- Saudi Aramco concluded 2023 with a staggering profit of $121.3 billion.

- Despite a slight downturn from its 2022 peak, Saudi Aramco remains a profit leader for the second consecutive year, navigating oil price fluctuations with resilience.

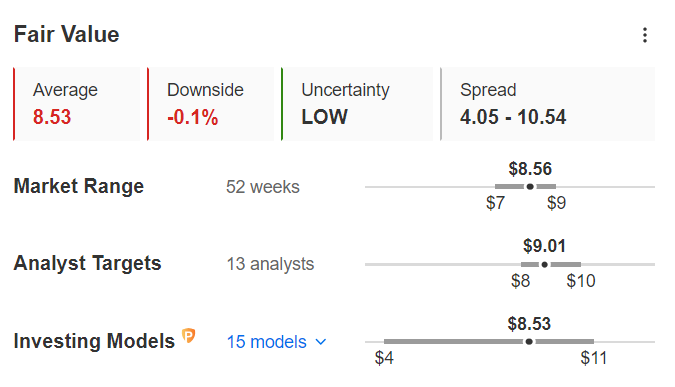

- As market attention shifts to Saudi Aramco's stock performance, analysts foresee potential growth, with InvestingPro's Fair Value assessment suggesting an optimistic outlook.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Saudi Aramco (TADAWUL:2222) closed out 2023 with an impressive profit of $121.3 billion, securing the top spot globally for profits among publicly listed companies.

To put this achievement into perspective, consider the combined profits of four major players on Wall Street's Magnificent 7: Meta (NASDAQ:META) ($39 billion), Amazon.com (NASDAQ:AMZN) ($30 billion), NVIDIA Corporation (NASDAQ:NVDA) ($30 billion), and Tesla (NASDAQ:TSLA) ($15 billion), totaling $114 billion.

This falls short by $7 billion compared to Saudi Aramco's earnings alone. Even Apple (NASDAQ:AAPL) and Warren Buffet's Berkshire Hathaway B (NYSE:BRKb), with profits of $97 billion in 2023, and Microsoft (NASDAQ:MSFT) with $72 billion, pale in comparison.

Saudi Aramco Share Price

The phenomenal profits actually marked a decline for Saudi Aramco compared to its record-breaking profit of nearly $161 billion in 2022. This can be attributed to the downward trend in oil prices, prompting efforts by OPEC+ to bolster prices through production cuts led by Saudi Arabia.

Despite sector volatility, the Saudi behemoth has cemented its status as the profit leader for two consecutive years. Looking ahead, the market's focus has shifted to the company's stock value.

Microsoft, Apple, and Nvidia lead in terms of market capitalization. Saudi Aramco follows closely as the fourth and final company with a market cap exceeding $2 trillion.

Currently trading at $8.55, Saudi Aramco's shares have appreciated over 20% since its listing in late 2019.

Based on InvestingPro's Fair Value assessment, which aggregates 15 financial models tailored to Saudi Aramco's specifics, the stock is deemed fairly valued, with a target price set at $8.53.

By the way, don't miss out on a special discount at InvestingPro+ - details are available at the end of this article.

Source: InvestingPro

The 13 analysts surveyed by InvestingPro, on the other hand, are more optimistic and predict a possible upward trend, estimating the target price at $9.01 per share, about 6% higher than the current value.

Risk Profile and Dividend Policy

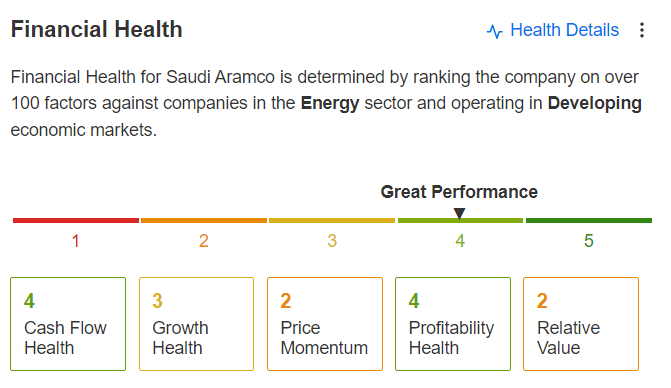

Looking next at the risk profile, Saudi Aramco has very strong financial health, with a score of 4 out of 5.

Source: InvestingPro

Saudi Aramco, despite facing lower profits this year, still opted to reward its shareholders by increasing total dividends for 2023 to $97.8 billion, marking a 30 percent increase.

Outlook: Aramco Looks to Expand Gas Production

Looking ahead, Amin H. Nasser, chairman and CEO of Saudi Aramco, is confident about the future. He emphasized the enduring importance of petroleum and gas in the global energy mix for decades to come.

While crude oil contributed 62% of revenues last year, there's an expectation for a shift in the balance in the future. Although the directive to maintain maximum sustainable capacity at 12 million barrels per day will limit oil investment, the company is focusing on expanding its gas operations.

The aim is to boost gas production by over 60% by 2030, compared to 2021 levels. This aligns with Saudi Aramco's strategic move announced last September to acquire a minority stake in U.S.-based MidOcean Energy for $500 million, further emphasizing its commitment to gas expansion.

***

Take advantage of a special discount to subscribe to InvestingPro+ and take advantage of all our tools to optimize your investment strategy.

(The link calculates and directly applies the discount of an additional 10%. In case the page does not load, you enter the code proit2024 to activate the offer).

As readers of our articles, you can take advantage of our stock strategy and fundamental analysis platform InvestingPro at a reduced price, with a discount on the annual plan.

Subscribe to InvestingPro now to optimize your investment strategy and benefit from a special discount!

Click on the link, and the page will automatically calculate and apply the additional discount.

If the page doesn't load, enter the code PRO124 to activate the offer.

Don't miss out on this opportunity!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.