- September often brings market volatility, but it can also be a prime time to find undervalued stocks.

- InvestingPro’s Fair Value tool offers a simple, yet professional way of spotting such names.

- You can use this link to get access to InvestingPro's Fair Value tool for less than £9 a month.

September is known for ushering in more than just the start of autumn - it also brings the so-called “September Effect,” a well-known seasonal pattern of market turbulence.

Historically, this month has earned its reputation as one of the weakest for stocks, often delivering lacklustre returns.

Over the last four years, the FTSE 100 has averaged around a -1.06% return for September:

- September 2023: +2.27%

- September 2022: -5.36%

- September 2021: +0.47%

- September 2020: -1.63%

Meanwhile, across the Atlantic, the S&P 500 the situation is even worse, with losses becoming more pronounced in recent years:

- 2019: -1.7%

- 2020: -3.9%

- 2021: -4.8%

- 2022: -9.3%

- 2023: -4.9%

Although past performance doesn't guarantee future results, this year seems to be following the same trend, with the FTSE 100 already down 1.81% so far this month.

However, these gloomy statistics don’t necessarily spell disaster for investors. For those with a keen eye, the market's dips can present golden opportunities rather than looming threats.

Market pullbacks, especially those driven by unexpected macroeconomic data, often provide the perfect chance to pick up quality stocks positioned for strong gains, particularly in a secular bull market like the one we’re currently witnessing.

Following the Bank of England's only rate cut of 2024 on 1 August, markets are expecting one more cut before the end of the year. However, it’s unlikely to come when the Monetary Policy Committee (MPC) meets next week.

With another rate cut on the table in 2024, now might be the perfect time to snap up undervalued stocks trading at a discount. But how can you effectively pinpoint these bargains amid the sea of conflicting data and market noise?

Fair Value Tool Offers a Simple, Yet Effective Solution

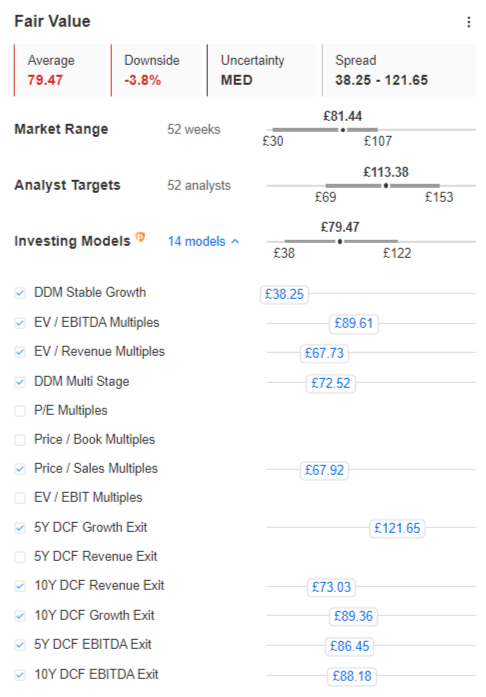

By integrating up to 15 industry-recognized valuation models, it provides investors with a professional, yet straightforward target for any stock in the market.

InvestingPro's tool also lets you take a deeper dive into any of the individual metrics used to provide the final calculation, allowing you to assess and even exclude any of them for an instant recalculation of the price target.

Source: InvestingPro

By combining transparency with best-in-breed financial modelling, Fair Value has proven a game-changer for investors during both good and challenging times.

In fact, just to talk about the previous broad market downturns, here are a few examples of the fantastic results our premium users managed to notch:

Pearson (NYSE:PSO)

- FV Potential: 30.68% (5/3/2023)

- Total Returns Since: 27.43%

Hargreaves Lansdown PLC (LON:HRGV)

- FV Potential: 45.43% (7/9/2023)

- Total Returns Since: 42%

Softcat (LON:SCTS)

- FV Potential: 39.33% (3/16/2023)

- Total Returns Since: 34.61%

Network International Holdings PLC (LON:NETW)

- FV Potential: 56.15% (3/29/2023)

- Total Returns Since: 64%

Salesforce Inc (NYSE:CRM)

- FV Potential: 41.09% (3/13/2023)

- Total Returns Since: 40.23%

Qualcomm Incorporated (NASDAQ:QCOM)

- FV Potential: 36.95% (3/14/2023)

- Total Returns Since: 40.45%

Amgen (NASDAQ:AMGN)

- FV Potential: 32.09% (4/29/2023)

- Total Returns Since: 35.30%

Rtx Corp (NYSE:RTX)

- FV Potential: 39.31% (7/28/2023)

- Total Returns Since: 36.98%

Interactive Brokers Group (NASDAQ:IBKR)

- FV Potential: 53.06% (4/20/2023)

- Total Returns Since: 53.98%

Followers of this column may have also read our series of previous articles. See below:

- Market Reshuffle Brings Fresh Opportunities - Here's How to Spot Them Now

- This Tool’s Sell Signal Saved Investors From 35%+ Drawdowns in These Stocks

- These Energy Stocks Jumped 40%+ Following Rare All-In Buy Signal

- Here's How You Can Find Stocks With 50%+ Upside Before the Market Does

Among thousands of other success cases.

Now, to better illustrate how Fair Value has been helping our premium users achieve market-beating results, let’s take a closer look at four recent dip-buys you could have easily spotted by just following our tool.

2 Great Picks During Market Dips

As the banking crises that knocked down historical Swiss powerhouse Credit Suisse and Silicon Valley Bank on the other side of the Atlantic sent shockwaves across the global banking industry, many investors were quick to flee the sector.

However, despite the ongoing woes, several banks remained financially sound, prompting opportunities for those able to separate the endangered ones from the gems.

Such is the case of Barclays (LON:BARC), which was spotted by our Fair Value tool as having a 66.20% upside potential after the stock price dropped to £142.38 on March 16, 2023.

After bottoming around £142.38, the stock went on to post 61.26% returns, falling short of its Fair Value potential by just 4.76%.

Barclays wasn’t the only stock to stage a remarkable recovery. Network International also emerged as a standout Fair Value pick during the same period.

In March 2023, Network International was flagged for a potential 56.15% gain based on Fair Value's calculations, and it didn’t disappoint.

You can almost guess what happened next - Network not only hit its target but exceeded it, posting a stellar 66% return since then, once again outperforming initial expectations by around 8%.

Like these examples, there are hundreds of other stocks trading at a significant discount right now, just waiting to be scooped up.

So whether you're looking for a massive 60%+ winner on the dip or just want to professionally evaluate if it's time to take profits in your positions, Fair Value will prove the ultimate game-changer.

Conclusion

September may bring volatility with key macro events looming, but savvy investors know that every dip offers opportunity.

While the "September Effect" is known for weighing down stocks, it also creates golden chances for those ready to act.

Take standout picks like Barclays and Network International - each stock managed to stage a turnaround after Fair Value signals, helping investors capitalize on market pullbacks for solid gains.

Will you just sit by if another market correction unfolds, missing out on potential gems available at discounted valuations?

With Fair Value insights for less than £9 a month, the choice has never been easier.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.