- Fear and panic can lead to missed investment opportunities, even in the strongest bull markets.

- Post-bear-market negativity is a common pitfall for investors, but focusing on practical strategies like diversification and asset allocation is essential.

- Don't rely solely on expert advice or economic predictions - focus on reality and your own investment goals to avoid unnecessary risk.

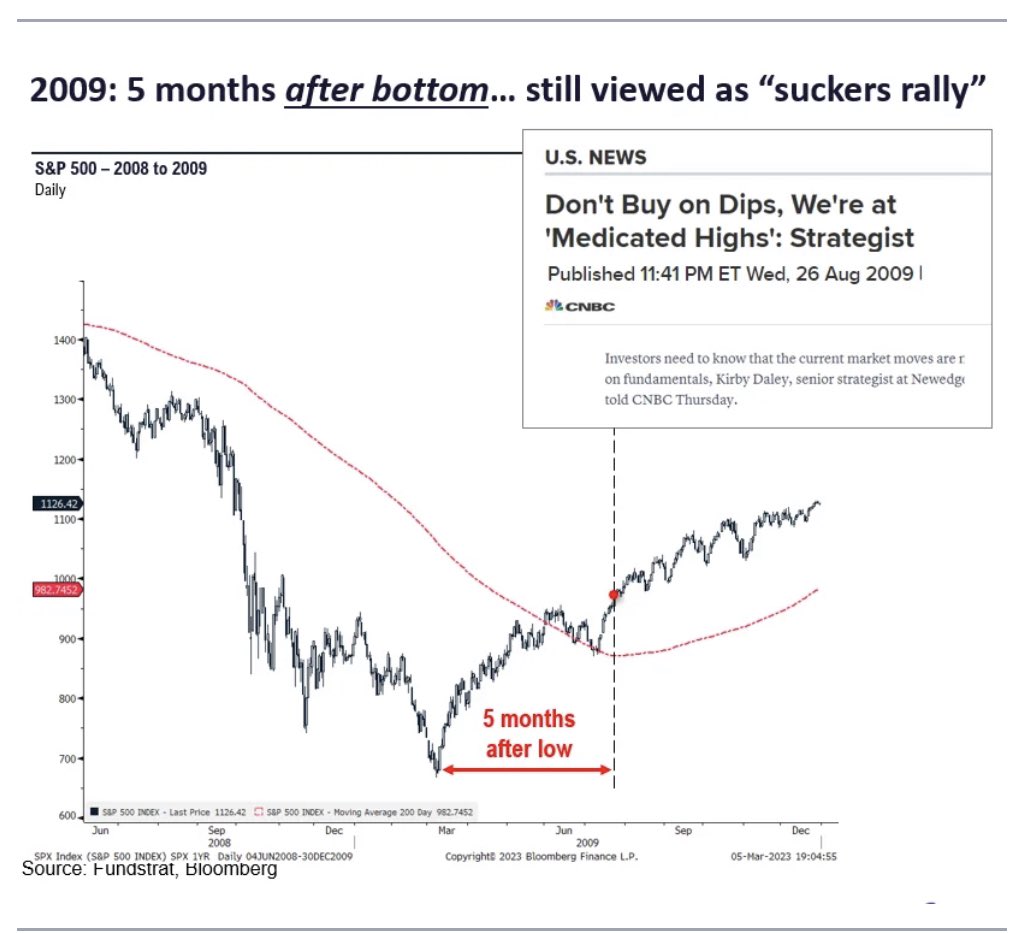

In March 2009, the subprime mortgage meltdown devastated investors and the financial system. The market had fallen some 58% from its October 2007 peak.

The market then rallied for five months in a row from March 2009.

But the narrative for investors and industry professionals was that this was just a technical bounce and that we would go back down, so buy at your own risk!

Source: Fundstrat, Bloomberg

What followed was history, one of the best decades with one of the strongest bull markets ever.

This happens all the time. When you add economists, media, and fund managers who ride the post-bear-market negativity, it is easy to fall prey to fear and panic.

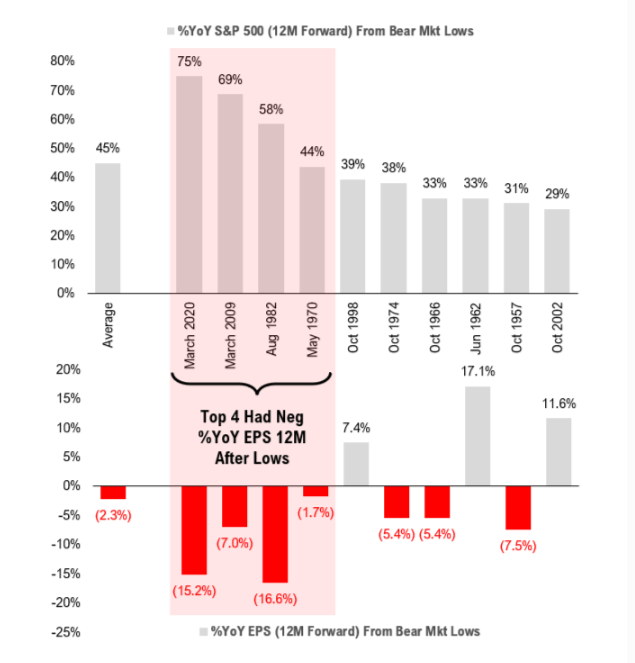

I heard another story that one of the possible reasons for the next big crash (which seems imminent) is falling profits.

It is a pity that after a bear market like the one in 2022, the markets have had the biggest bounces in history (grey columns)... with falling profits (red columns).

So, the game is always the same: We can be either bearish or bullish, and for each thesis, we can always find some data, some chart, or some expert to confirm our cognitive BIAS.

But then, we have to come back to reality and remember the usual boring stuff: CAP, diversification, strategic and tactical asset allocation, and rebalancing, which I will repeat endlessly.

To try and put some practical spin on these things, I've also started a column on a 60/40 2030 horizon in the hope that it will help.

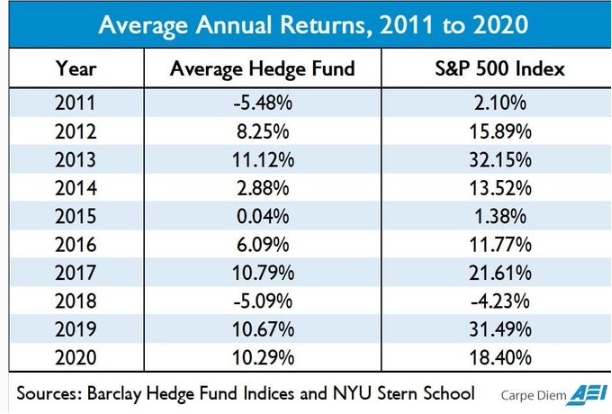

Finally, the famous pros, here is how they have performed over the last ten years against the S&P 500 index:

Source: NYU School

They didn't beat it a single year. So, what are we talking about? If you listen to everybody, you only risk getting hurt.

Disclaimer: This article is for informational purposes only and does not constitute a solicitation, offer, advice, or recommendation to invest as such, nor is it intended to encourage the purchase of any investment. I want to remind you that any type of asset is highly risky and valued from many perspectives. Therefore, any investment decision and the associated risk remain with the investor.