Markets were up on the broader index but mixed overall, with 319 names lower in the S&P 500 and 180 higher. The day was uneventful from an equity market standpoint, but we saw big moves in FX, with the EUR/USD standing out.

The French called for a no-confidence vote for their newly appointed Prime Minister, Michel Barnier, and this sent the EUR/USD down by around 80 bps on the day.

The EUR/USD doesn’t look great at this point and probably could fall further. Indeed, when looking at the technicals, a drop below 1.04 and potentially below 1.03 looks possible. Momentum is bearish and not showing much in the way of a clear bottom yet.

French 5-year credit default swaps have traded to their highest level since 2020.

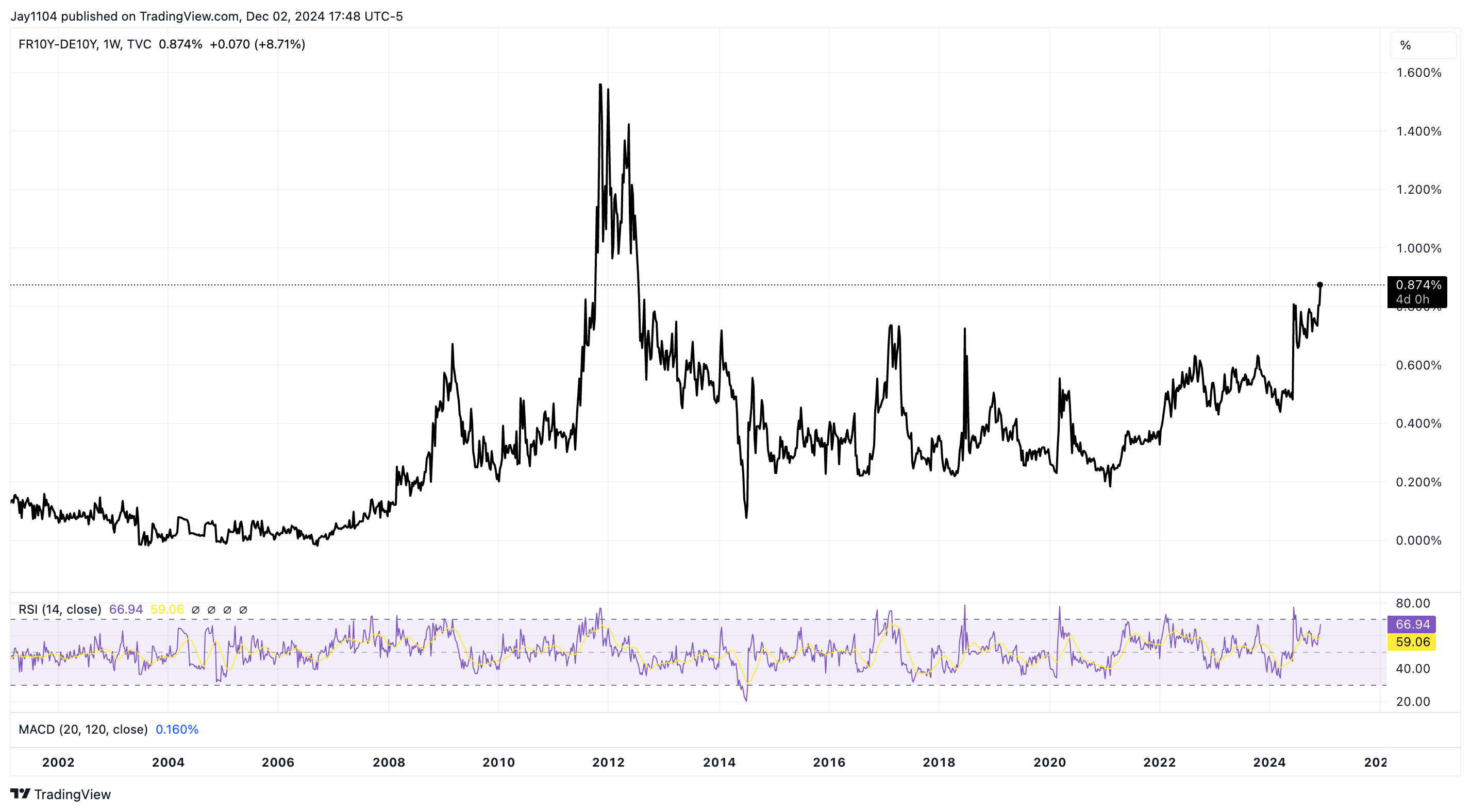

Meanwhile, the French/German 10-year spread rose to its highest since 2012. So, as long as the French budget issues persist, the euro risks further struggles.

