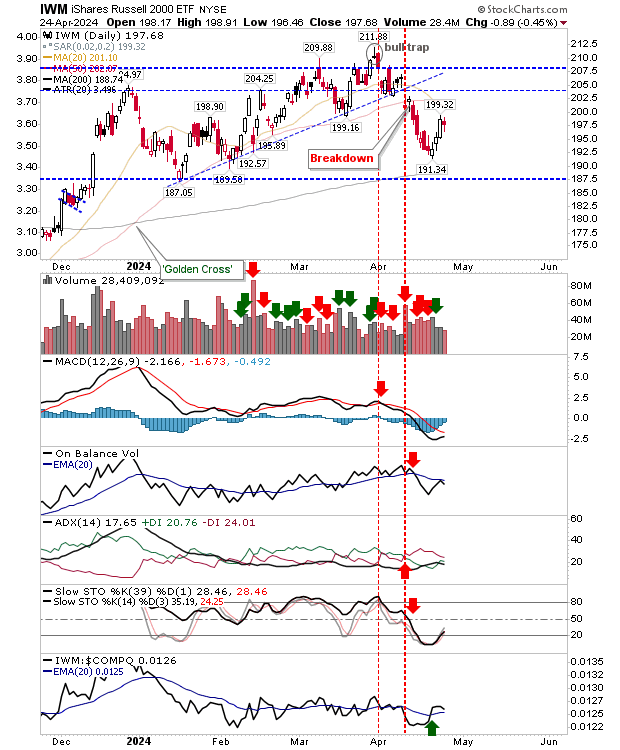

The relief bounce for indexes finally hit the first potential reversal point with 'black' candlesticks in the S&P 500 and Nasdaq, and a bearish harami cross for the Russell 2000 (IWM).

Trading volume in the Russell 2000 was lighter than in previous days, a positive sign for those looking for more from this bounce.

Momentum indicators have moved out of an oversold state, although I like to see a cross of the mid-line before I consider the situation to be under the control of bulls.

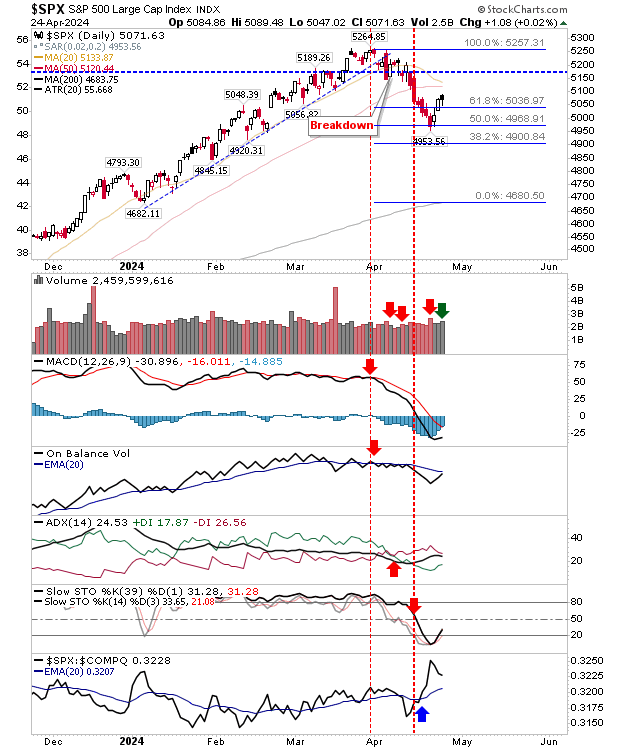

The S&P 500 closed the day with a more bearish 'black' candlestick, a common reversal candlestick on a bounce, but more so at a new high.

Technicals are weak and net bearish which increases the chance for a bearish reversal. Watch for a gap down on the open.

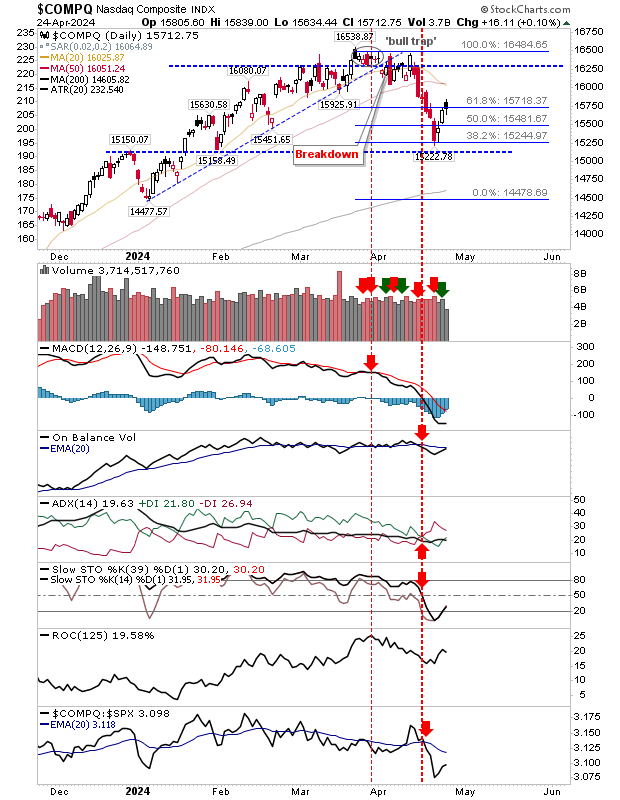

It was a similar story for the Nasdaq as for the S&P 500; a bearish 'black' candlestick on net bearish technicals.

If indexes do start heading lower, watch for the measured move targets which for the Nasdaq and S&P 500 are close to their respective 200-day MAs. The Russell 2000 ($IWM) target is near breakout support from December.