In principle, last Friday's action was relatively bullish, with some decent bullish candlesticks at support. Volume was a little mixed in that there wasn't across-the-board accumulation, but we will take what we can.

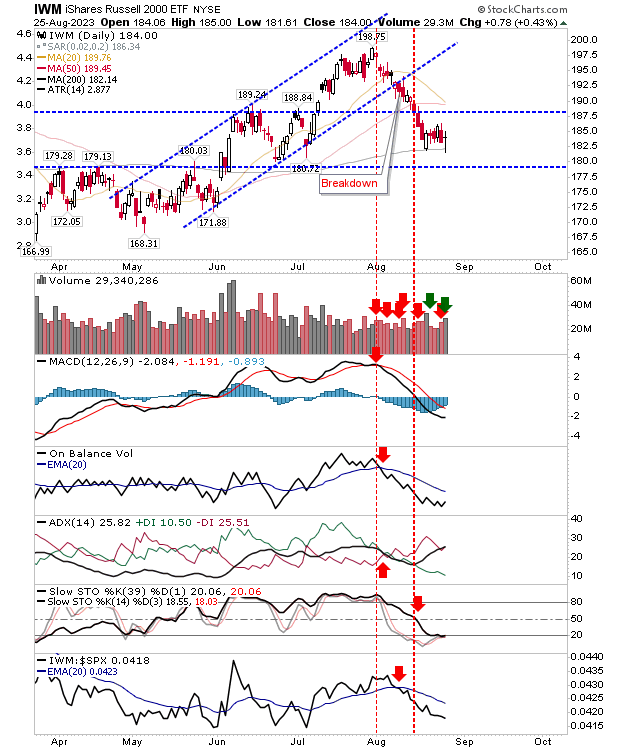

The Russell 2000 (IWM) closed with a 'dragonfly' doji at its 200-day MA on higher volume accumulation. It was the second such test in a couple of weeks, which increased the probability of an undercut of the moving average.

There is still good support at $179 should this happen, but I wouldn't be counting on this should the break happen. Technicals are net bearish, and Friday's action did little to improve that.

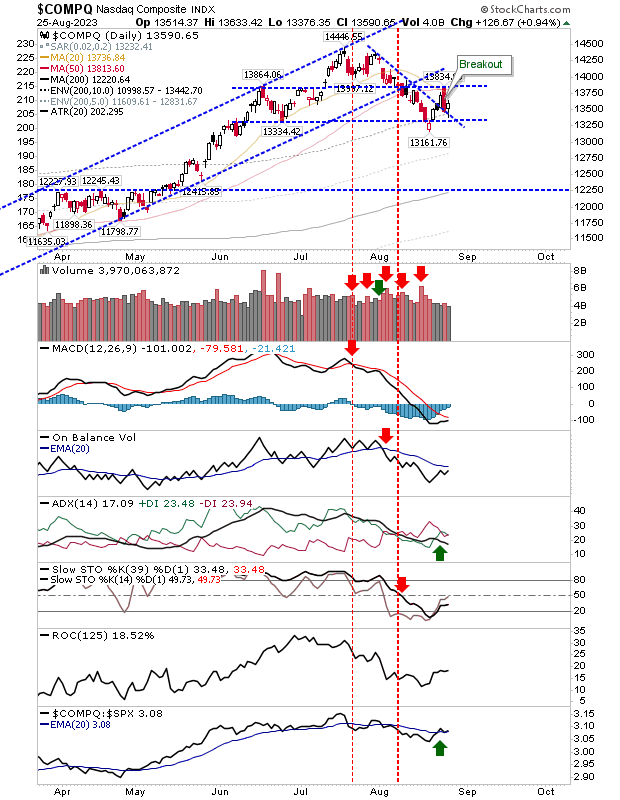

The Nasdaq came back to tag former resistance turned support with a more neutral 'spinning top' candlestick. The only technical improvement was a cross in +DI/-DI and the continued relative outperformance against the S&P 500.

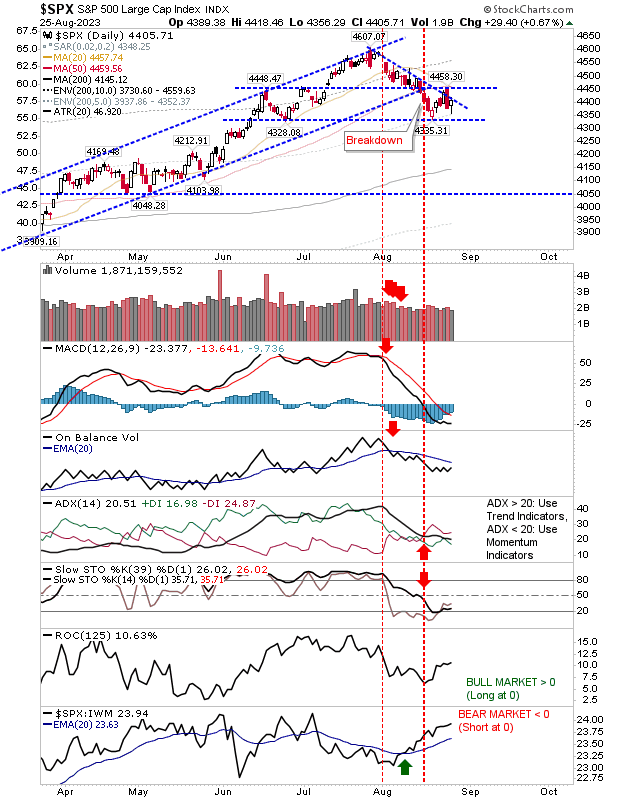

The S&P 500 finished with a bullish 'hammer,' but the lack of clear price support or oversold momentum indicators weakens the strength of the candlestick. I suspect this index will hold to scrappy action over the coming weeks, but with a 4,335 swing low, there is a measurable risk to work off for anyone looking at long positions.

As we enter the last week of summer, I would not be looking for any major swings in the market until after Labor Day. However, in August, we have seen a relatively orderly decline, particularly when it looked like losses would accelerate a couple of weeks ago.

I would be cautiously optimistic about an end-of-year rally (despite mid-level breadth metrics), but we will let market action be our lead. As it stands, as an investor, we are in a classic 'hold' situation.