The latest UK jobs report is undeniably hawkish for the Bank of England.

The unexpected fall in the unemployment rate to 3.8%, which is still pretty close to all-time lows, underscores the overall resilience of the labour market right now. At the margins, there are still some signs of cooling, with vacancies edging lower and the redundancy rate higher, though both still look stronger than long-term averages.

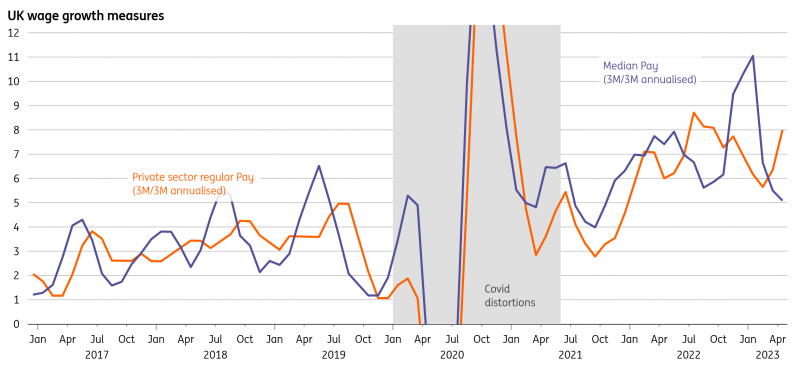

Crucially for the Bank of England, we also saw another marked acceleration in wage growth – both when comparing the latest three-month period to the prior three, or to the same period last year. It's maybe easier to think about this in level terms, and regular pay increased by £4 across the most recent month of data, which compares to an average of £3-4 monthly increases through the second half of 2022. In other words, wage growth isn't necessarily accelerating – and indeed the annual rate of growth (now 7.2%) is unlikely to rise much further due to base effects. But it's also clear that wage growth is failing to fall back either.

Wage growth momentum is failing to slow

Admittedly, survey evidence suggests firms are looking to raise wages less aggressively over the coming months, and the BoE’s own survey of chief financial officers points to a marked slowdown in pay growth over the coming months. But as we wrote in more detail yesterday, we think it's going to take some time for wage growth to come down to something consistent with at-target inflation.

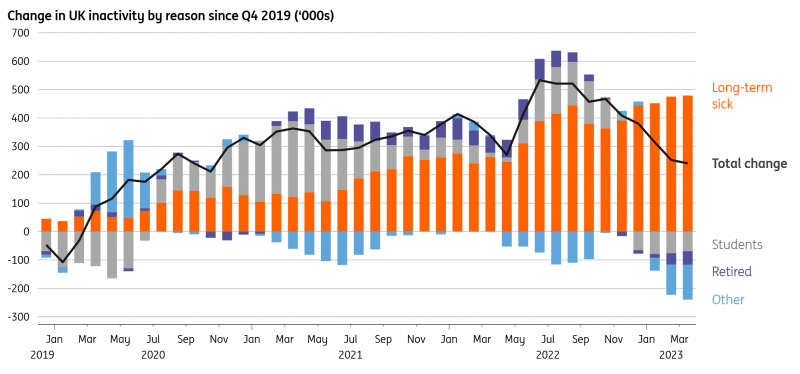

Worker shortages do appear to have eased, and the number of workers inactive (neither employed nor actively seeking a job) has fallen in recent months. Nevertheless, it looks like some of the drivers of hiring difficulty during the pandemic are structural. That’s neatly demonstrated by a further rise in the number of workers outside of the labour market due to long-term sickness.

Overall inactivity levels have fallen, though long-term sickness remains an issue

For the Bank of England, all of this cements a June rate hike and if the inflation numbers continue to come in hot, it’s quite plausible that we end up with an August move as well. Much will depend on how CPI inflation comes out over the next couple of months.

But the reality is that UK rates are now comfortably into restrictive territory, and we think the amount of tightening priced into markets – an additional 120bp of rate hikes – looks excessive. However, today’s data are a reminder that the Bank of England is unlikely to rush into rate cuts, which we think are unlikely until this time next year.

This article was first published on Think.ing.com.

—

Get ready to level up your investing game! We're hosting a Webinar on ETFs (Exchange Traded Funds) designed to help you navigate the world of investing and enhance your understanding of the market. Don't miss this opportunity to learn from the experts and connect with like-minded enthusiasts. See you there!