- Tesla shares corrected on disappointing Q3 deliveries.

- Eyes are now on next week's robotaxi event, expected to be a game-changer for the EV maker.

- After the event, the focus will be on the Q3 earnings numbers.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Tesla (NASDAQ:TSLA) shares took a hit after data showed that the EV maker fell short of production and delivery expectations in Q3. Despite a strong rally earlier this month, the stock price is now back below its recent high.

Increased competition from Chinese rivals like BYD (OTC:BYDDY) and Geely, as well as established U.S. players like Ford (NYSE:F) and General Motors (NYSE:GM), is putting pressure on Tesla's market share.

The EV maker's stock closed down 3.49% at $249.02 after dipping to an intraday low of $241.50 - the lowest point since September 20.

This decline raises questions about the bullish trend that followed the low of $182 on August 5, during which shares soared by 45.5% to reach a high of $264.86 just two days ago.

Production, Delivery Numbers Weigh on Sentiment

Investors reacted negatively to the company's latest production and delivery figures, which fell short of expectations.

Tesla delivered 462,890 vehicles in Q3, slightly below the 463,310 anticipated by analysts, while production reached 469,796 vehicles.

This marks an improvement from last year's Q3, when Tesla reported 435,059 deliveries and 430,488 vehicles produced.

The current landscape presents Tesla with increased competition, particularly in China, from rivals like BYD and Geely, as well as new entrants such as Li Auto (NASDAQ:LI) and Nio (NYSE:NIO).

In the U.S., established players like Rivian (NASDAQ:RIVN), Ford, and General Motors are ramping up their electric vehicle (EV) offerings.

Ford, for instance, sold 23,509 EVs in Q3—an increase of 12% year-on-year—while GM's sales surged around 60% compared to the same quarter last year.

Looking Ahead: Can Robotaxis Prove a Game-Changer?

Next week, all eyes will be on Tesla as it hosts its long-awaited robotaxi event on October 10.

After postponing the presentation originally scheduled for August, the company plans to showcase its autonomous “Cybercab” and provide updates on production costs, operational locations, and potential features of its ride-sharing app.

Analysts also expect the introduction of a new, lower-cost vehicle and updates on Tesla’s autonomous driving software and Optimus humanoid robot.

Elon Musk’s charismatic presentations often captivate investors, so there’s a good chance the excitement generated by these announcements could overshadow the recent mixed delivery figures.

Q3 Earnings Loom on the Horizon

However, reality will set back in with Tesla's Q3 earnings report due on Wednesday, October 16.

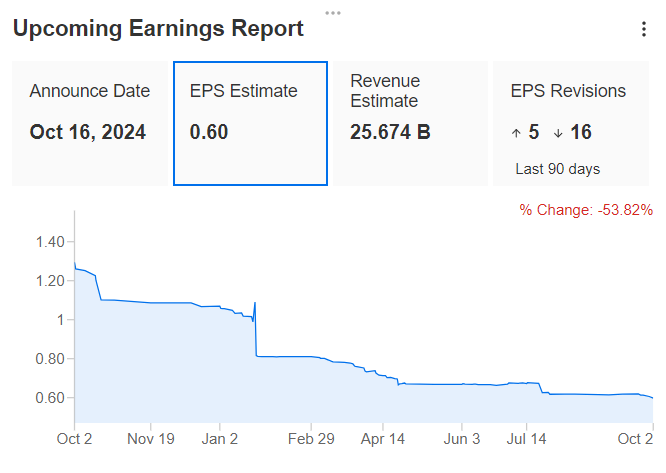

Source : InvestingPro

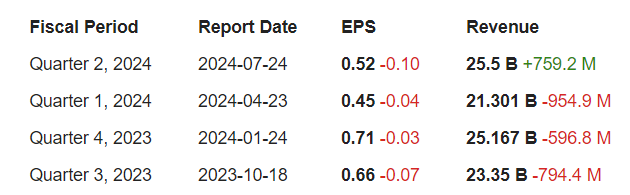

Analysts forecast earnings per share (EPS) of $0.60, reflecting an 11% decrease from $0.66 in the same quarter last year.

Additionally, sales are projected to reach an average of $25.674 billion, representing a 10% year-on-year increase.

Source: InvestingPro

Is Tesla Stock a Buy?

To better understand Tesla's share price prospects, it's essential to consider analysts' valuations.

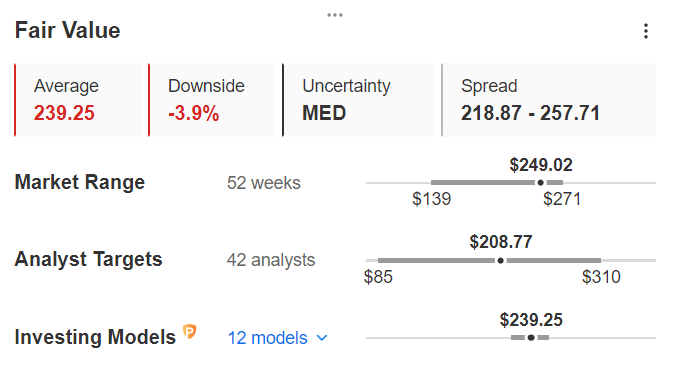

Source : InvestingPro

Despite recent gains, Tesla's stock currently trades above the average target of $208.77—15.7% lower than Wednesday's close.

According to InvestingPro, Tesla’s fair value estimate of $239.25 suggests a potential downside of nearly 4%.

Conclusion

After a 45% rally, the disappointing Q3 delivery numbers could signal the onset of a correction phase for Tesla shares.

While the upcoming robotaxi event might rekindle investor enthusiasm, the subsequent Q3 earnings report could bring a dose of reality back into play.

For Tesla investors and enthusiasts, the next few weeks will be crucial in determining the stock's trajectory.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.