Siemens AG (ETR:SIEGn) is one of the largest and most well-known German companies worldwide. The DAX-listed group operates 125 locations in Germany and is active in various sectors, including rail vehicles, engines, medical technology, energy and defence equipment.

Historical development

Siemens was founded in 1847 by Werner Siemens after he developed a pointer telegraph for the Prussian Telegraph Commission. In the following decades, the company grew into one of the first multinational corporations in Europe and expanded its activities globally.

Challenges and scandals in the 21st century

In 2006, Siemens was embroiled in one of the biggest corruption scandals in German economic history. Systematic bribery payments were uncovered, leading to the resignation of CEO Klaus Kleinfeld and Supervisory Board Chairman Heinrich von Pierer. As a result of the incidents, Siemens was fined heavily. As early as 2007, the group began restructuring its operations in the industrial, energy and medical sectors.

Strategic realignment

As part of the restructuring, Siemens divested itself of some business areas, including mobile communications technology and nuclear power, and focused on new fields such as wind power. In 2017, Siemens announced that it would establish a joint venture with French competitor Alstom (EPA:ALSO) in the rail transport sector. At the same time, CEO Joe Kaeser made negative headlines when he announced 7,000 job cuts, 3,400 of which were in Germany. However, the company plans to create new jobs in future-oriented areas.

Realignment in the field of eMobility

Siemens is currently planning further restructuring. The eMobility division, which deals with charging solutions for electric vehicles and employs around 1,300 people worldwide, is to be given its own legal structure. This should enable the division to be more flexible and pave the way for new partnerships, as Siemens CEO Matthias Rebellius emphasised.

It was not revealed whether Siemens is planning to divest itself of eMobility in the long term or to take the division public. This year, Siemens has already acquired the Dutch charging solution expert Heliox, thereby expanding its presence in Germany, Portugal, the USA, India and the Netherlands. This argues against a sale of the eMobility division.

A poor advisor: average opinion

Those who give in to the general negative sentiment now will miss out on extreme opportunities that arise whenever sentiment couldn't be any worse. Stock markets are faster than the average opinion due to their efficiency. The latter is sluggish and always lags behind the market.

We do not want to ignore the problems in German industry. They are there, but they can all be solved, including those in the automotive industry. We have already pointed out the opportunities that lie ahead in the automotive industry. And Siemens is now showing it with a phenomenal increase in its share price in recent weeks.

We are already invested and have recently purchased additional Siemens shares because we believe that Siemens stock will move very far upward in the coming years. Incidentally, this also applies to numerous European and US stocks. We are currently buying a lot and following up. There are so many opportunities now that no one should miss.