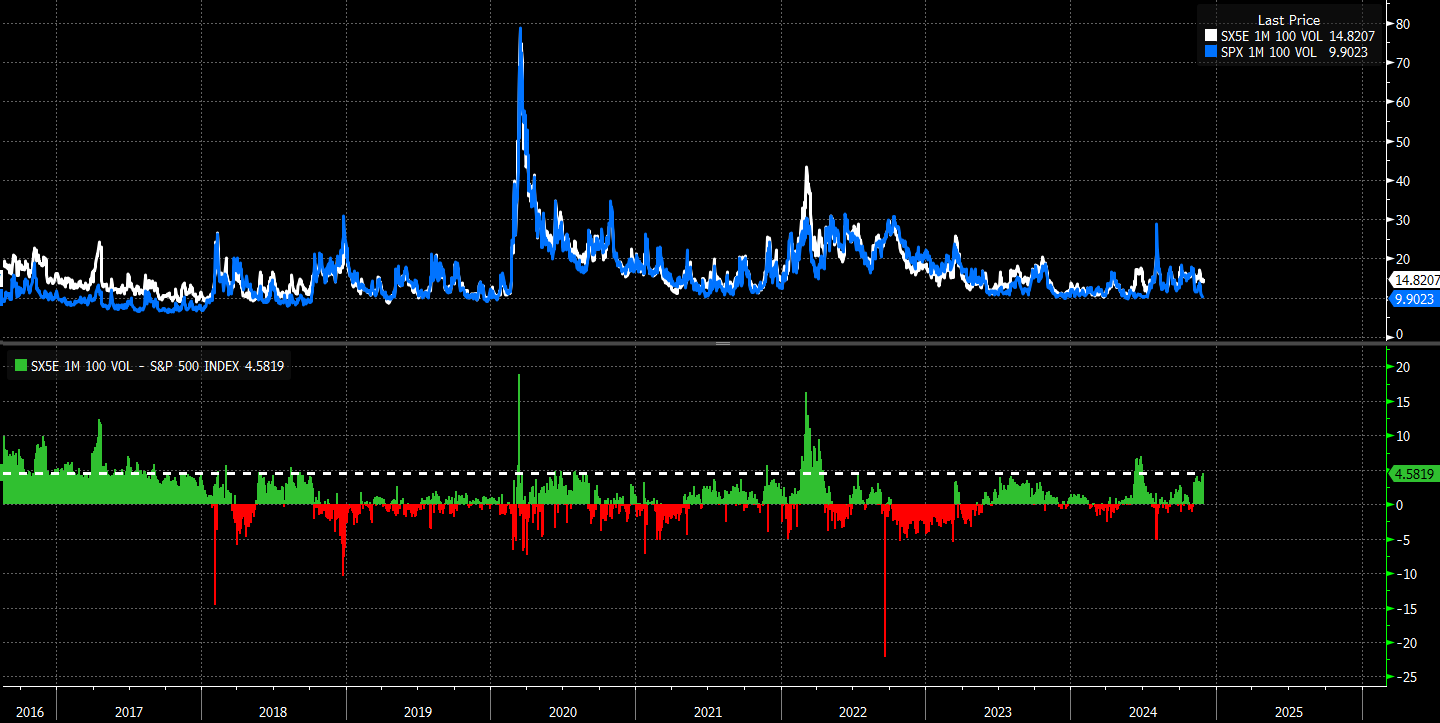

Additionally, yesterday, we saw the S&P 500 ATM 1-month IV and Stoxx 50 ATM 1-month IV spread widen out to 4.5 vols, which is a pretty decent-sized spread.

More recently, it has only been higher once, and that was when the whole French parliamentary issue started back in late May and June.

