-

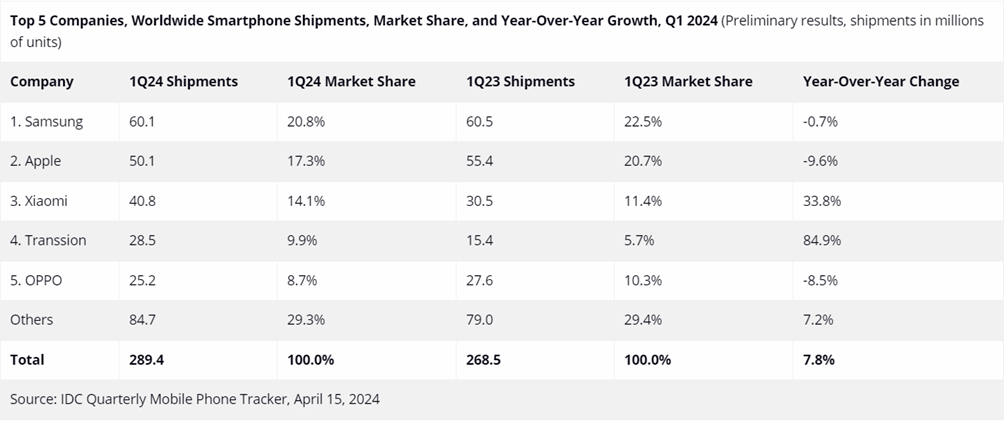

Samsung (LON:0593xq) topped global smartphone sales in Q1 2024, while Apple saw a 10% decline in iPhone shipments.

-

Samsung's strategic moves secured a 20.8% market share, outpacing competitors like Apple and Xiaomi.

-

Backed by U.S. funding to expand chip production, Samsung's stock has surged recently, with analysts optimistic about its future growth amid soaring chip demand.

-

For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

- ProPicks: equity portfolios managed by a fusion of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 synthetic indicators based on financial data that provide immediate insight into the potential and risk of each stock.

- Advanced Stock Screener: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!

Samsung Electronics (KS:005930) surpassed Apple (NASDAQ:AAPL) to become the world's leading smartphone maker in Q1 2024, according to data from market research firm IDC. Apple's iPhone shipments fell by almost 10% compared to the previous year.

This decline happened despite the global smartphone market bouncing back, with shipments increasing by 7.8% to reach 289.4 million units.

Samsung regained the top spot as it sold 60.1 million with a 20.8% market share while Apple lagged as it sold 50.1 million iPhones with its market share at 17.3%.

Chinese brands such as Xiaomi (OTC:XIACF) and Huawei also gained ground, with Xiaomi taking the third position at 14.1% market share.

Samsung Benefits From U.S. Chips Act

On Monday, the U.S. Department of Commerce announced that the Biden administration plans to grant up to $6.4 billion to the South Korean company for expanding its chip production in Texas.

This funding is part of America's strategy to ramp up chip production domestically, spurred by the Chips and Science Act of 2022. The aim is to reduce reliance on Asian semiconductor manufacturing by incentivizing companies to invest within the U.S.

As part of this effort, the U.S. government anticipates Samsung will pour around $45 billion into building and expanding facilities in Texas by the end of the decade.

These high-tech investments not only promise wealth and job growth in the U.S. but also provide a significant boost to Samsung.

The company is already benefiting from soaring demand for semiconductors. In early April, Samsung projected its first-quarter operating profit for 2024 to be more than ten times higher than the previous year, driven by surging chip prices.

Specifically, the group expects its operating profit for January to March to jump by 931.3 percent to 6.6 trillion won, approximately $4.77 billion.

Samsung Stock Surges

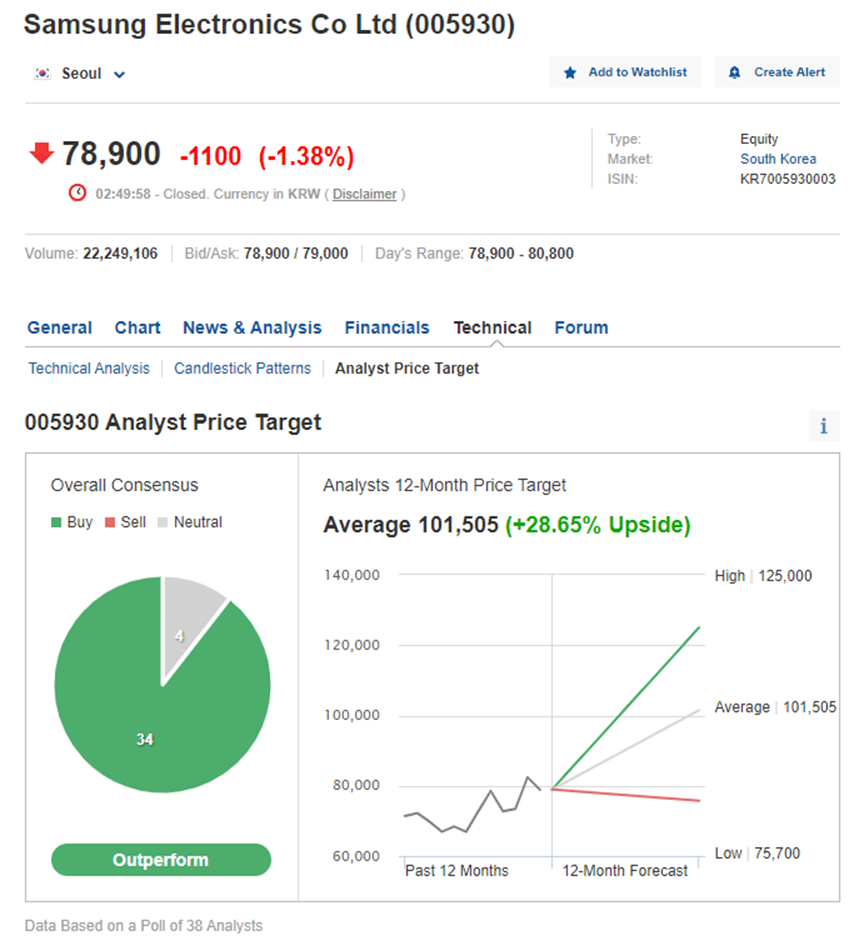

This bullish outlook is also evident in Samsung's stock market performance. While Apple has seen a 15 percent decline from its December peak, Samsung has been on an upward trajectory, rising about 11 percent from its three-month lows in January.

Over the past year, Samsung's stock value on the Korean Stock Exchange has surged by more than 21.44%, reaching a market capitalization of approximately $385 billion.

Analysts remain optimistic about Samsung's future, with 38 experts forecasting an average target price of 101,505 Korean won per share ($73.40) over the next 12 months, representing a 28.65 percent increase from the current price of 78,900 won ($57.06).

Source: Investing.com

On April 30, the company will release its financial report for the first quarter of 2024. Investors will discover if Samsung can keep growing in the stock market after dominating the smartphone market. The big question is whether the chip surge will fuel further growth.

***

DISCOUNT CODE:

Take advantage of a special discount to subscribe to InvestingPro+ and take advantage of all our tools to optimize your investment strategy. (The link directly calculates and applies the discount of an additional 10%. In case the page does not load, you enter the code proit2024 to activate the offer.)

You will get several exclusive tools that will enable you to better cope with the market:

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.