- US stocks have continued to recover with inflation cooling slightly.

- Amid this rebound, opportunities lie in the tech sector, where stocks could be gearing up to erase previous losses.

- In this piece, we'll take a look at how you can discover the bullish setups in these stocks using Investing.com's scanner.

- You can uncover winning stocks today by accessing the new Investing.com screener here.

US stock indexes have staged a rebound after a sharp sell-off that was fueled by concerns over a potential recession.

Yesterday's inflation data, which largely aligned with expectations and showed signs of cooling price pressures, has boosted investor confidence and aided the bounce.

The technology sector has been under pressure in recent weeks and could be poised for a resurgence as investor sentiment improves.

For the Nasdaq, the key to regaining an uptrend will be overcoming the 17600 resistance level, which marks the starting point of the previous decline.

Breaking through this barrier could pave the way for a rally towards the historical high of around 18600 points. However, the path forward remains uncertain, as the Federal Reserve's monetary policy decisions will continue to influence market sentiment.

This week's release of the Fed minutes will provide crucial insights into the central bank's thinking regarding interest rate cuts and the overall economic outlook.

As investors look to identify potential bullish setups in this sector, Investing.com's screener can be a valuable tool.

In this piece, we will delve deeper into how we can utilize the tool to discover tech stocks that could be gearing up for a bull run.

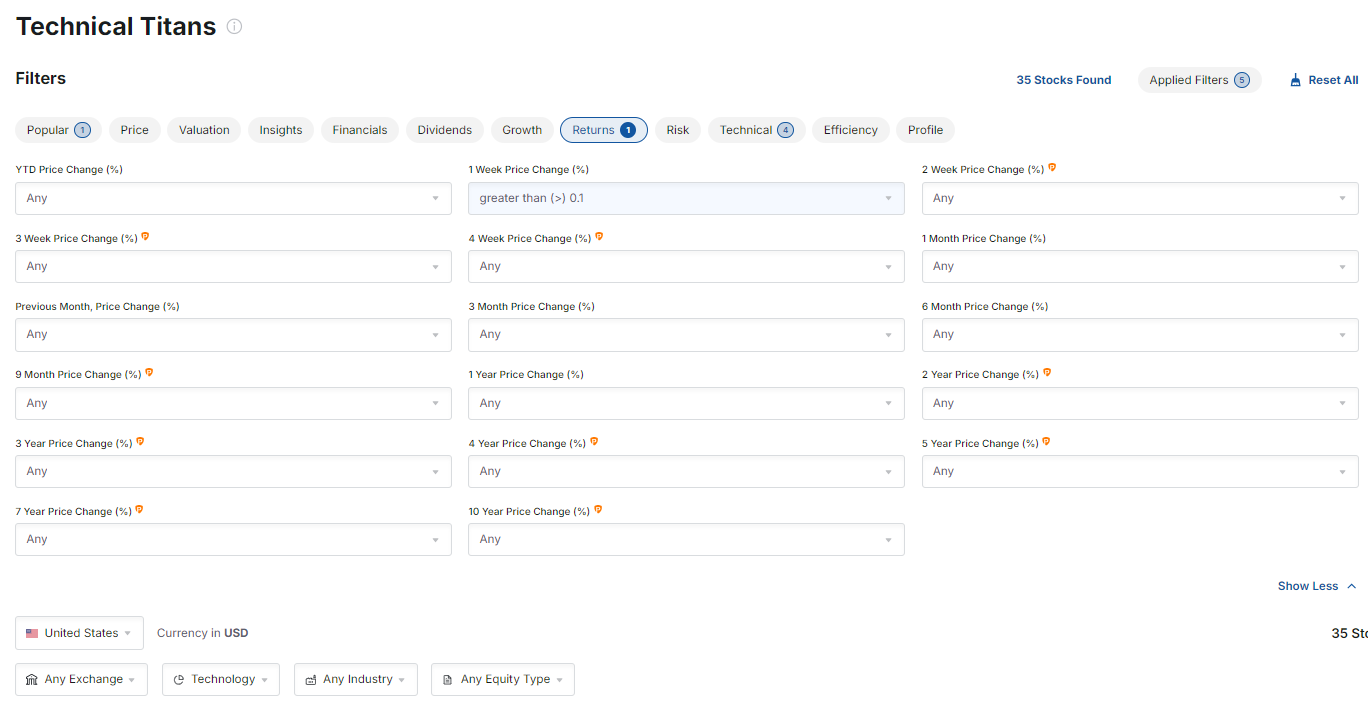

Setting Criteria for Filtering High-Growth Tech Stocks

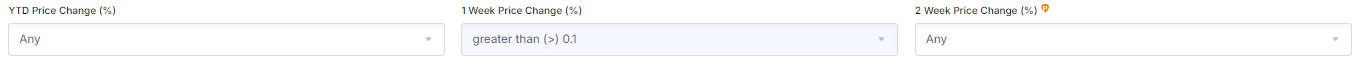

To build this portfolio, focus on selecting companies using technical oscillators that aren't in the overbought zone and have shown a positive return over the past week.

