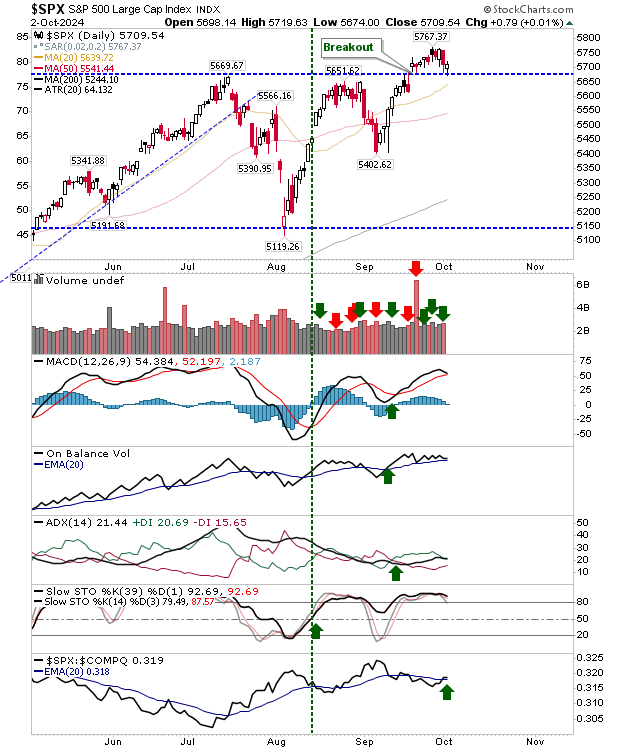

It's not strong selling, but it's still selling. The S&P 500 now finds itself back at breakout support as other indices drift further away from all-time highs.

This is an important test because if the S&P 500 were to lose breakout support it would open up for a bull trap.

After that, things could start to get away for the Russell 2000 and Nasdaq. The S&P 500 holds to bullish net technicals with a return to relative outperformance over peer indices.

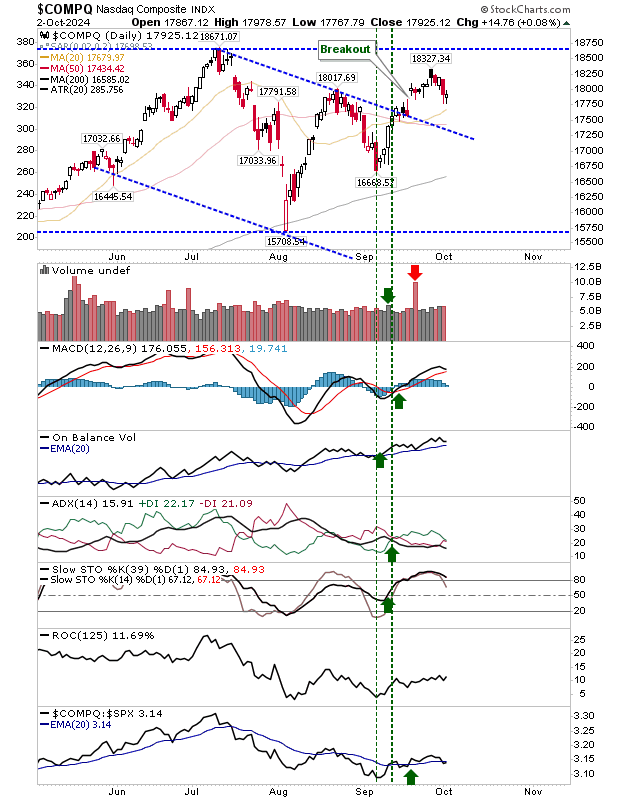

The Nasdaq has drifted back to the breakout gap, also near the 50-day MA. I'm not sure there is enough between yesterday's and the day before yesterday's spike lows to suggest a "tweezer" bottom; a reliable reversal pattern. Watch up for an open above yesterday's close to set up a day-long rally.

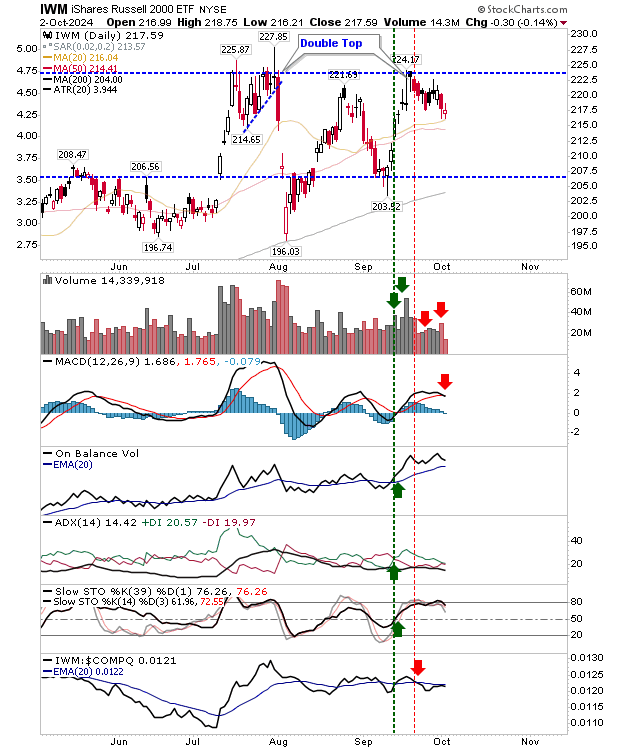

The Russell 2000 (IWM) has tagged its 20-day MA and has started to weaken technically. There was a 'sell' trigger in the MACD with the trend measure, ADX, also close to a new 'sell' trigger. While the earlier attempt to challenge highs has faded, the index is still range-bound and therefore, trendless. This means the chance of further selling is perhaps just as likely as buying.

For today, the S&P 500 is the index to watch. It will be important for breakout support to hold, although an intraday violation of this support level is acceptable. As for the Nasdaq and Russell 2000 ($IWM), it could go either way.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.