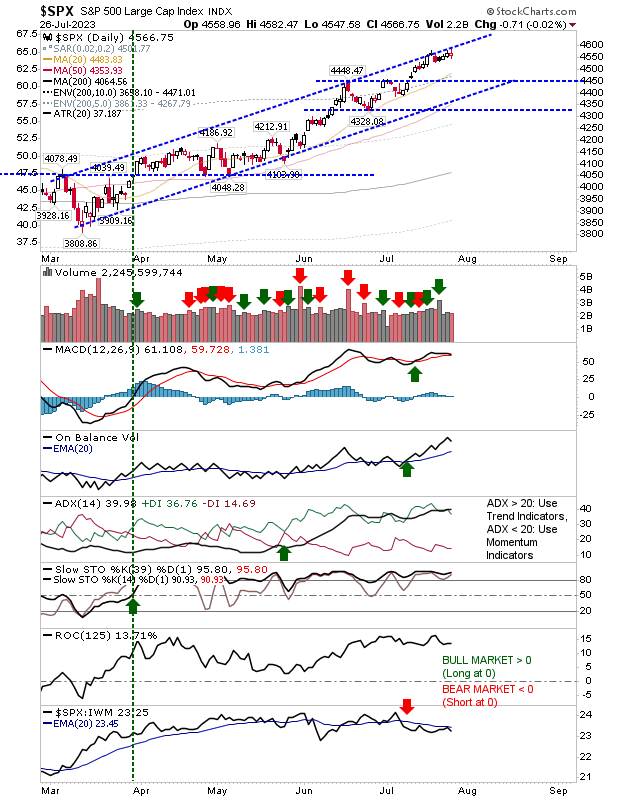

The headline would have been a small loss, but S&P 500 action over the past week and a bit have been for an index running alongside upper channel resistance, looking ready to break through higher. Technicals remain net positive, although the MACD is close to a new 'sell' signal. Even if this were to materialize, I would be surprised if it brought any serious selling and may offer a better buy-the-dip opportunity.

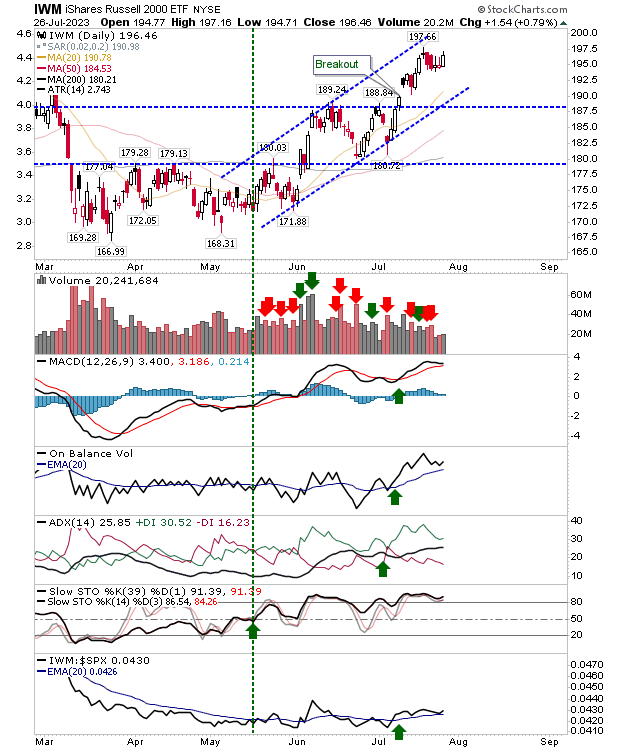

The Russell 2000 (IWM) didn't experience the modest selling the S&P 500 and Nasdaq did and managed to post a decent enough white candlestick, but buying volume was relatively light.