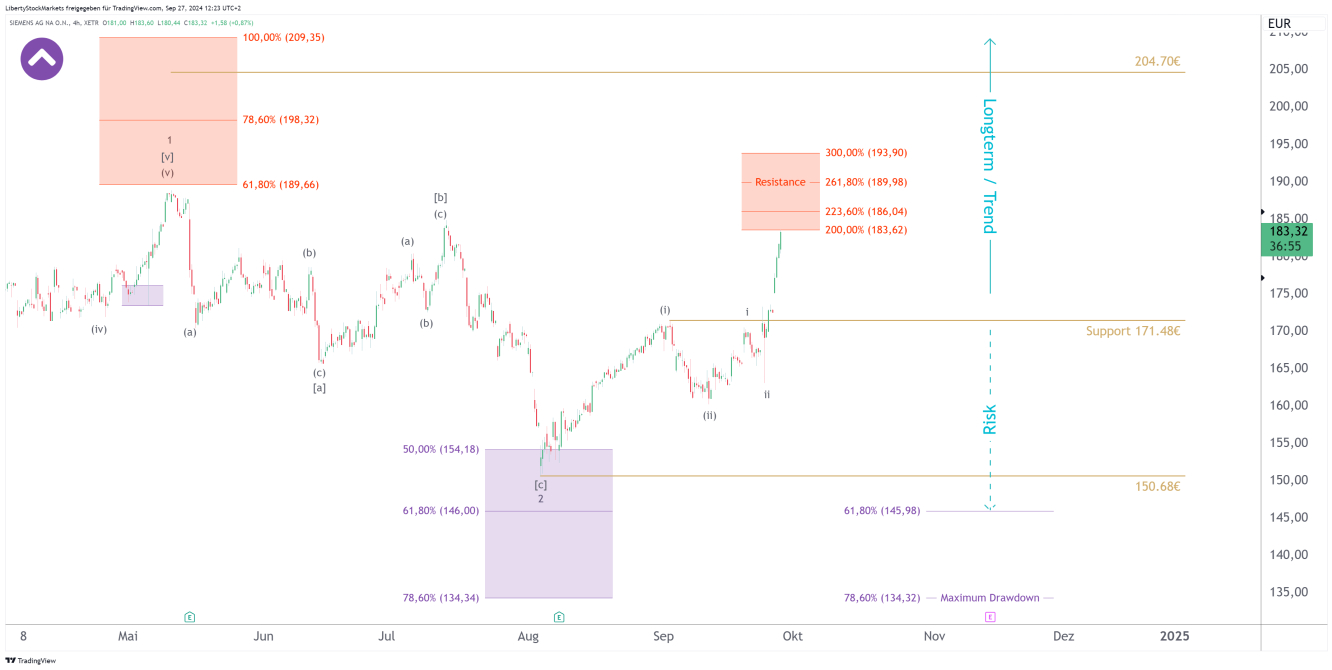

Siemens has seen an extremely strong upward trend. In the area of the red box between €183.62 and €193.90, resistance lurks that the stock must overcome. We see the maximum downside risk as being the zone between €145.98 and €134.32. Support is at €171.48. If this holds, further increases can be expected. In the long term, in both cases, the share price is expected to rise well above €204.70.

You can find a detailed analysis of the Siemens share on our website. There, we analyse the stock and show exactly where good buying opportunities arise. In addition to accurate analyses, each of our customers also receives trading signals when action is needed.

Get up to 20% off all our subscriptions now. Voucher code: LIBERTY (link to the website is next to my profile picture above).

Siemens has it all: a solid balance sheet, good management, excellent products, a forward-looking approach to trading and an internationally absolutely competitive position, in many areas even market leadership.

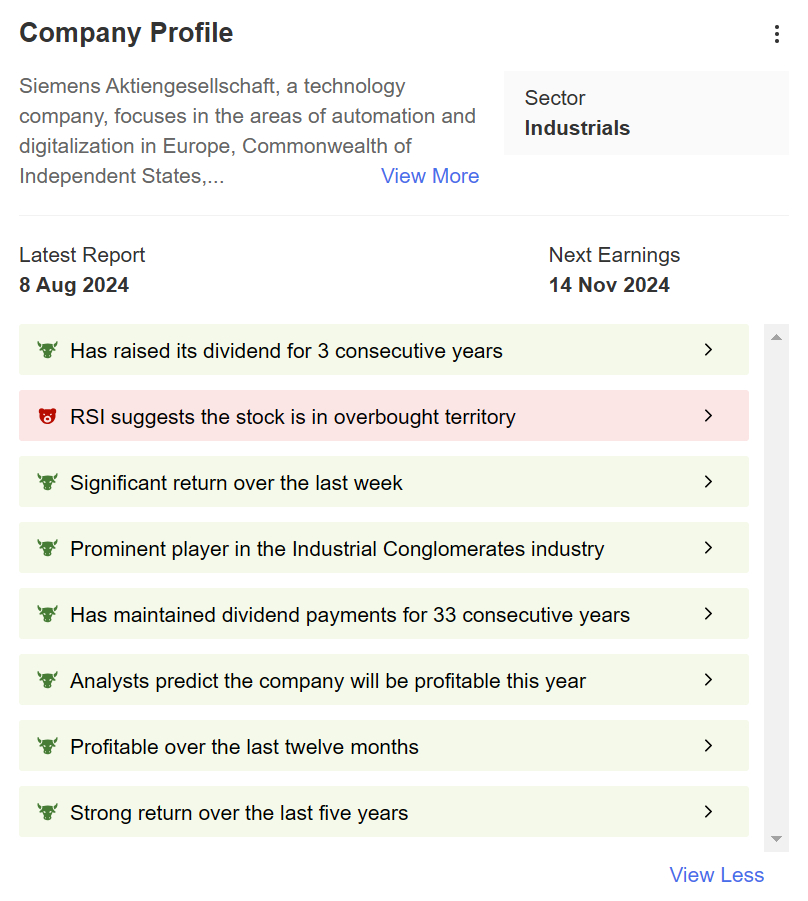

In the short overview, we also mostly see green values:

Now it is very important to make the right decisions at the right time. We are in a bull market. Perhaps even the strongest and longest we have ever had.

Unlock all analyses including trading signals on our website (link is at the top next to my profile picture). Get up to 20% off with the code LIBERTY from now on.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Top cop with strong performance. Big opportunity.

Published 27/09/2024, 11:58

Top cop with strong performance. Big opportunity.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.