Whether these issues spill over into US markets remains to be seen. I guess it will come down to how long and how severe the problems become.

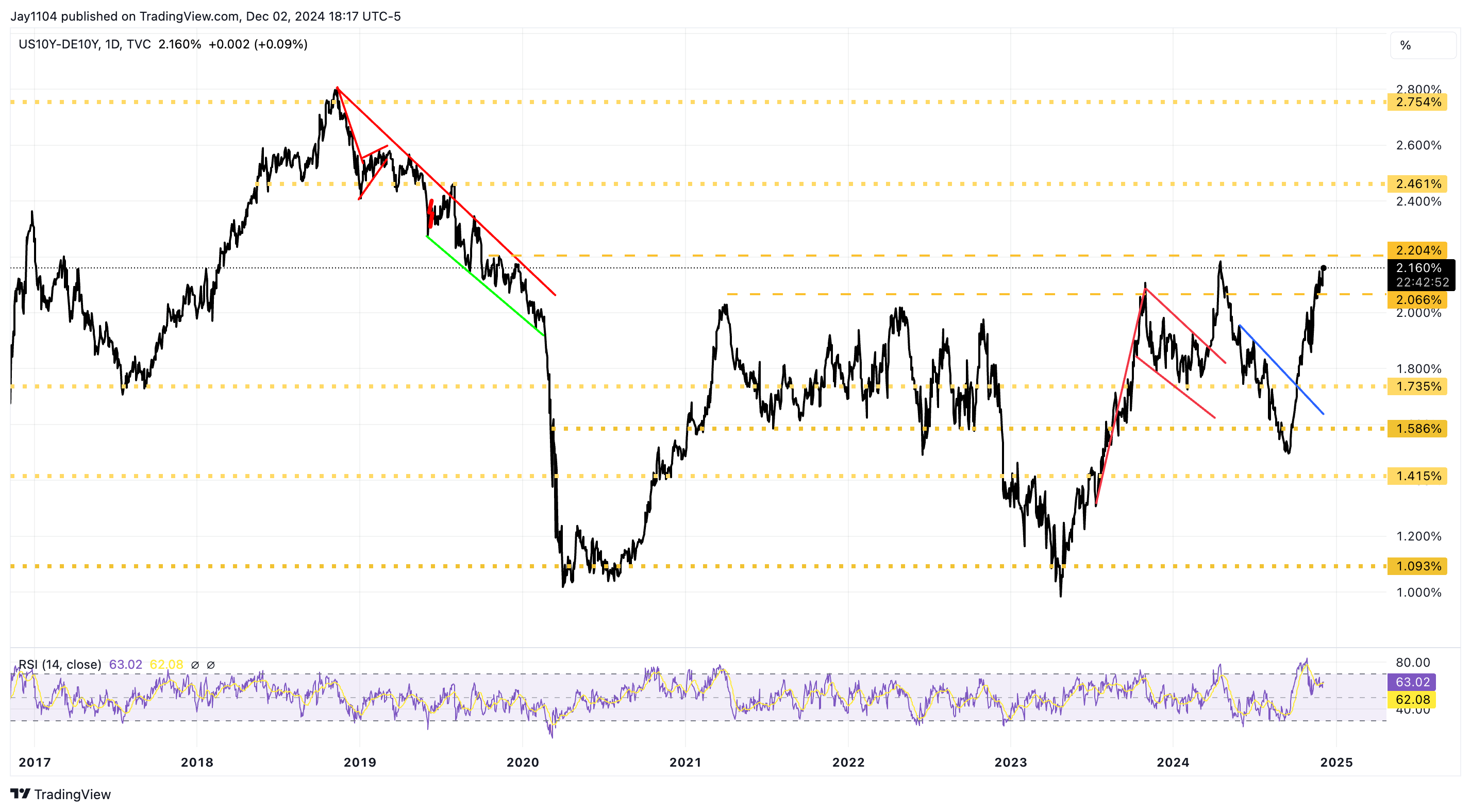

The US 10-year and German 10-year spreads are at an important spot, at 2.16%. If the spread rises above 2.2%, it could lead to a pretty sharp breakdown in the euro.

