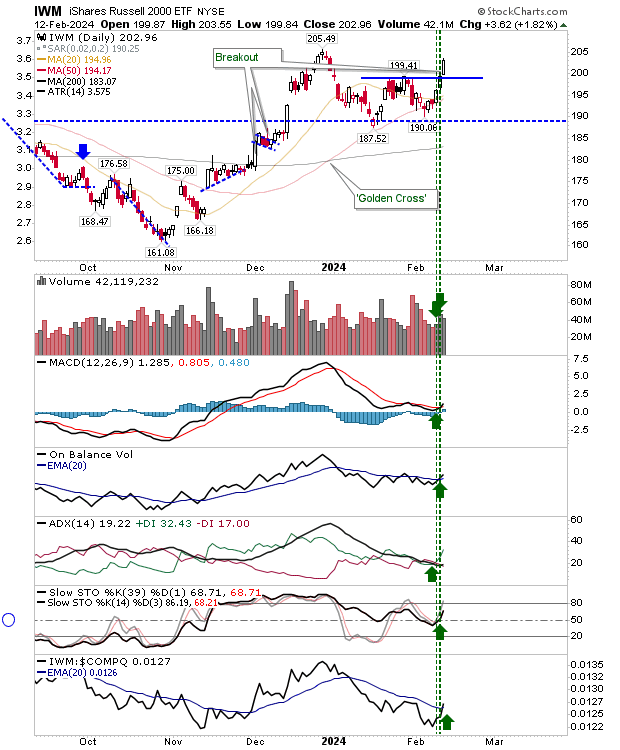

Friday left the Russell 2000 (IWM) primed for a breakout and Monday delivered on that setup. By the close of business, the Russell 2000 was left with a bullish "three white soldiers" setup and the potential for more upside.

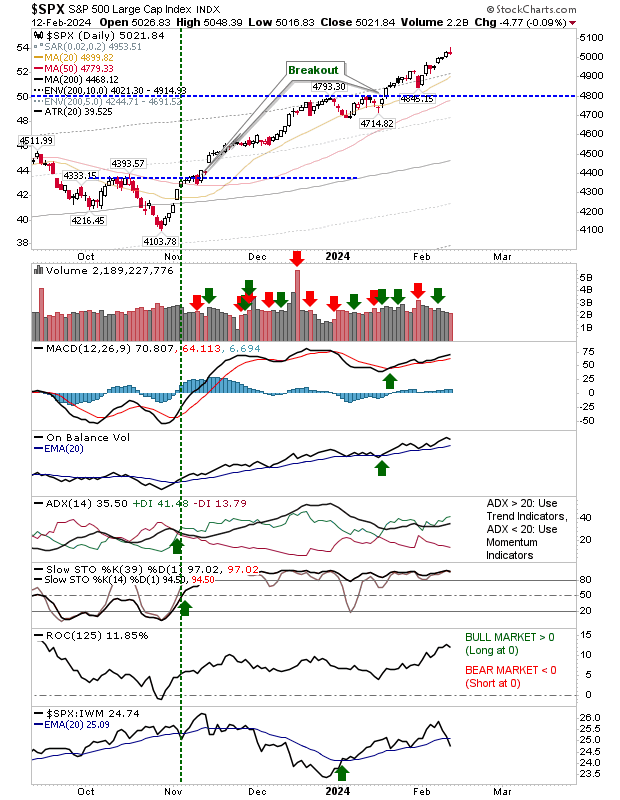

So while the Nasdaq and S&P 500 are near market "extreme" tops, the Russell 2000 is still trading well within itself.

Technicals for the Russell 2000 ($IWM) are net bullish and improving, but Monday's volume didn't register as accumulation.

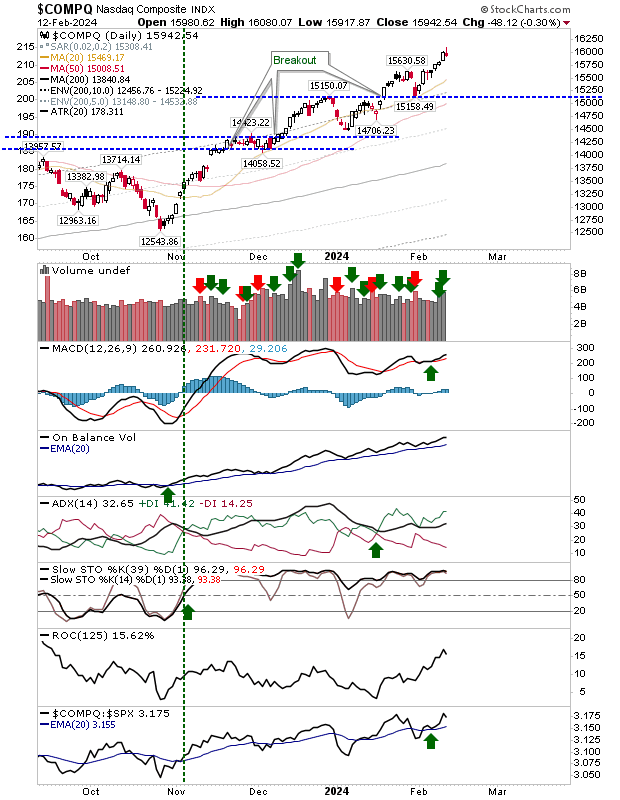

The Nasdaq eased off its high, but the losses didn't do a whole lot of technical damage.

It has been several months since the index last tested its 50-day MA, so if the selling was to continue then I would be looking at a test of this moving average.

The S&P 500 finished with a doji like the Nasdaq. What applies to the Nasdaq also applies to the S&P 500.

After yesterday's action indices have shown their hand.

We have bearish doji in the Nasdaq and S&P 500 that should deliver lower prices in the coming days, but the Russell 2000 ($IWM) may pause today, but I would be looking for gains to resume.