growing signs of specific industry—and economic—paradigm shifts.

So who were the biggest winners and losers of the season? And what were some of the key themes that influenced corporate balance sheets?

Bleak Overall Picture

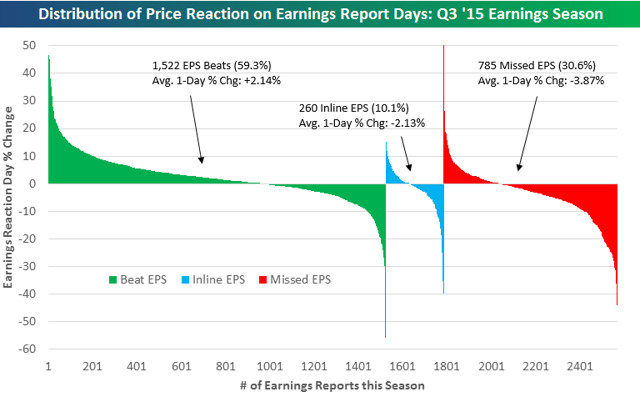

In total, 1,522 of the companies on Wall Street beat earnings expectations in the third-quarter, a 59.3% beat rate.That sounds pretty impressive, till you consider this additional fact: 785 stocks missed estimates this season, a 30.6% miss rate. Plus, 260 companies reported earnings that simply met expectations.

In comparison, during the same period last year, a whopping 74% of Wall Street companies were able to surpass estimates.

Source: Bespoke Investment Group

All told, that makes this third-quarter earnings season the worst since 2009.

According to Leigh Drogan of Estimize, a financial estimates platform that aggregates the fundamental performance estimates of independent buy- and sell-side analysts, at the start of this earnings season, the Estimize community expected “earnings per share (EPS) to decrease 2.2% for the quarter and revenues to decline 1.7%.”

With the bulk of results now announced, year-over-year, growth in earnings per share of S&P 500 companies was about minus 2.5%, with revenue down 3.1%, the second straight quarter of negative earnings growth, which is otherwise known as an "earnings recession".

Providing another cause for concern, the number of companies which downgraded their future earnings outlook during the third quarter rose by a hefty 30% compared to the same period a year earlier, meaning that corporate earnings next year will be even less impressive.

On the flip side, only 6% of Wall Street companies guided higher, compared to the year-ago period.

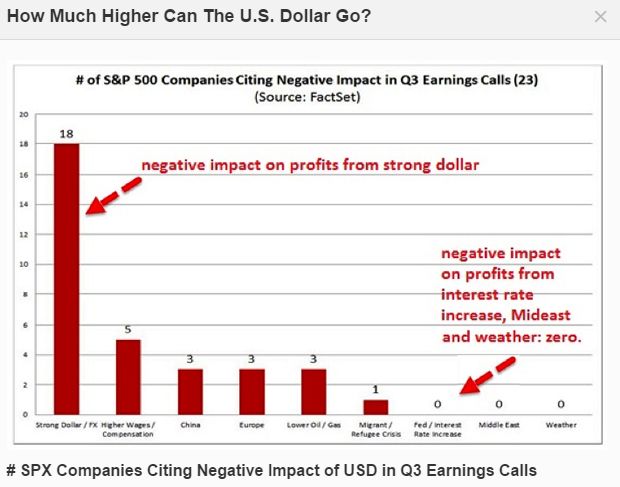

The bleak performance came as U.S. corporations faced significant headwinds from a stronger dollar, slumping oil prices and uncertainty surrounding the global growth outlook, especially in China and Europe.

Biggest Disappointments: Energy, Basic Materials

The bulk of the earnings declines came from the energy and basic materials sectors as oil and metal prices tumbled to multi-year lows. The biggest losers in the energy space were Chevron (N:CVX), Chesapeake Energy (N:CHK), NRG Energy (N:NRG), Consol Energy (N:CNX), while Freeport-McMoran (N:FCX) and Joy Global (N:JOY) were basic materials laggards.

In terms of downside surprises, quarterly results from NRG and Consol fell significantly short of analyst expectations, due mostly to the depressed commodity price environment, while Freeport slumped on the back of depressed copper and silver prices, which have lost 29% and 17% respectively on the year.

Energy and materials may be a better story next quarter since expectations are now so low, but weak commodity prices will continue to weigh on shares in these sectors.

Retail Sector Paradigm Shift

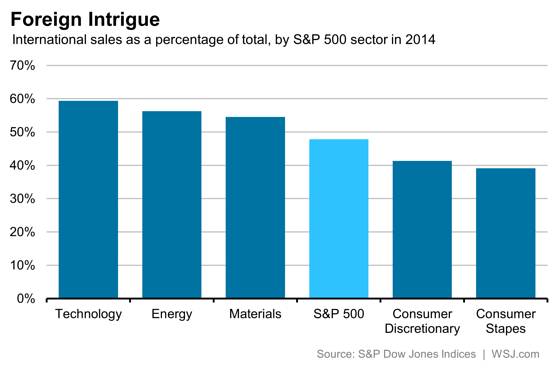

The retail sector saw some pretty dismal earning reports as well, alongside a brewing shift away from brick-and-mortar retailers in favor of the growing e-commerce juggernaut. Mall-based retailers experienced a slowdown in sales, especially now that the strong dollar limits the spending power of international customers.

Macy's (N:M), Nordstrom (N:JWN), Gap (N:GPS) and Urban Outfitters (O:URBN) were some of the big-name disappointments this quarter. Walmart (N:WMT), which has struggled mightily this year due to increasing competition from Amazon(O:AMZN), surprised with an earnings beat.