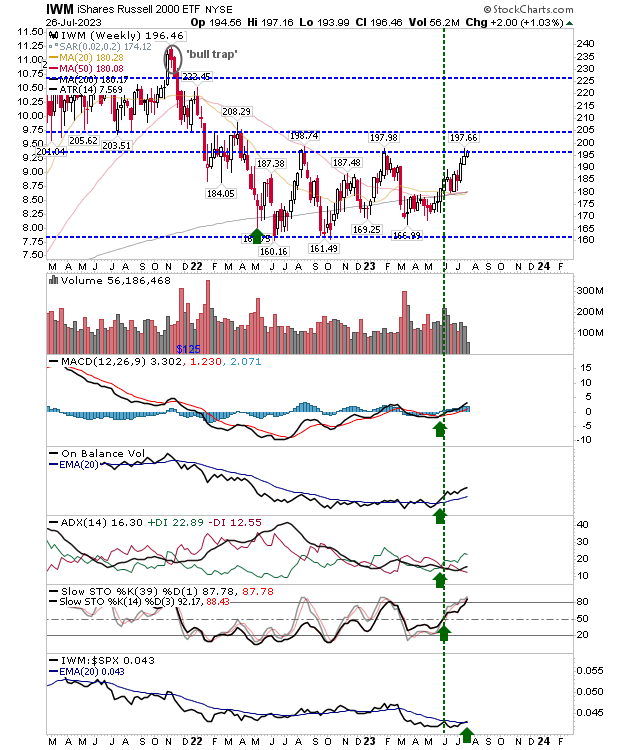

It's still a slow burn in the bullish relative performance shift versus the S&P 500, but On-Balance-Volume is moving more strongly in bulls' favor. More significant is the weekly resistance at $197, but we need to see what happens on Friday to confirm this.

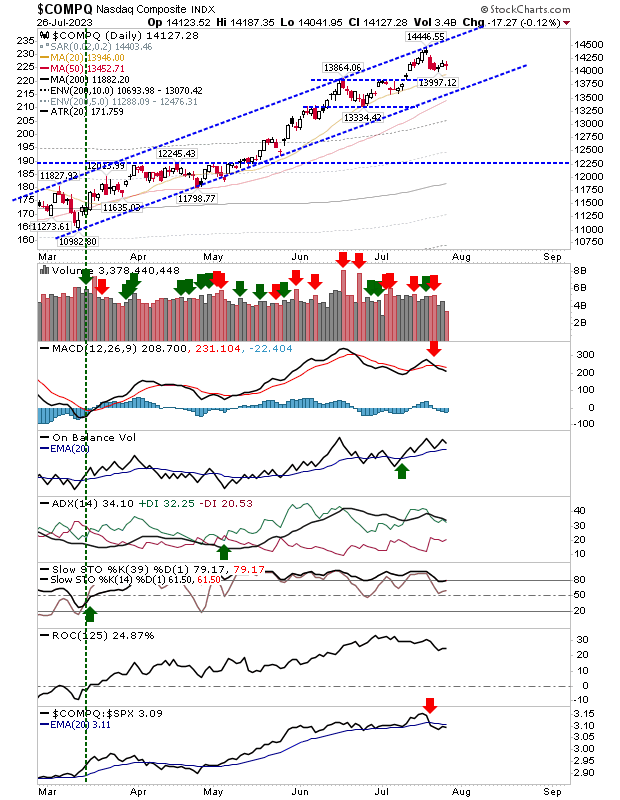

The Nasdaq had pulled back from its last tag of channel resistance, so it had perhaps a little more 'value' to offer potential buyers than either the S&P 500 or Russell 2000 ($IWM), but it didn't deliver on this. The MACD trigger remains on a 'sell' with a bearish divergence and is underperforming relative to the S&P 500. Vacation volume clouds the issue a little, but it looks like buyers want to go for Large Caps over Tech stocks.

My next post won't be until next Tuesday at the earliest, so the end-of-week finish in the Russell 2000 ($IWM) is perhaps the most important thing to track. I want to see a breakout on a weekly time frame for this index - if not this week, then next.