Additionally, you can refine your search by selecting "Technology" in the sector filter.

Source: Investing.com

This approach identifies companies with short-term positive returns that still offer upside potential since they aren't yet overbought.

However, your selection criteria can extend beyond technical factors. You can also consider various fundamental ratios like P/E, P/B, fair value, and financial condition to refine your choices further.

The basis of the assumptions of the described portfolio is the selection of companies primarily through technical oscillators that are not in the overbought zone while having a positive return over the past week.

As an additional criterion, you can also add 'Technology' in the lower filter in the sector field.

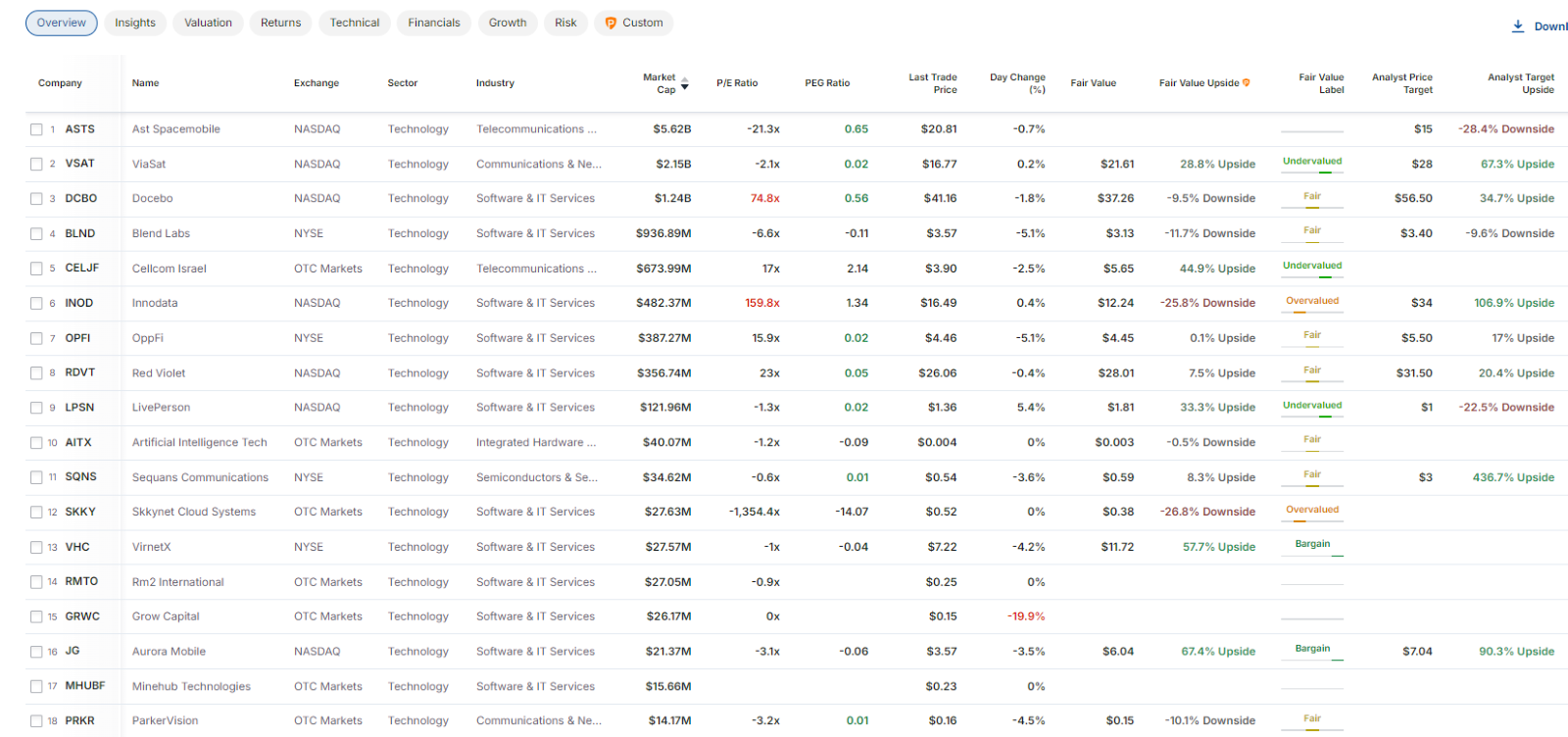

Filters Selected: What's Next?

Once you select your custom criteria or one of the prepared portfolios, the scanner generates a list of companies that meet your preferences.

Source: Investing.com

You can then organize these companies into up to eight available groups, plus an additional group based on your personalized settings.

The default view, 'Overview,' displays key indicators, such as 'Fair Value,' which is calculated using various fundamental models. To refine your selection, focus on selections with high growth potential.

This is how the Investing.com screener can help investors find opportunities in a rebounding market. To get started with this powerful tool, you will need to log in to Investing.com on all your devices.

To access the screener, you can use this link.

Also, you can check out these pre-designed screeners that can help you take advantage of the rebound in tech stocks:

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.