However, this was after Wall Street lowered expectations for the retailer's results. Indeed, the company’s most recent guidance calls for no sales growth and profit-per-store falling by 12% next year due to increased costs.

One of the more prevalent themes of the Q3 earnings season was the diverging performance between the brick-and-mortar retailers and the online retailers, such as Amazon and Alibaba (N:BABA), which both reported robust earnings growth.

The trend is likely to continue into the all-important Q4 holiday shopping season, as online shoppers outnumbered brick-and-mortar counterparts over the Black Friday weekend. According to the National Retail Federation, more than 103 million people shopped online over the four-day weekend, compared with fewer than 102 million who ventured into traditional stores.

Adding to the potential for additional brick-and-mortar pain, high inventory levels and excessive markdowns are expected to keep the pressure on traditional retailers' fourth-quarter gross margins.

Technology Triumphs

Elsewhere, many big-name technology companies reported stellar quarterly numbers for the June-September period. Apple (O:AAPL), Google parent Alphabet (O:GOOGL), Microsoft (O:MSFT) and Facebook (O:FB) are just a few to report blowout results.

Apple's results were boosted by soaring demand for its iPhone in China, Alphabet shares hit an all-time high thanks to strong growth in its mobile search business, Microsoft climbed due to upbeat results at its cloud-based business, while Facebook rallied on the back of robust video ad revenue.

This follows the already year-long uptrend in the tech sector, specifically among the FANG stocks, (Facebook-Amazon-Netflix-Google). Apple, a double-entry within this acronym, is often swapped out with Amazon in the "A" portion of the phrase.

Perhaps one of the biggest surprises in the tech space was eBay (O:EBAY), which saw shares jump the most in 10 years, after reporting third quarter profit and sales that topped expectations. The online shopping marketplace, which recently spun off its PayPal (O:PYPL) division, also raised its full-year outlook and bought back $599 million of its own stock.

Q4 Outlook: Headwinds But Nothing Alarming

Looking forward, the outlook for the fourth-quarter earnings season is rather bleak. Market analysts expect another quarter of negative earnings growth, which would be the third in a row.

Still, says Brian Gilmartin, all is not as dismal as it may seem: “Investors should expect 5%-7% core earnings growth ex-Energy and ex-Apple in Q4 ’15. Financials will likely have a decent quarter, with Thomson Reuters expecting 12% growth and Factset expecting 10% growth."

Corporate results will continue to face headwinds from a stronger U.S. dollar. The currency could strengthen even further in the year ahead if the Fed does indeed raise interest rates in mid-December as expected. Goldman Sachs predicts the dollar and euro will soon hit parity, falling from $1.09 today.

In addition, feeble global growth prospects will further weigh on earnings, especially for multinational corporations which do the bulk of their business abroad. Companies with less exposure to foreign sales will continue to do better through year-end and into 2016.

Q4 And Beyond: Potential Winners and Losers

For the fourth quarter of 2015, I expect earnings of consumer discretionary stocks and consumer staples, such as Amazon, Home Depot (N:HD), Nike (N:NKE) and Starbucks (O:SBUX), to outperform, while industrials which are sensitive to the global growth outlook, like Caterpillar (N:CAT) and Deere (N:DE) will underperform.

Looking further ahead into 2016, current projections point to yet another quarter of negative earnings growth, before stabilizing and turning higher in Q2 of next year.

U.S. Indices: SPX - Exhausted Bull; NDX - Relentless Uptrend

A technical examination of the S&P 500 vs. the NASDAQ 100 charts suggests that the technology sector may outperform in Q4 in comparison to the rest of the market.

On the S&P 500 Index monthly chart, above, a doji candle has formed just below a fresh supply zone, and the big drop we witnessed this past August indicates that there are still many sellers around the 2100 level.

At the time we went to press, it seems that the yearly candle for 2015 will look like a doji cross, purple in the chart below:

This candle formation—after a long uptrend—could signal the end of the seven good years the market has experienced since the 2008 crisis.

If Q4 reports disappoint as many analysts expect, or merely signal that the moment has come to pull out and wait for better times, we may see the S&P index testing the demand zone again (after having tested it earlier this year, in August and September). A break below 1820 (the base of the weekly demand zone) will open the way for further losses—with the first target around 1560, where a resistance area has turned to support.

If Q4 reports surprise to the upside, and offer hope for better results in 2016, and if the interest rate is kept low enough, the S&P 500 Index may breach the aforementioned supply zone around 2135, which then (again) opens the way for new, never-before-explored, highs.

However, the current sideways movement, which has been a hallmark of market activity during the fall, alongside lower volume and a 7-year-long uptrend, all increase the chances of a coming corrective move.

The story is a bit different for the NASDAQ 100. The index has consumed the seller's area between 4700 and 4200, and it relentlessly continues its uptrend around the highs of March 2000 (4780-4800), above. At the moment it’s strongly possible that it will close above these highs, but unless a firm demand zone is formed, new highs could be a mere 'false break'.

Around these historical levels, investors are advised to keep an eye on the weekly and monthly charts for warning signs in the form of reversal candles and patterns.

At the moment, it looks like the yearly candle is about to close as a bullish hammer (unless price drops through month-end), which by itself inside an uptrend means nothing but continuation.

The decreasing volume could signal some weakness, but it hasn't stopped the NASDAQ 100 from going all the way back up. Therefore, we still expect the technology sector to show strong reports for Q4 and perhaps even into Q1 '16.