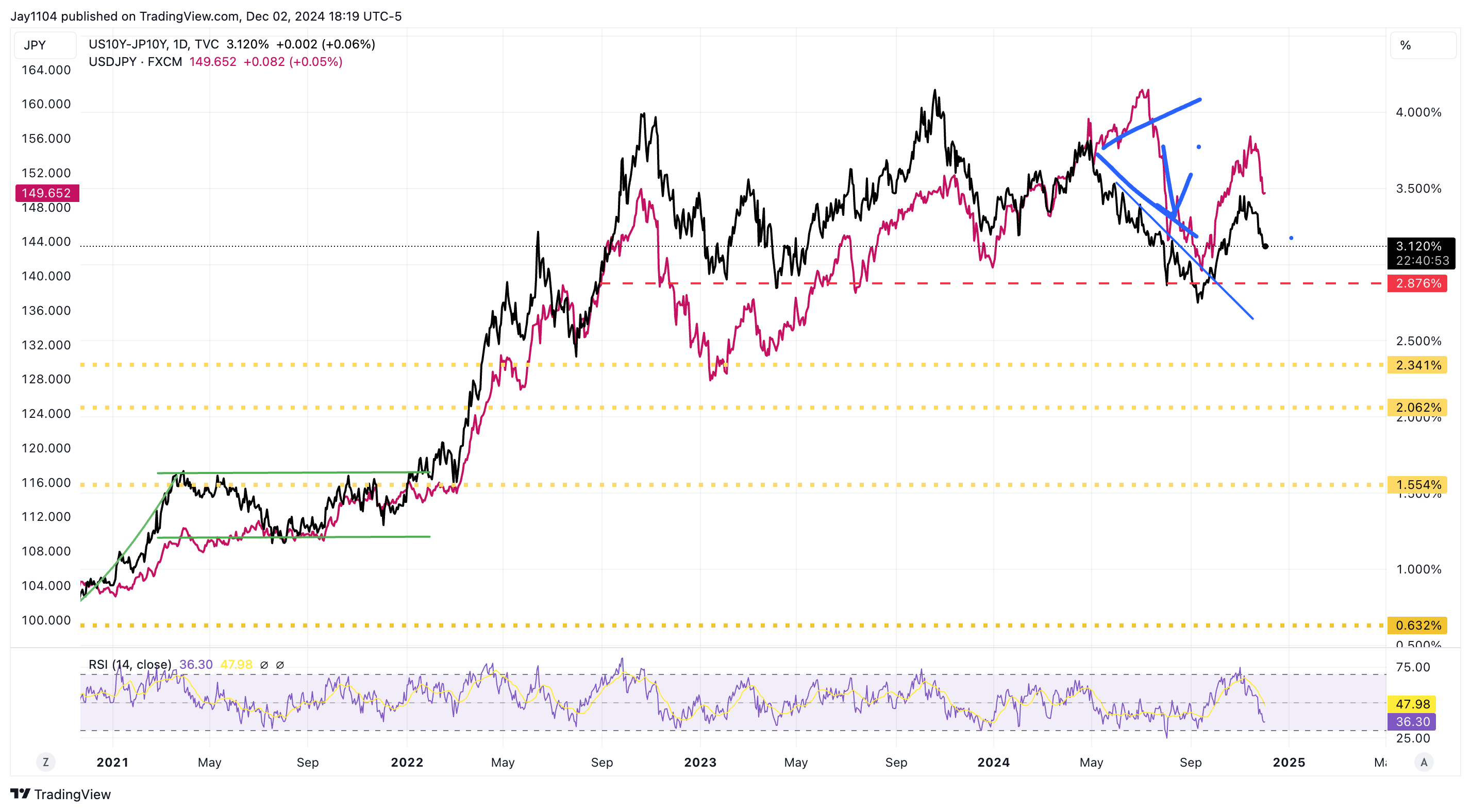

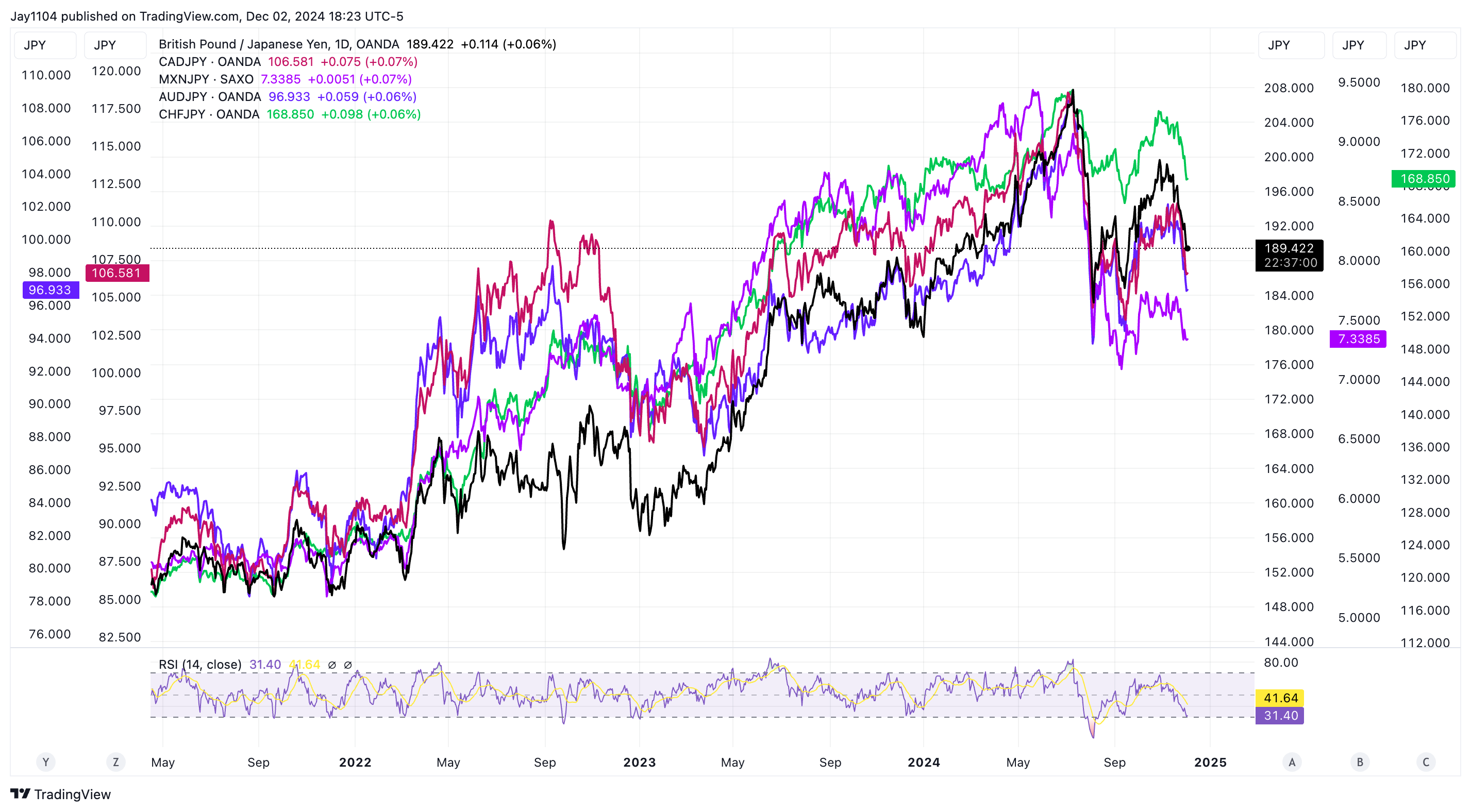

The opposite happens in Japan, with 10-year spreads and US rates contracting. If the spread continues to contract, it will lead to a stronger USD/JPY, meaning the USD/JPY falls from its current level.

Of course, you could imagine what that means if the US dollar strengthens across just about every G10 currency except for the yen, and it isn’t pretty. The EUR/JPY is not far off its August lows.

It is the same look for the AUD/JPY, MXN/JPY, CAD/JPY, GBP/JPY, and CHF/JPY.

I guess the bigger question is when the US stock market will care.

I guess we will find out soon enough.